Listen To This Episode:

In this episode of Bitcoin Magazine’s “Fed Watch” podcast, we responded to Federal Reserve Chairman Powell’s comments at Jackson Hole on August 27, 2021. We listened to several important sound bites and discussed it along the way. Powell was expected to announce a Fed taper, where it begins to shrink its monthly purchase of securities in quantitative easing.

We have often said that Powell is somewhat of a straight shooter relative to other central bank leaders of the past and present. We also are hesitant to ever agree with a Federal Reserve chairman, but in this case, we find many points to agree on.

Bitcoin is beginning to naturally fit into every discussion on central banks and the international financial system. We touch on bitcoin throughout this episode.

Chairman Powell At Jackson Hole

We went very in depth with this analysis. In the first couple of sound bites, Powell introduced the anomalous nature of this recession. Namely, that average incomes rose due to fiscal stimulus. He made it clear that the unique interplay between rising incomes and unavailable services from the pandemic shifted demand from the service sector to the manufactured goods sector. This spike in demand and spending on manufactured goods as supply chains were effectively frozen caused huge distortions in the market and some prices to rise.

The volatile nature of these price moves are not captured entirely in a 12-month window in which consumer price index (CPI) is measured. Powell introduced an 18-month chart that corrects for some of the shortcomings of the 12-month version, by including the recession and recovery in whole.

We stepped through some charts showing how transitory price increases don’t necessarily mean a declining rate of change, but actual price declines. Prices go up and prices go down. As used cars, commodities, oil, gasoline, and copper, all go up and down.

The last two clips we listened to were about actual Fed policy. Powell described what is, in my opinion, the only Fed policy tool, anchoring inflation expectations:

“Our monetary policy framework emphasizes that anchoring longer term expectations at 2% is important, for both maximum employment and price stability,” he said.

Powell finally danced around the issue of taper, never saying the word. He reiterated what he has said before, that if significant and sustained improvement toward the Fed’s goals are made it might be appropriate to begin tapering this year. Co-host Christian Keroles and I went over this comment in depth. We see it as likely that Powell was searching for a way to keep taper very much on the table but also give the Fed an out if the global economy takes a dive in the next few months. That dive is looking more and more likely, by the way.

Powell’s Reappointment As Chairman Gets Political

For our second major topic, we stayed with the Fed. Chairman Powell is up for reappointment in February and it is getting somewhat political. The Fed is supposed to be apolitical, but Powell is coming under increased criticism from progressives in the government. They want a more politically-motivated central bank, to help them force in climate regulations and other progressive objectives.

Powell is caught here between growing pressure from politicians to be more of an activist and members from within the Federal Open Market Committee (FOMC) itself calling for tapering. He must find a way to walk a fine line if he wants reappointment.

China’s Credit Impulse And Purchasing Managers’ Index (PMI)

