Ethereum seems to have been leading the crypto market in terms of price performance. The second cryptocurrency by market cap has several potential catalysts that could add more bullish momentum. With time, the list has continued to expand.

U.S.-based company Circle has announced its intention of going public via a special purpose acquisition corporation (SPAC). Jeremy Allaire, co-founder, and CEO at Circle, stated via his Twitter account that the decision to go public has become a critical step for the firm.

The company has been forming new partnerships to expand the reach of its key product, stablecoin USD Coin (USDC). Thus, the firm seeks to increase their levels of transparency, the reserves that back USDC, and the business created around this Ethereum based stablecoin, Allaire said.

Circle intends to become the most public and transparent operator of full-reserve stablecoins in the market today. With upcoming public filings, and new USDC reserve attestations, our intention is to provide a detailed summary of USDC reserves.

Ultimately, the company will attempt to meet the transparency standards required by the U.S. Securities And Exchange Commission (SEC). At the same time, it aims to tackle new regulatory and self-governance models.

John Todaro, Vice President of crypto Asset and blockchain research at Needham, said that Circle’s decision to go public could usher a new wave of institutional adoption to Ethereum. By increasing their levels of transparency and compliance, more institutions could feel attracted to Ethereum, and especially its DeFi sector.

Anthony Scaramucci, SkyBridge Capital CEO, Mike Novogratz, Galaxy Digital CEO, and others have pointed out Ethereum’s potential to shape a new financial system with a number of use cases. A clear regulatory framework has kept other institutions from participating in its ecosystem, but the status quo could change with Circle’s debut in the public market.

Circle To Be Wall Street’s Door Into The Ethereum DeFi?

Jeremy Allaire acknowledged that greater scale, adoption, and success must be with greater transparency. USDC is becoming the dominant stablecoin on Ethereum, according to data provided by Messari researcher Ryan Watkins.

This stablecoin has been displacing its competitor Tether (USDT) and could be even more relevant in the DeFi sector. Around $12.5 billion or 50% of USDC’s total supply has been locked into a smart contract. Thus, Watkins concluded that USDC is now the “preferred stablecoin in DeFi”.

From Maker, Aave, and Compound, USDC has been driven a large number of DeFi dApps. This trend seems poised to continue in the future. Watkins said:

With the pending launch of Compound Treasury and a swath of initiatives centered around Circle’s DeFi API it is very likely this trend will continue meaning more dollar liquidity will funnel into DeFi.

Senior Commodity Strategist for Bloomberg Intelligence Mike McGlone claimed that Ethereum has managed to “flushed out” potential liabilities. The second cryptocurrency by market cap has reduced excess in terms of speculation while increasing its levels of adoption as reflected by its rise in addresses. This network alone could be “accelerating the digitalization of money”.

If Circle managed to capitalize on its strength and relevance in a sector likely to be worth trillions in the future, Wall Street and other institutions could find a legitimate entry via its SPAC into the future of finance.

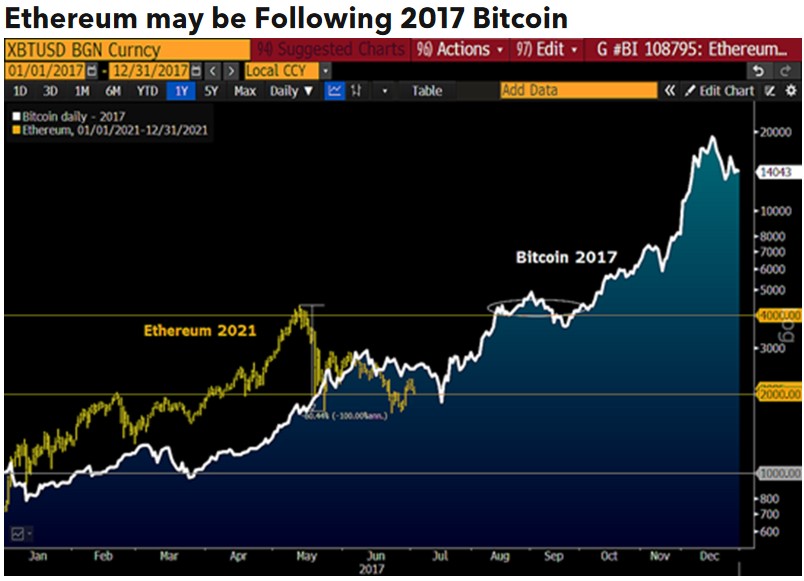

McGlone believes ETH is trading at a discount when compared to its potential. The second cryptocurrency by market cap could follow a similar trajectory to Bitcoin in 2017 and make its way beyond the $10,000 per ETH based on its future limited supply.

Ethereum may represent a next level of innovation, one-upping the tech-heavy Nasdaq. The No. 2 crypto is gaining luster as the building block for the crypto market and fintech, which is digitalizing rapidly as the Ethereum supply is set to decline.

At the time of writing, ETH trades at $2,170 with moderate losses in the daily chart.