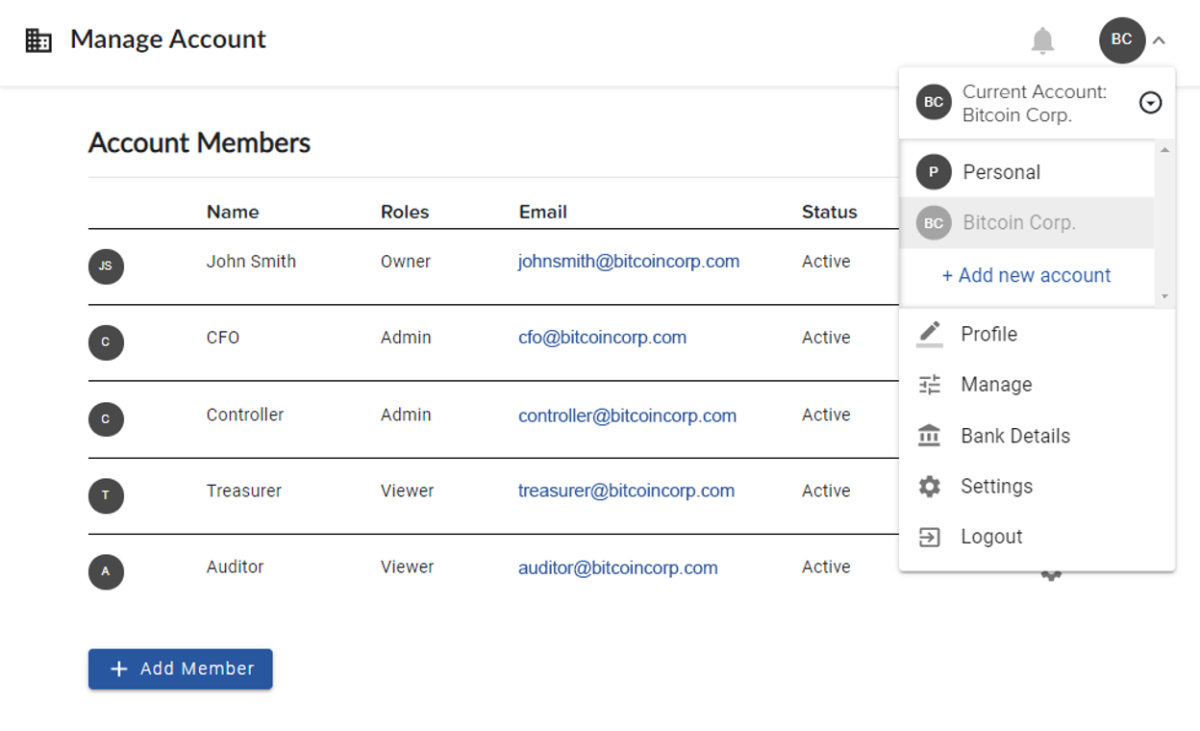

Unchained Capital, an Austin-based financial services firm, has announced its new enterprise-grade self-custody offering, aptly named “Business Accounts for Bitcoin.”

The underlying principle of this new offering is “collaborative custody,” for which Unchained’s goal is to focus on simple workflows for funds, businesses and B2B2C providers to manage private keys. Common alternative solutions for managing multiple private keys might be splitting up the keys into multiple pieces and using Shamir’s Secret Sharing or relying only on multisig key security. Neither of those alternatives take into consideration any actual business logic needed for determining more complex arrangements to spend bitcoin, though.

According to Unchained’s release, it has built the product to add in the additional business logic while still having zero counterparty risk. Each private key in the system is augmented to be tied in with the user-level settings inside of the application in order to offer enhanced functionalities that are specific to its product. However, if you do want Unchained to be part of your key management process, you can integrate with its open-source Caravan product or include Unchained as a backup key holder.

When asked about the primary customer Unchained is searching for, Parker Lewis, the head of business development, highlighted case studies done with Amber and Tantra Labs in which self custody was a top priority. After working with Unchained’s collaborative custody solution, Amber CEO Aleks Svetski told the firm that “Collaborative custody allows us to do much of the same multi-party schemas, but in a way that spreads the risk across multiple hardware wallet manufacturers, multiple unrelated users, and an extra layer of sharding previously unavailable. Ultimately, Amber is in full control of the funds through our own secure private keys but we leverage Unchained’s expertise, key management technology and Unchained as a backup keyholder to increase security.”

The timing of this announcement comes right on the heels of the Office of the Comptroller of the Currency (OCC) clarifying that banks can now custody bitcoin on behalf of their customers, which is another use case that Unchained is keeping in mind.

When asked about Unchained’s plans to target banks as customers for this new product, Lewis commented via email that the OCC’s clarification has led to a direct rise of interest in Bitcoin from banks.

"With the recent interpretive letter from the OCC, financial institutions including banks are starting to recognize the need for a bitcoin custody strategy and we've seen increasing inbound interest from banks and wealth managers looking for solutions to custody bitcoin,” he wrote. “Our advanced business suite is ideal for these institutions to leverage because it lowers the risk and investment burden, while ensuring the most critical component of the custody chain, private keys, remains in the unilateral control of businesses serving end clients."

Disclosure: BTC Inc is a customer of Unchained Capital.