It is not too late to invest in bitcoin, said multinational financial services giant Wells Fargo in a Monday report, drawing parallels between the adoption rates of the internet in the 1990s and that of cryptocurrencies today.

Wells Fargo’s global investment strategy team explained in the report that Bitcoin’s over 200% annualized gains since its first transaction in 2010 often lead some investors to think that it may be too late to join the party. However, the big bank disagrees.

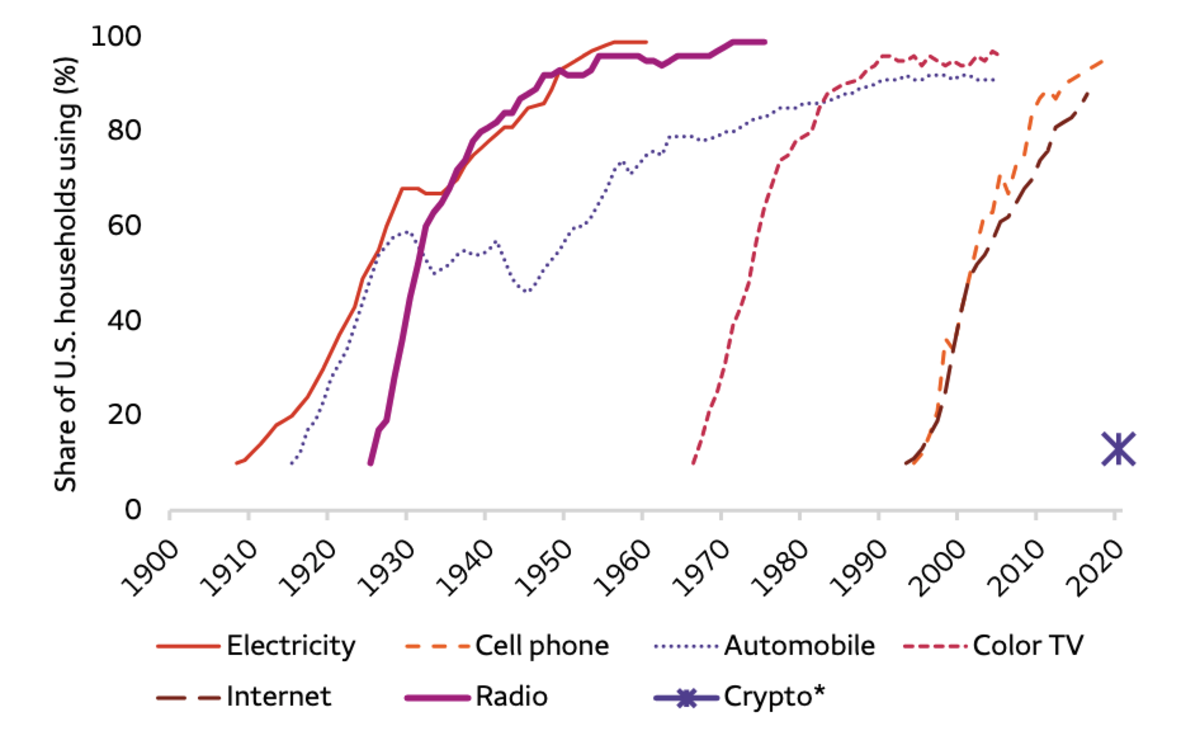

“We understand the ‘too late to invest’ argument but do not subscribe to it,” the report said, explaining that similar to the internet in the mid-to-late-1990s, Bitcoin and cryptocurrencies “could soon exit the early adoption phase and enter an inflection point of hyper-adoption.”

Moreover, Wells Fargo believes that Bitcoin’s adoption rate will be even faster than that of the internet because “each new digital invention rides the coattails of the digital infrastructure already built,” as evidenced by the steeper rise in smartphone adoption.

Technology S curves. Source: Wells Fargo.

“We expect that cryptocurrencies eventually will follow an accelerated adoption path similar to recent digital inventions,” the report said.

