As the Bitcoin and crypto landscape continues its rapid evolution, this week stands out as a pivotal juncture filled with events that have the potential to reshape market sentiments and dynamics. From Bitcoin’s price performance to macroeconomic indicators and significant documentaries, here’s a closer look at the key events that every enthusiast and investor should be keenly observing this week:

#1 Can Bitcoin Hold Above $30,000?

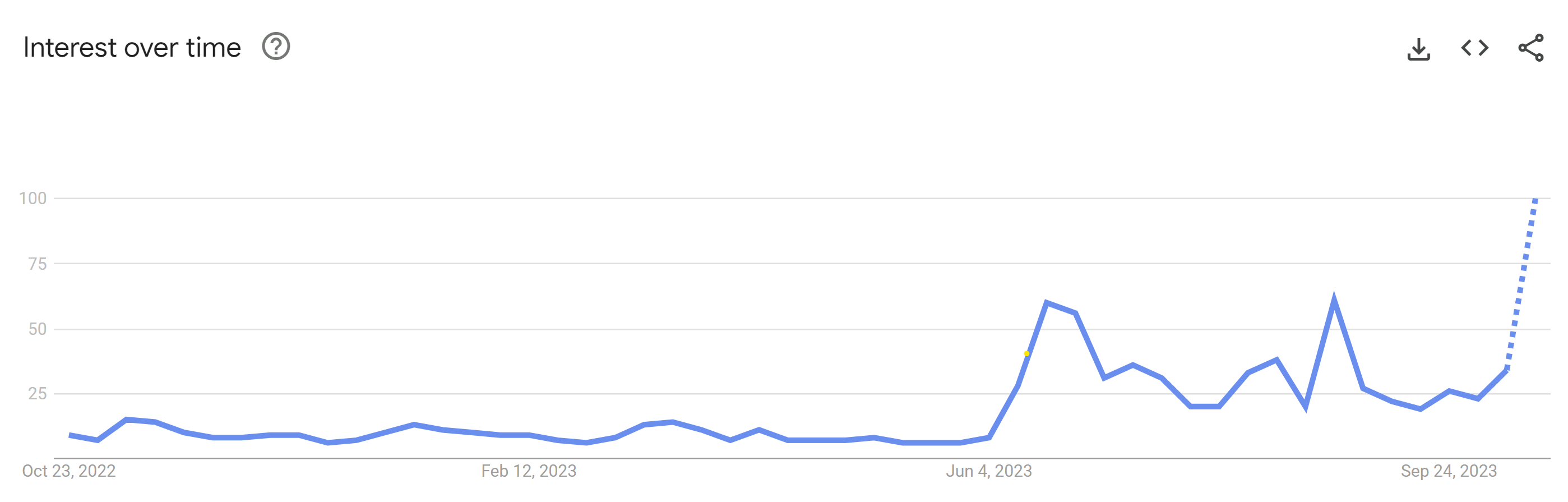

Bitcoin, as in previous early stages of a bull market, is currently the driving force in the entire crypto market. The escalating hope that a spot Bitcoin ETF could be approved by the US Securities and Exchange Commission by the end of this year has brought back the bullish momentum. As Google Trends shows, interest in a Bitcoin ETF has returned among retail investors. Google’s Search volume hit a 12-month high last week.