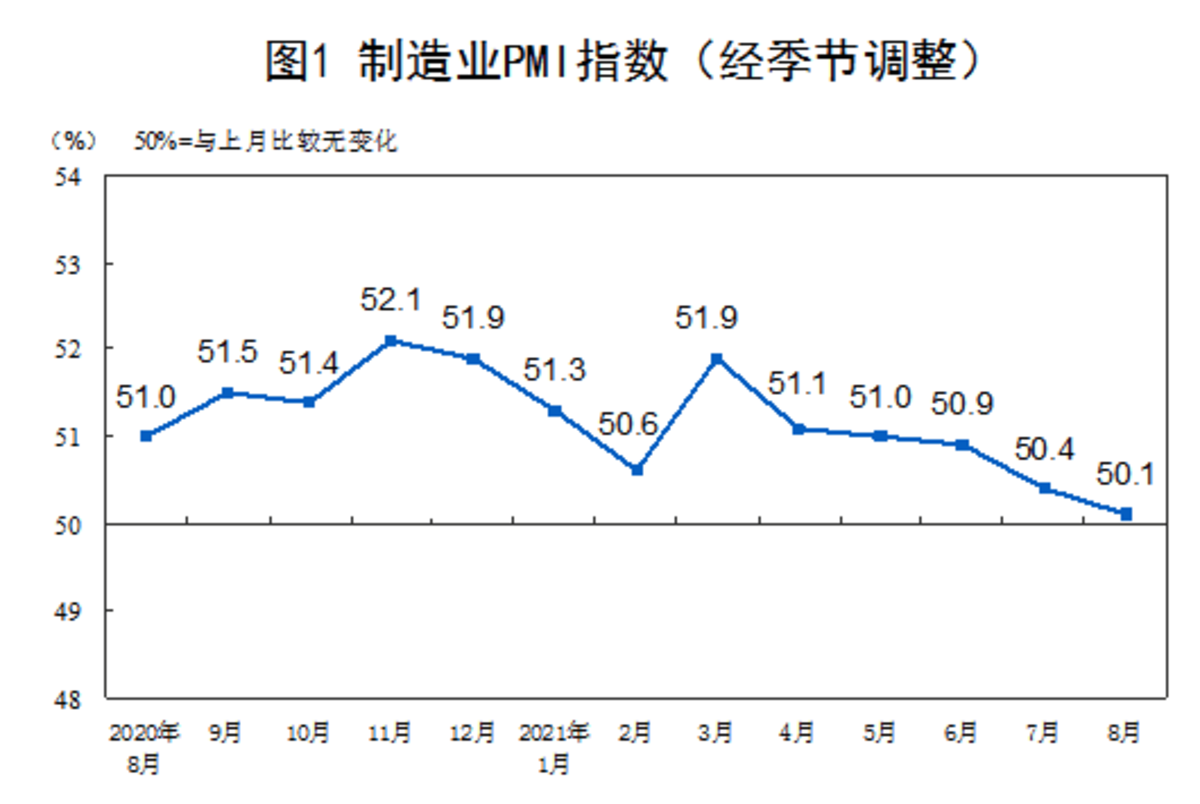

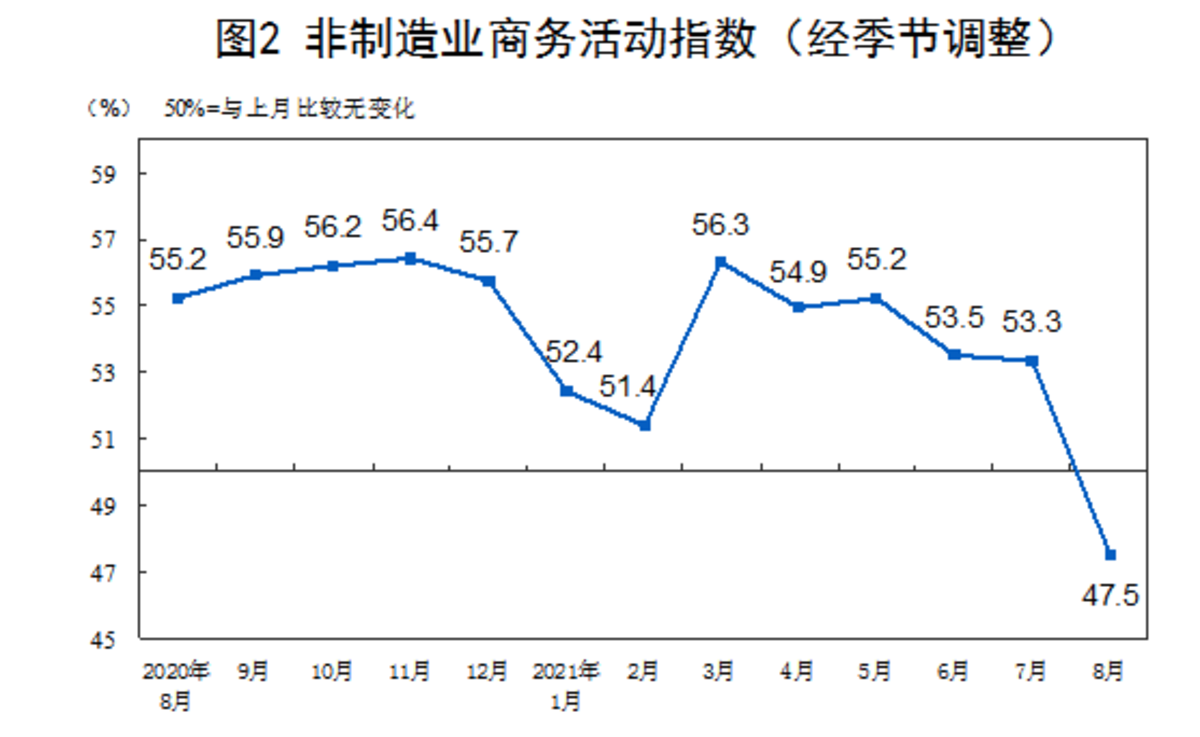

China’s economy is wavering. It was celebrated post-Great Financial Crisis (GFC) as the source of growth that pulled the global economy out of recession. If you had any illusion that that would happen again, this week’s PMI data has smashed your hopes.

These numbers show the contraction in China is serious and gathering pace. Remember, in a highly indebted economy, low growth is not enough to avoid a crisis. You need expansion to cover repayment of principal plus interest. If the Chinese average interest rate is 5%, it must have 5% growth or else defaults and contagion spread. As soon as the defaults become too numerous to deal with, bankruptcies could spread throughout its bubble economy.

Manufacturing PMI

Non-Manufacturing PMI

We hope you enjoy this episode. It is jam packed with Federal Reserve updates. If you like it please share and give us thumbs up on YouTube and a good review on iTunes.

Articles mentioned:

Politico: AOC, Tlaib, Pressley call on Biden to dump Powell as Fed chair

IMF: Climate Change and Financial Risk