Past data shows that Bitcoin bull market breakouts typically happen following a US Presidential Election. However, Democratic party candidate Joe Biden has recently overtaken Trump in the polls – something Wells Fargo warns could shake up the stock market.

And with Bitcoin tightly correlated to the stock market, a Biden win could be harmful to the leading cryptocurrency by market cap. But why?

Wells Fargo Chief Strategist Warns of Stock Market Reaction To Joe Biden Win

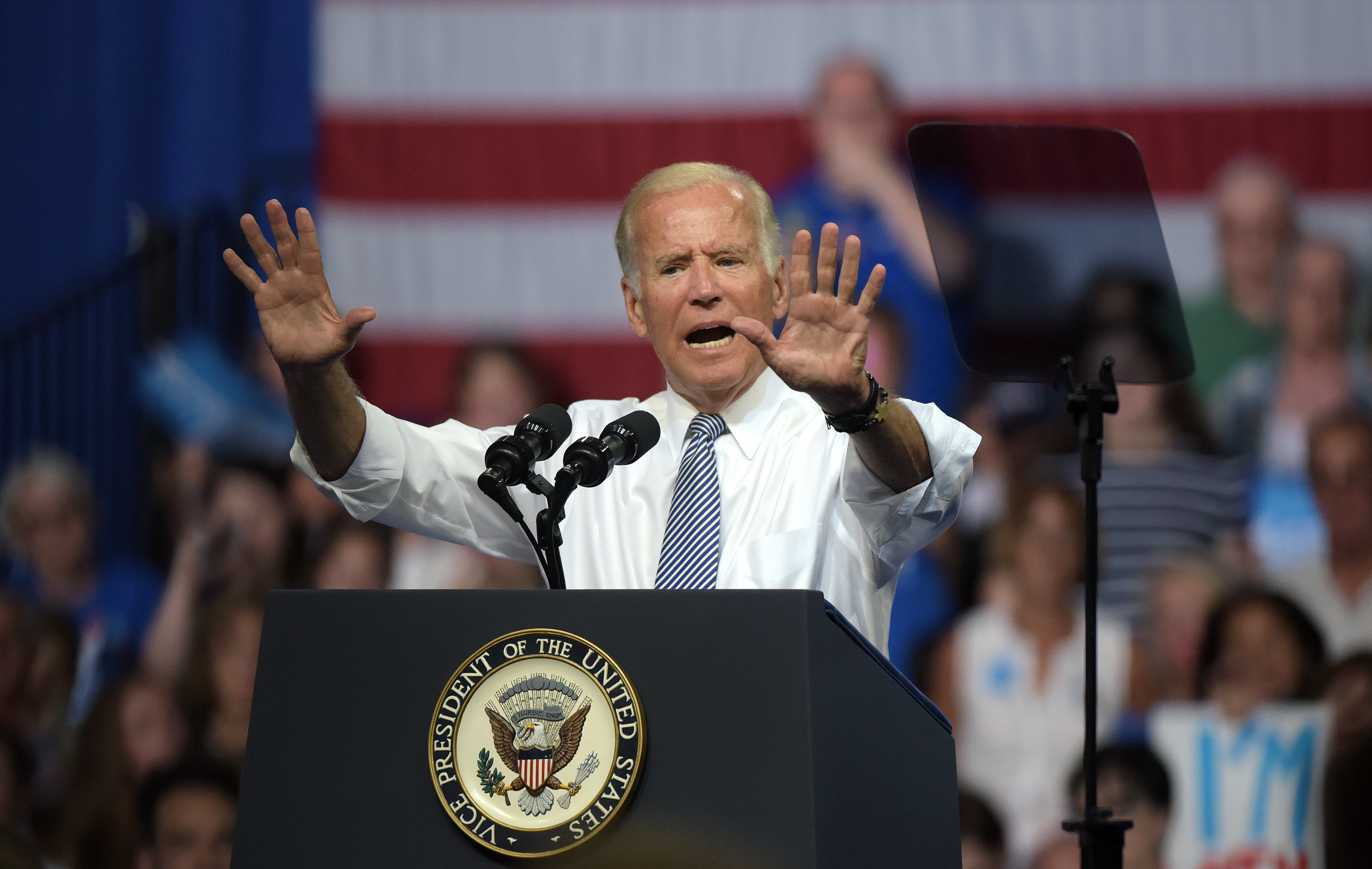

The United States presidential election is coming in just a few short months. Current and controversial President Donald Trump will face off against former Vice President Joe Biden.

Biden served in the role under Barack Obama from 2009 to 2017 and was the 47th Vice President in the White House.

Now Biden is looking to take on the top-ranking role in the country, and oust Trump from the White House after just one term.

The economy may now be in trouble under Trump’s watch, though his presidency has done wonders for the stock market. A favorable tax environment and other corporate benefits have helped the stock market boom.

RELATED READING | GROWING MISTRUST IN GOVERNMENT AUTHORITY MAY BOOST BITCOIN BUYING

At the start of the year, major stock indices like the S&P 500, the Dow, and more set a new all-time high.

But the pandemic caused a major shakeup in markets and dealt a powerful blow to the economy. It caused the stock market to set its worst quarterly close on record. Bitcoin also crashed over 50% in the madness.

In these conditions, Biden taking over could make matters worse due to a poor tax climate and other changes potentially coming from a Democratic power change.

Wells Fargo head of equity strategy Chris Harvey says that a Biden win is a major risk to the market. Harvey also says that the potential scenario isn’t yet “priced into the market,” according to comments made on CNBC’s Trading Nation.

Brave New Coin Bitcoin Liquid Index Daily | Source: TradingView

Bitcoin Correlation With S&P 500 Could Be Harmful Post 2020 Presidential Election

The first-ever cryptocurrency has only existed a little more than a decade. But during that time, its seen three total US presidential elections. The two prior presidential elections sparked incredible bull runs in Bitcoin after the uncertainty settled.

From the moment Trump took office, Bitcoin went on its strongest bull market ever. The asset peaked a year after Trump took office at $20,000.

This next time, however, may not have such positive results if Wells Fargo is correct.

RELATED READING | HOW THE 2020 US PRESIDENTIAL ELECTION MAY BE KEEPING BITCOIN AT BAY

Bitcoin has been tightly correlated with the S&P 500 over the last several months. The S&P 500 is one of the most important US stock indices and a barometer to the country’s economic health.

Recently, as the S&P 500 rises and falls, Bitcoin follows closely behind. If a Biden win drags down the stock market post-election or gets priced in pre-election, it could be harmful to Bitcoin.

The cryptocurrency’s next bull market could be postponed further as a result. If not, as past data suggests, the election could be the one thing standing in the way of the next bull market.

Featured image from Shutterstock. Charts via TradingView.