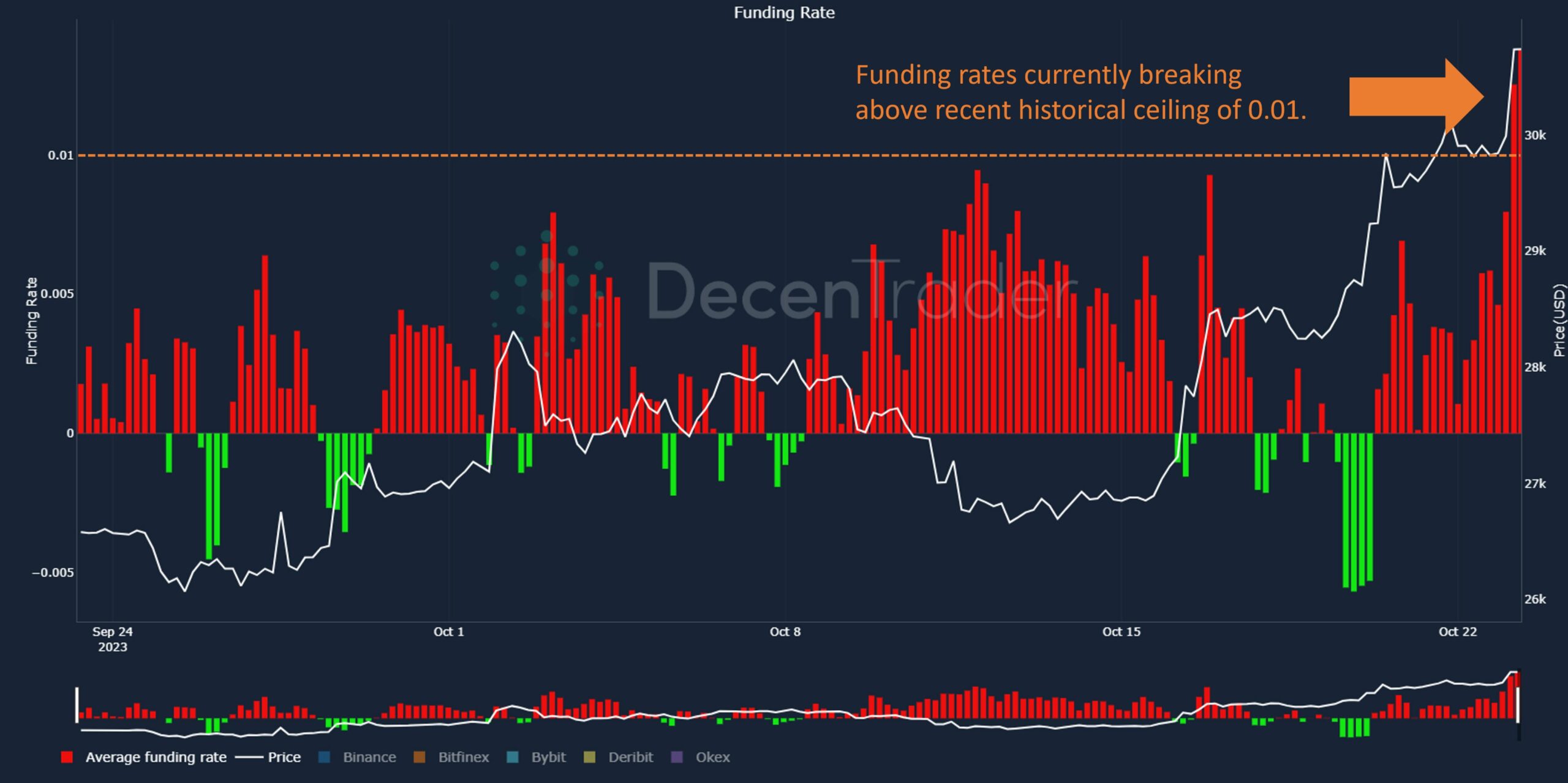

However, it is questionable whether the current movement is sustainable. Some experts warn that futures are overheating. “Bitcoin funding rates have quickly gone from negative to +0.01 as Bitcoin breaks $30,000. Traders becoming more bullish,” remarked the market intelligence platform Decentrader via X.

However, German crypto expert Furkan Yildirim warned: “Many new Bitcoin positions are coming in via the futures markets. Open interest is at its highest level since August and could indicate that the market is starting to overheat.”

