Previously reported by

Bitcoin Magazine

, bitcoin and gold exchange Vaultoro has reached $1 million in gold trading volume, recording an average monthly trading growth rate of 91 percent and rapid increase of its user base. Following its milestone, Vaultoro plans to expand its team and services internationally, to become the “key ingredient for the 2.6 billon under-banked” individuals all around the globe.

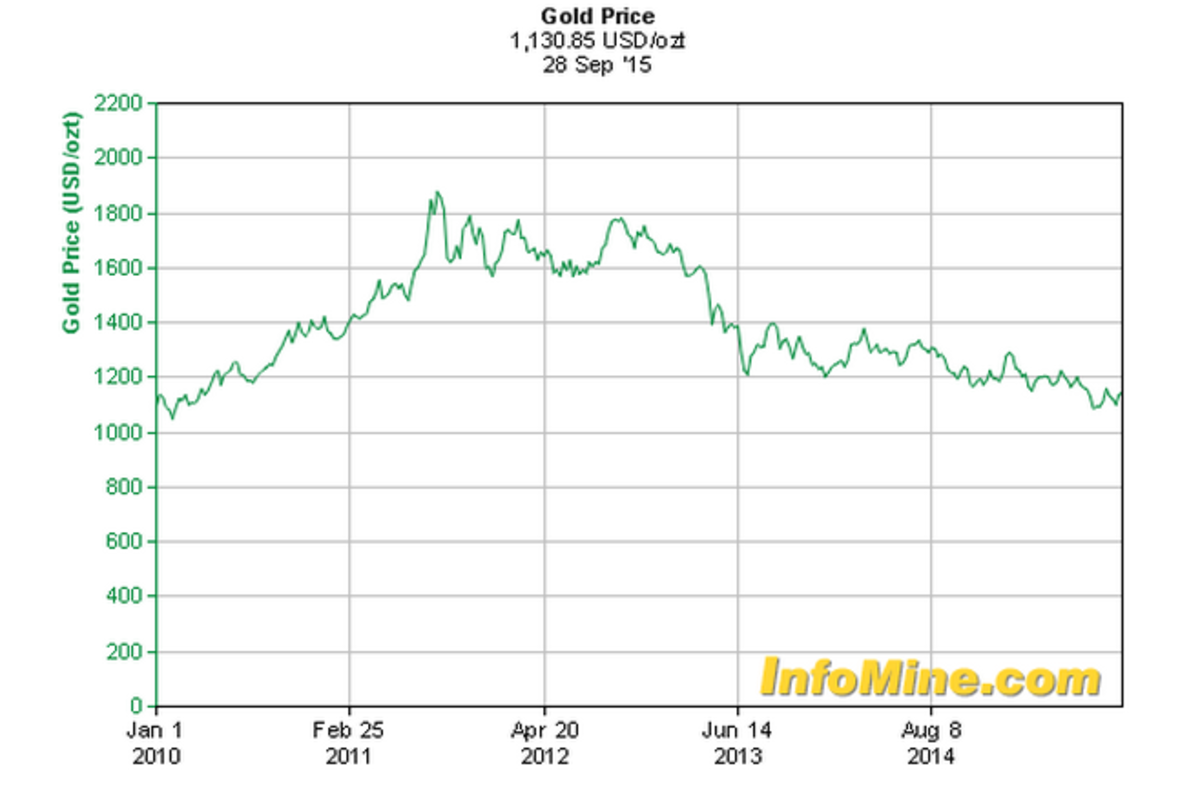

Gold has been the international store of value for thousands of years. Unlike bitcoin or fiat money, gold has proved to be a stable universal currency with very low volatility. Based on the five-year gold chart taken from Infomine.com, the gold price in January 1, 2010 stood at around $1,100. At this time of writing, the price of gold is around $1,130, recording a mere $30 difference over the last five years.

Brothers Joshua and Philip Scigala developed Vaultoro to allow the underbanked population to escape the volatility of bitcoin and store their wealth in physical gold.

“We built Vaultoro so people anywhere in the world can hedge the bitcoin price volatility without going back to fiat but by instantly parking any value in gold. Gold gets its value from the markets and not by government dictate. It is also globally recognized as a store of value. It has lasted more than 3,000 years, whereas no paper fiat currency has lasted more than 200 without collapsing with terrible consequences for the holder,” Joshua Scigala told

Bitcoin Magazine.

“We see Vaultoro being a key ingredient for the 2.5 billion underbanked in the world to be able to accept payment from all around the world with bitcoin, hold that value in assigned gold and then spend it within seconds using bitcoin again,” added Scigala.

Currently, Vaultoro stores all of its physical gold in a Swiss high-security vault, 100 percent insured against theft, fire and other eventualities. Unlike most of fiat-to-gold bitcoin exchanges, Vaultoro will deliver gold bars in physical form to their users at any time.

Vaultoro to Launch a Point of Sales App

Online merchants, especially in Latin America and Southeast Asia have fallen victim to the highly volatile nature of bitcoin and time and time again. Today, there are very few platforms that enable users to hedge the value of bitcoin to another asset.

With an aim to serve small and medium-sized bitcoin merchants in underbanked regions, Vaultoro plans to launch a point of sales application that “will allow merchants to choose their hedge, meaning a 50/50 split or a 10/90 split between bitcoin they get in and gold they hold. We are looking at possible partnerships with ATMs and mobile payment providers in these regions so they can hook up to our system via API and use gold and bitcoin directly or indirectly through us,” Scigala told

Bitcoin Magazine.

“Lock-in Service”

A few bitcoin platforms such as Coinapult offer a bitcoin “lock-in” service that allows users to lock in the price of bitcoin to the price of another asset has been popular in the United States and Latin America. The Vaultoro team found the idea of a gold-to-bitcoin lock-in service interesting, but they believe that the lock-in feature would contradict the fundamental philosophy that wealth is backed by real physical assets.

“When someone trades into gold on Vaultoro they actually buy physical gold that is secured as their property in their name. The gold is held in what’s called a bailment contract meaning we secure someone else’s property (just like self-storage facilities hold your furniture). By offering to lock in someone’s bitcoin to a certain price we would be moving away from the fundamental philosophy that wealth is backed by real physical assets and not by a promise to lock a price and deliver on that,” said Scigala.

Instead, the Vaultoro team may look into diamonds or other physical assets that are even more stable than gold.

Investments

Currently, Vaultoro is considering a funding round to maintain its services and expand its team. The Vaultoro team is exploring a few options including crowdfunding campaigns and venture capital investments.

“Any other investment we would take on would not only be to raise money but also to gain expertise and knowledge by bringing onboard people that will help us grow our vision long term,” Scigala said. “A vision of open markets, a vision where we stop taking money from poor people in rich countries and giving it to rich people in poor countries, but rather give poor people in poor countries the tools to lift themselves out of poverty by enabling them to join a global market of goods and services through a bank and state independent monetary system we all know and love as Bitcoin.”