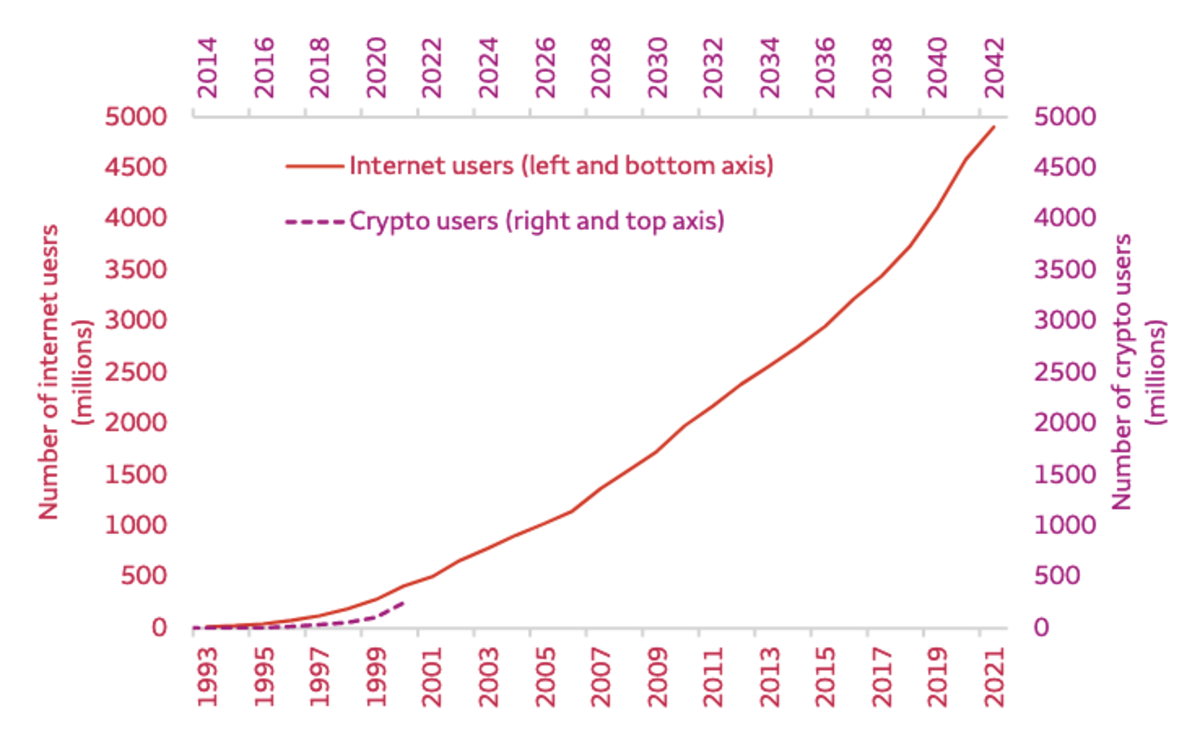

Internet usage history versus cryptocurrency users. Source: Wells Fargo.

“It appears that cryptocurrency use today may even be a little ahead of the mid-to-late 1990s internet,” Wells Fargo said, referring to the chart above. “Precise numbers aside, there is no doubt that global cryptocurrency adoption is rising and could soon hit a hyper-inflection point.”

The report said a steeper S-curve for Bitcoin might be fueled in part by greater regulatory clarity as legal frameworks that have begun being drawn solidify the digital currency as an investable asset for many high-net-worth individuals that have been unwilling to make an allocation.

However, Wells Fargo suggests that investors obtain bitcoin exposure through private placements by professional asset managers rather than buying the digital currency directly from an exchange, arguing that “the technology is complex.”

Buying bitcoin isn’t as complicated as it used to be as intuitive developments get built around the world. In the U.S., for instance, users can buy BTC directly from Cash App, the popular financial services application by Block, and withdraw to a bitcoin wallet of their choice. Even though there is a learning curve with self-custodying bitcoin, the positives outweigh the negatives in the long run since it is the only way to benefit from Bitcoin’s value proposition of complete financial freedom.