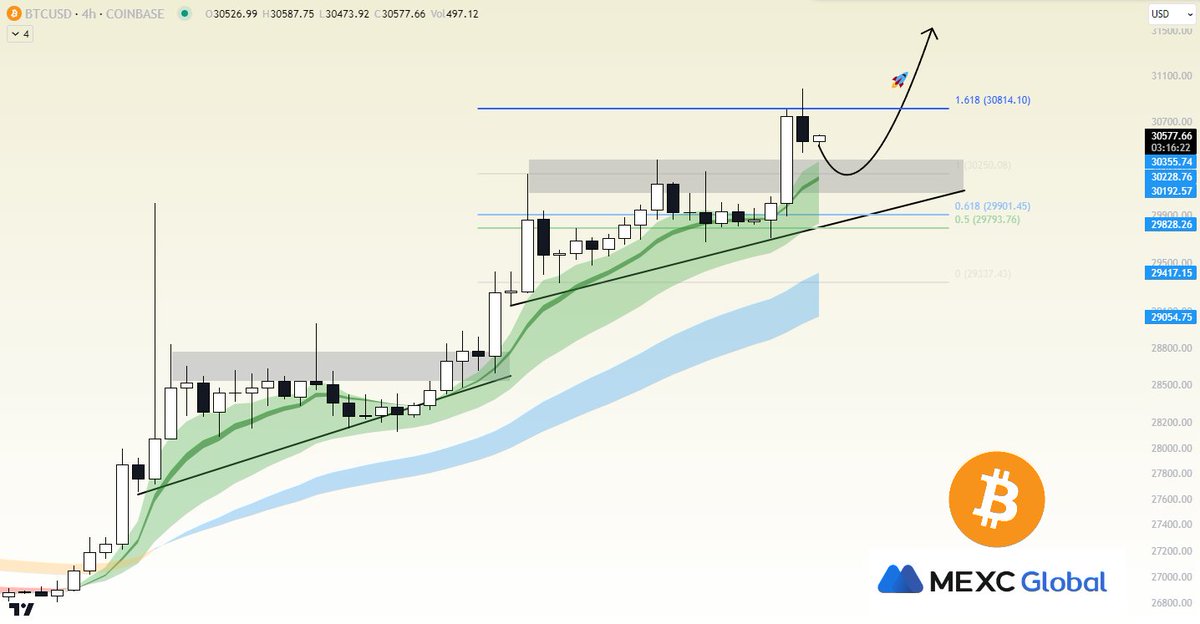

Meanwhile, crypto and macro analyst Mortensen Bach tweeted: “Bitcoin: So far so good! Swiped the 1.618 Fibonacci extension and now we’re retesting the $30,000-$30,500 level. What we want to see is bulls defending those $30,000 to confirm the breakout higher!”

