The decentralized finance (DeFi) industry grew by 865% between 2020 and 2022, hitting $254.99 Billion in December of 2021 by total value locked (TVL). Despite the high-yield opportunities creating solutions that give users access to multi-chain capabilities and interoperable blockchains transactions, DeFi is still struggling to capture even 1% of the traditional financial market share. This post will discuss some of the significant challenges hindering DeFi adoption in 2022 and possible ways to navigate the adoption maze.

What is Decentralized Finance—DeFi

DeFi describes a set of decentralized applications or protocols built on top of blockchain technology. These protocols facilitate trustless, open, and pseudonymous peer-to-peer financial transactions. DeFi’s major goal is to offer permissionless borrowing, lending and access to yield optimizing solutions through decentralized applications.

DeFi adoption has continued to increase significantly with the increasing blockchain-based financial products and services. Since it’s an expanding industry, significant improvements and iterations are continuously made on existing solutions to further increase the overall usability of protocols and improve user experience. However, there are still many challenges facing the DeFi space, which we will discuss below.

Transaction Costs

Ethereum’s first-mover advantage has positioned itself as the home of major DeFi protocols. According to data analytics site defiprime, 214 of the 237 DeFi projects listed are built on Ethereum. The implication is that with so many DeFi activities on a single network, there is a corresponding rise in transaction fees due to network congestion as Ethereum currently cannot scale. This high traffic on the Ethereum network and the scaling limitations frequently leads to spiking gas charges, with users averaging $300 per transaction fee to carry out retail activities on it. If DeFi rivals traditional financial services like Visa, the transaction cost must be lowered to a bearable level.

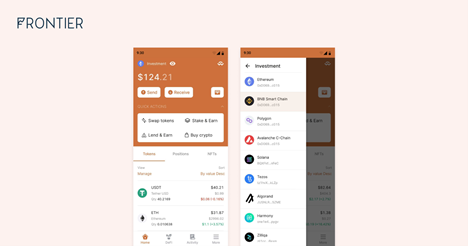

Alternative blockchains like Solana, Avalanche, etc., capitalize on Ethereum’s weakness to offer faster and cheaper solutions. Equally, EVM compatible Layer 2 solutions like Polygon, Optimism and Arbitrium are being developed to help solve the transaction fee problem. However, the DeFi ecosystem is yet to come to a place of dynamism. Hence, there is a need for a solution that enables users to access assets in one spot via multiple chains eliminating high costs and this is where Frontier comes in.

Liquidity

The DeFi ecosystem suffers from the problem of an inefficient market which stems primarily from low liquidity. Different models have been adopted to help solve the liquidity problems. The first was the adoption of liquidity pools which incentivizes token holders to deposit their tokens in asset pools and earn rewards generated from the trading activities in the pools. But this approach has its limitations and is associated with risks such as impermanent loss and is mainly dependent on token holders who may not act in the interest of the protocol.

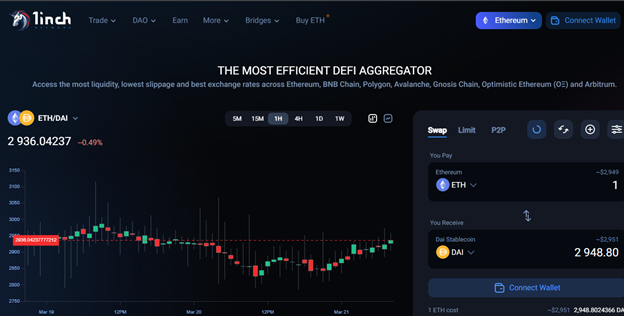

In addition, solutions like DEX aggregators–such as 1inch, which directs liquidity to the best prices for users and DeFi aggregators, allow users to access a wide range of trading pools through a single interface. These solutions mentioned above have helped reduce the liquidity problem appreciably. The emergence of the new DeFi 2.0 model—a protocol-owning liquidity model pioneered by OlympusDAO offers a solution. This model seeks to build a single source of liquidity for every asset in DeFi, which any protocol can easily plug into for efficient market access.

Interoperability

Blockchain networks differ, offering different designs, consensus protocol, asset definition, access controls, etc. The capabilities offered by blockchain networks often exist in isolation, presenting a significant pain point for users in DeFi because of the difficulty encountered in moving value from one blockchain to another. Making it necessary to bridge blockchain networks for them to interact. This limits the potential for protocols to maximize functionality and scalability. DeFi cannot scale unless users can carry out transactions seamlessly across multiple chains.

There have been workarounds for centralized interoperability, like swapping cryptocurrencies between chains. However, bridging assets often expose chains to security vulnerabilities eliminating the goal of blockchain and decentralization. Another workaround is Ethereum and its EVM compatible bridges.

However, blockchain networks like Polkadot and Cosmos provide more sustainable solutions with Polkadot as a heterogeneous Layer zero network enabling interoperability among other Layer 1 building atop it. Polkadot employs a novel Cross-chain Messaging (XCM) framework, allowing one layer communication with another layer. While interoperability between L1s on Polkadot and EVM chains can help alleviate this concern, DeFi needs true interoperability where different networks can interact with little to no friction. With its IBC bridge, Cosmos Network is an excellent example of an ambitious move towards industry-wide interoperability. With interoperability addressed, liquidity and market efficiency will equally be positively impacted.

DeFi Regulation

The current DeFi ecosystem, unlike the traditional financial system, is largely unregulated. This is because protocols run on smart contract codes, and no legally recognised centralized entities can be held responsible for smart contract code problems. This lack of regulatory presence within the DeFi ecosystem has made room for many malicious activities in DeFi, with over $10 million lost in investors’ funds in 2021.

This poses a significant problem to the mainstream adoption of DeFi as most financial institutions are reluctant to use DeFi protocols without the good introduction of satisfactory regulatory frameworks to protect their funds. However, regulatory bodies are continuously making efforts to understand the DeFi space further to enable them to adopt effective regulatory architectures suitable for the rapidly evolving nature of the DeFi ecosystem without stifling innovation.

The Future of Decentralized Finance

Over the past few years, there has been a significant increase in the adoption of DeFi and DeFi solutions, most of which happened in 2021 alone. However, various roadblocks still need to be removed to accelerate DeFi growth towards the mainstream sector. But with the rapidly evolving nature of the DeFi space, there is little doubt that 2022 will see further significant improvements and better solutions for the inefficiencies mentioned above. As the industry looks forward to the future of Decentralized Finance , more research needs to be constantly undertaken as interoperability is a continuum rather than a single silver bullet that needs manufacturing.

Image: Pixabay