Why Do Munger And Buffet Criticize Bitcoin?

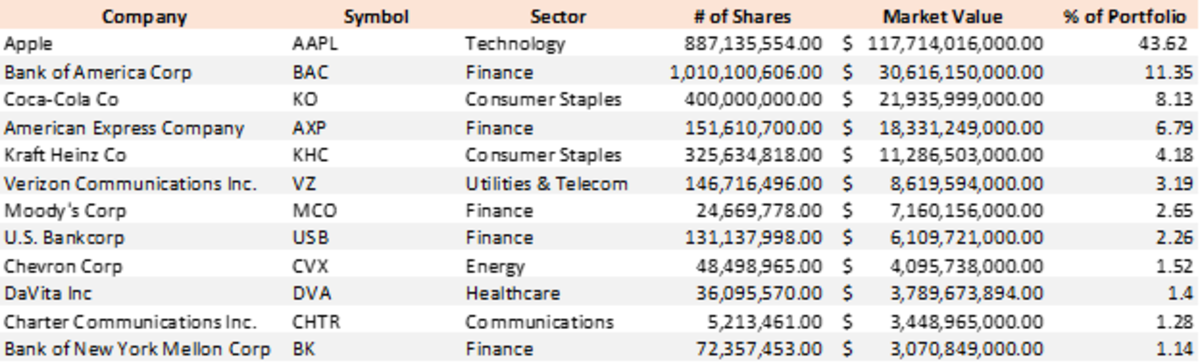

A breakdown of Berkshire Hathaway’s top-12 portfolio holdings and their high correlation with the existing fiat financial service system.

Have you ever noticed people who criticize bitcoin possess one of two key characteristics? 1) They do not understand at all what bitcoin is or why it has value, and/or 2) bitcoin’s success threatens their wealth in the fiat system. Without fail you can categorize 98% of bitcoin criticism into these two categories. It’s really quite astonishing!

Fiat Billionaires

Warren Buffet and Charlie Munger publicly criticized bitcoin at the recent annual Berkshire Hathaway shareholders meeting. Buffett is the fifth richest person in the world (in USD) with a net worth of ~$105 Billion USD. Charlie Munger is also a fiat billionaire with a net worth of over $2 billion in USD terms. Buffet is the chairman and CEO of Berkshire Hathaway, and Munger is the vice chairman. Both Buffett and Munger can easily be classified as two of the most successful investors in the last 50 years. When they talk, people listen and for good reason! They are obviously good investors; being among the richest people on the planet tends to give you credibility in that way. Having said that, Buffett and Munger are dead wrong about bitcoin.

Munger’s Thoughts On Bitcoin

During Berkshire Hathaway’s annual shareholder meeting this weekend, Munger criticized bitcoin by stating: “Of course I hate the Bitcoin success … nor do I like just shuffling out a few extra billions and billions of dollars to somebody who invented a new financial product out of thin air.” To me, this quote is very telling.

1) It illustrates both a lack of understanding of what bitcoin is, and

2) a reluctance or anger to have to adopt a new financial model.

“Of course, I hate the Bitcoin success” is a particularly strange choice of words. Why the hate? What has bitcoin ever done to you? My interpretation: Munger has become a billionaire in USD terms and does not want to all of a sudden have to switch his unit of account. Simply put, Munger is hesitant to adopt the bitcoin standard as he would go from one of the world’s wealthiest (in USD) to owning zero bitcoin.

I liken Munger’s comments to someone who has been playing a sport his entire life. Munger and Buffet have been two of the best at their sport for decades. Suddenly, 13 years ago, the rules of the sport changed (Bitcoin), but nobody told Munger or explained why. Today, Munger looks around and there are now a lot of new people playing the same sport as him. But only playing better because the new rules say so.

For Munger, recognizing bitcoin’s success, would indirectly devalue the USD. He sees bitcoin as a threat to the wealth he and Buffet have made in fiat terms. When people either feel threatened by bitcoin or do not understand bitcoin (or both) they tend to lash out negatively and publicly. It’s human nature; we mock what we do not understand and we fight when we feel threatened.

Berkshire’s Fiat Financial Services Holdings

Why does Munger feel threatened by bitcoin? Because five of Berkshire Hathaway’s top-12 investments (based on percentage of portfolio allocation) are banks or directly related to fiat financing (based on Berkshire’s latest 13F filings). Based on percentage of portfolio allocation, those companies are as follows:

Almost a quarter of Berkshire’s top-12 holdings (let alone their entire portfolio allocation) are invested in either a bank, a credit card company or a financial services company which provides investors with credit ratings, risk analysis and research for stocks, bonds and government entities.

- Bank of America Corporation (BAC), 11.35%

- American Express Company (AXP), 6.79%

- Moody’s Corporation (MC), 2.65%

- U.S. Bancorp (USB), 2.26%

- Bank of New York Mellon Corp (BK), 1.14%

In fiat dollar terms, that is $65.28 billion USD invested toward fiat financial services continuing to excel.

Putting Your Mouth Where Your Money Is

Based on this portfolio allocation, does this seem like a company which stands to gain or lose wealth through the adoption of a new financial system? Based on Berkshire Hathaway’s investments, does bitcoin as an accepted unit of wealth help? Of course not. Berkshire stands to lose wealth with bitcoin’s success. Based on the amount of capital that Buffet, Munger and Berkshire have invested in the fiat monetary system, do their negative comments on bitcoin surprise me? Not at all, frankly if they had come out in support of bitcoin, with that much exposure to fiat financial services, I would have been shocked. My guess is so, too, would their shareholders. This past February, if I had bet $65.28 billion on the Tampa Bay Buccaneers to win the Super Bowl, do you think I would be cheering for the Kansas City Chiefs to get a first down? Heck no.

“Don’t tell me where your priorities are. Show me where you spend your money and I’ll tell you what they are.” — James W. Fick

The next time you read a negative comment toward bitcoin ask yourself: What do they stand to lose with bitcoin’s success? The answer is very telling.

“‘I’ll miss a lot of things that I don’t feel I understand well enough, and there is no penalty in investing if you don’t swing at a ball that’s in the strike zone, as long as you swing at something at some point ... We’ll try to stay within our circle of competence, and Charlie and I generally agree on where that circle ends... We’ll try to stay within our circle of competence … We’re going to miss a lot of things.” — Warren Buffett

Like investing, staying within our circle of competence should hold true for criticisms as well. Knowledge is power.

This is a guest post by Drew MacMartin. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.