#2 Wednesday: Powell Speaks

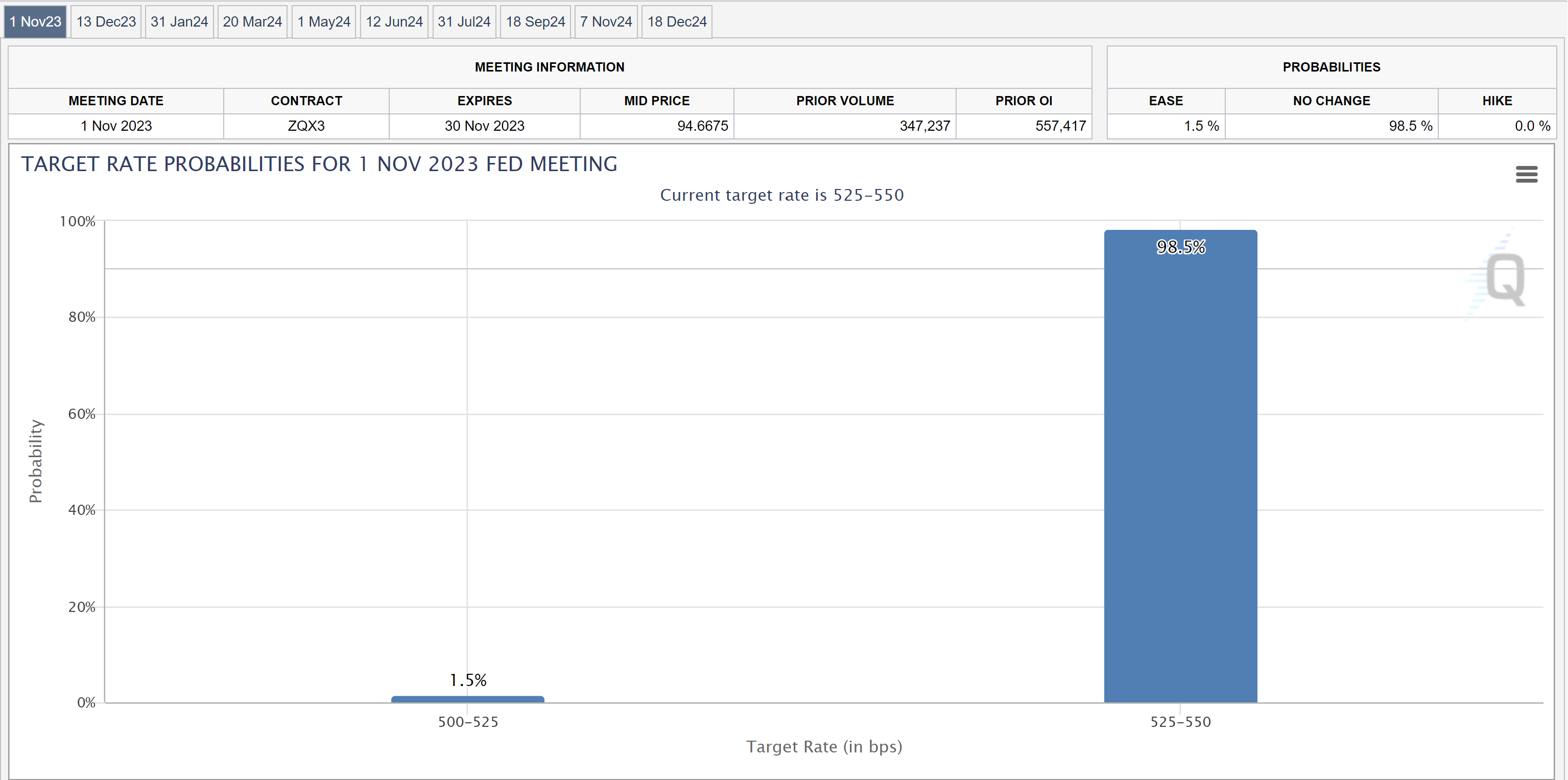

Last week’s speech by Jerome Powell moved the markets quite a bit as the Fed chairman reiterated “higher for longer” while also signaling a rate hike pause for the upcoming FOMC meeting next week, from October 31-November 1, 2023.

Amidst the turmoil in the bond market, the US yield curve kept bear-steepening with a 2-year/10-year spread jumping 19 bps after Fed’s Powell gave the ‘green light’ for higher long-term bond yields with 10 years nearing 5%. Although no surprises are expected in comparison to last week’s speech, a Jerome Powell speech should always be on the watchlist.

#3 Thursday: Bloomberg TV’s SBF Documentary Premieres

Bloomberg TV will unveil its much-anticipated documentary, “RUIN: Money, Ego, and Deception at FTX” on October 26, chronicling the meteoric rise and fall of FTX’s founder, Sam Bankman-Fried (SBF). The production, shedding light on the tumultuous journey of FTX, will offer insights into the downfall of the crypto exchange.

A Bloomberg Originals production, the documentary amalgamates investigative journalism with firsthand accounts from industry insiders to paint a comprehensive picture of FTX’s downfall and the subsequent legal challenges SBF faces. With its trailer already creating a buzz since its release on October 13, the documentary is set to be a riveting watch for anyone keen on the intricate dynamics of the crypto world.

#4 Friday: $3.6 Billion Crypto Options Expiry on Deribit

Friday might see pronounced volatility in the crypto realm, with $3.6 billion in notional crypto options set to expire on Deribit, the world’s largest options exchange. Of this, $2.25 billion pertains to Bitcoin, constituting 21.4% of all BTC options open interest on Deribit, and $1.35 billion to Ether (ETH), representing 22.7% of all ETH options open interest as of October 20.

