TradingView still has flaws when it comes to the crypto market and will have to break away from its traditional finance background to put the funds it received to good use and make crypto inroads.

TradingView, a developer of social networking and data analysis tools for financial markets, got in early as a crypto trading and investment tool finding an amazing opportunity, which has resulted in the company receiving a whopping $37 million in new funds by Insight Venture Partners. While their idea is sound, top traders managing large crypto hedge funds have already found that there are major differences between the data used to invest in stocks versus crypto. In short, emotional sentiment plays a much more significant role in how people invest in crypto vs more traditional fundamentals based stock market approach.

The Benefits and Problems of Technical Analysis

The technical and deep analysis used in traditional finance and offered by TradingView for the cryptocurrency market isn’t the standalone data beginner investors can rely on or properly use.

Crypto isn’t the stock market – there is more data that needs to be analyzed for the best results. Social media sentiment, news analysis, fork analysis, liquidity analysis, mining network analysis, cross exchange arbitrage, and blockchain protocol analysis just to name a few.

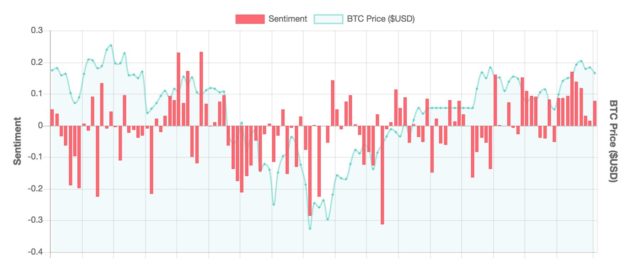

The crypto market is tied to blockchain technology, is becoming more regulated, is far more easily swayed by public sentiment. A lot of crypto experts would agree that in crypto, social sentiment signals are actually more effective than the standard technical analysis tools.

Austin Burkett, Global Head of Quant and Feeds, Thomson Reuters, says:

News and social media are driving the investment and risk management process more than ever with the continuing rise of passive and quant-driven trading.

Not only that, but very few crypto investors, even the intermediates and those who consider themselves advanced, really understand how to interpret hard data. While TradingView is doing well to provide support and resources to the crypto community, it is not yet effective for the majority of crypto investors.

For example, RSI (relative strength indicator) provides raw data open to interpretation which has been nailed down to a science by stock traders, but how data is interpreted is dependant on many factors which those entrenched in finance understand – like knowing positive and negative reversals for RSI, which are the opposite of bearish and bullish divergences.

Stock traders and those who manage giant portfolios never intended it to be easy for just anyone to use and that’s the major flaw with tools like TradingView.

While it’s great that they’re producing data for the cryptomarket, it’s by no means accessible to beginners and tends to cause more harm and confusion than good when not combined with a means of interpreting that data.

Another problem is the culture of crypto investing itself. Investors tend to be highly emotional and even with a solid strategy and data available, it’s hard to stick to it, particularly with HODL on the back of our minds. Crypto is an entirely different market that just happens to share similarities to stocks.

Few tools give a complete picture of the market in a way that’s conducive to both beginners and more advanced traders.

But New Tools Pouring in to Fill the Gaps with a Different Approach to Trading

A couple of promising crypto trading tools are RoninAi and Signals.Network. RoninAi is a new software service that analyzes a wide spectrum of data and indicators including social/news sentiment and interprets the best course of action based on Ai and big data analysis aggregation, while Signals.Network allows you to configure and train your own Ai trading model by feeding it data.

These tools make no promises of human traders giving advice, which is a good thing. No matter how experienced, all humans are prone to mistakes and unlike the stock market, crypto trading is open around the clock. Algorithms and bots can analyze data 24/7 and send notifications, but real artificial intelligence can also interpret that data adjusting to changes not just in the market, but everything that creates, supports, and affects that market.

This is more beneficial for crypto investors who tend to be more hands-off while still wanting to learn how the market works making better decisions on when to buy and sell, without needing niche expertise in chart reading that seems to be a must for TradingView.

As the crypto market quickly progresses out of its infancy, these inherent truths will become more apparent, those that take notice, both investors and tool developers alike, will reap the benefits that cryptocurrency as a unique asset class has to offer.

Which crypto trading tools do you use? Let us know in the comments below!

Images courtesy of Silicon.nyc, TradingView, Medium (Sam Couch), Pexels