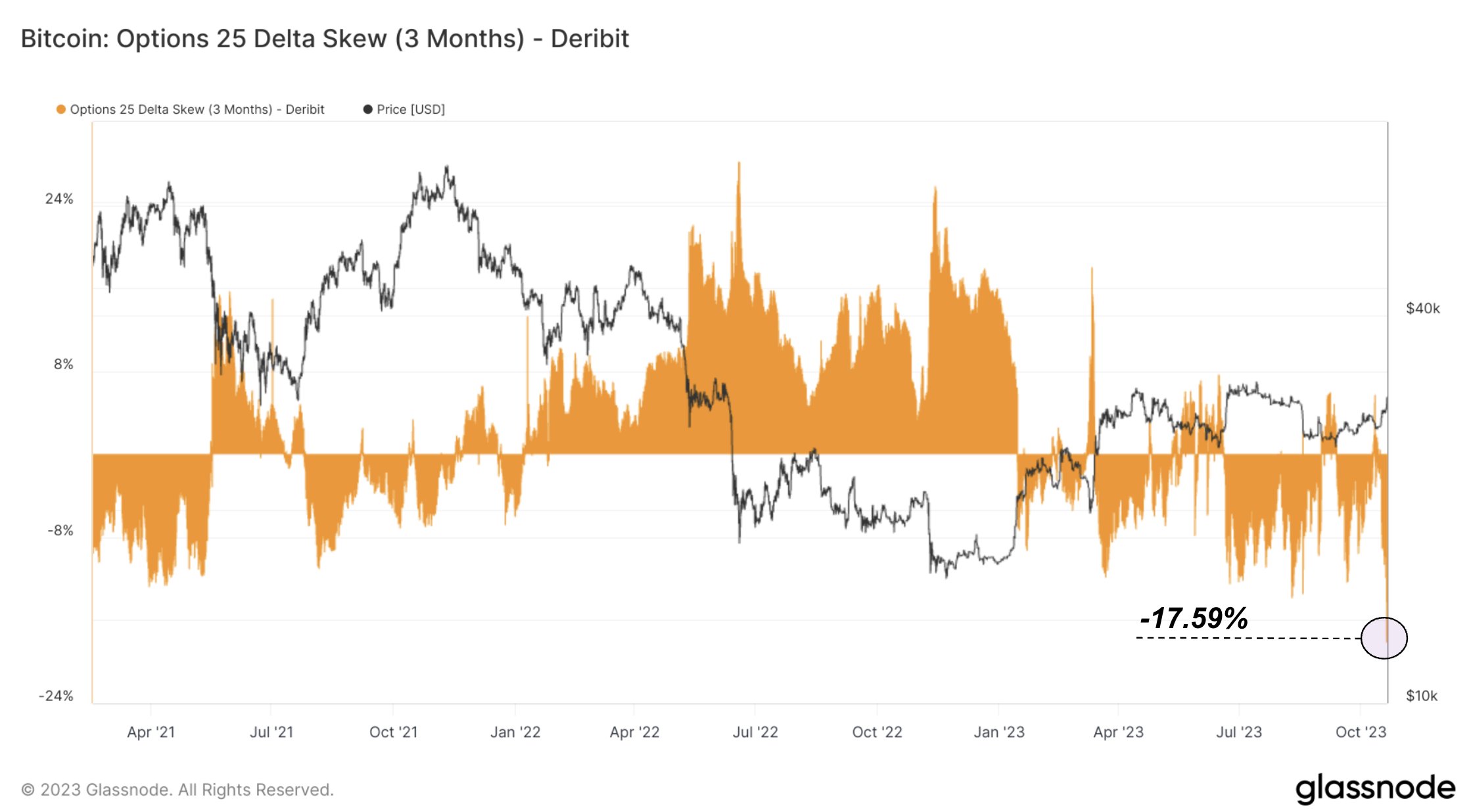

Bitcoin analyst Dylan LeClair has been on the frontline, keenly observing strong shifts in the options market most recently. LeClair monitored a notable trend: “For 3-month options, calls are trading at the largest ever premium relative to puts,” he tweeted.

He went on to demystify the concept of ‘skew’, emphasizing its pivotal role in gauging market sentiment. In simple terms, a positive skew suggests a tilt towards downside protection (or puts), while a negative one leans towards the upside potential (calls). Pointing out the bullishness on the options market, LeClair remarked, “Looking at options volume, it’s the largest ever for a BTC move not to the downside.”

#5 Friday’s US PCE Report For September

From a macro standpoint, the forthcoming US Personal consumption expenditures (PCE) report for September is poised to significantly influence both the wider financial market and the crypto landscape. Slated for release on October 27, the PCE Index— the Fed’s inflation yardstick— will furnish insights into consumer trends.

This data is pivotal for economists and the Fed, offering a clearer picture of economic health before the imminent rate decision during the FOMC meeting on October 31-November 1.

With the Fed having maintained rates at 5.25%-5.50% during its September 2023 FOMC meeting, analysts eagerly await the core PCE details. Anticipations are rife for a “hawkish pause” continuation, fortified by any core PCE readings aligning with or falling below predictions.

Extra: Thursday – Q3 2023 US GDP

Extra: Thursday – Q3 2023 US GDPBeyond the realm of crypto, the announcement of the Q3 2023 US Gross domestic product (GDP) will also capture significant attention this week, potentially influencing broader market sentiments.

For investors, this week promises a riveting blend of events and revelations. From Bitcoin’s performance trajectory to pivotal macroeconomic updates, the coming days are pivotal for anyone keenly tracking the Bitcoin and crypto landscape and broader financial markets.

At press time, BTC traded at $30,570.