Ultimately the market for ICOs is about the companies that make up that market. When you buy a token, you are holding a promise. You’re not holding a piece of that company. It’s important to understand at a deep level what that promise is.

From Skeptic to True Believer

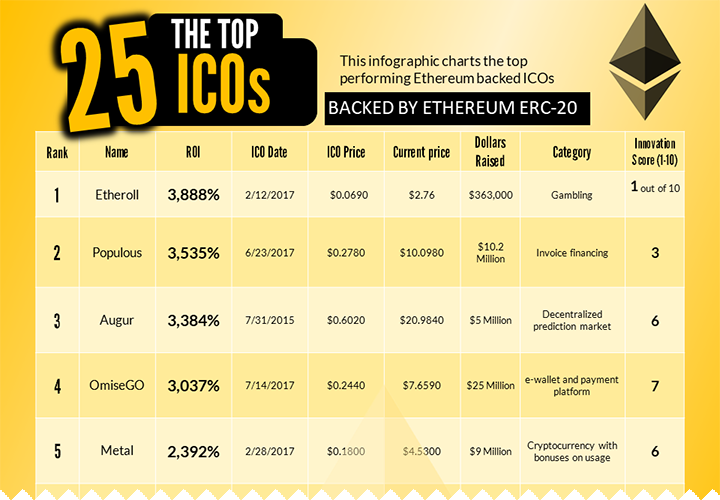

For the past few days, I’ve examined the top performing ICOs that are backed by Ethereum’s ERC-20. Almost all of them are promises to deliver value and some even commit to a return on token.

Going in, I was skeptical about these high performing ICOs and their business plans. But except for a few gambling endeavors, the level of business innovation was shocking. As a marketer, I listened to the ICO hype of easy money from sleazy imposters and I was skeptical. But not anymore.

Take Golem for example, if you haven’t heard of Golem you’re not alone. Golem has given a 1958% return on their ICO from a year ago. That means had you invested just a $1000 in their ICO, it would be worth $19,580 today.

Golem’s business model is also innovative – this isn’t a commodity play. In short, Golem allows users to make money ‘renting’ out their computing power or developing software. And, they’ve tied their token value to the success of the overall platform which theoretically will increase the value of their token over time. That means if you’ve purchased a token or earned a token, that token may get even more valuable over time (on top of the 1958% return).

But investing in utility backed tokens is a completely different intellectual experience than we are ever taught about invest and how to make money. It’s more Kickstarter than stock market, but the token has a secondary market which may pay off in the future.

I wanted to learn more about companies like Golem and the potential of tokens so I decided to research 25 of the top performers. I’ve also rated them by an innovation score based on my own business experience. Why? Because I went in with the theory that most of them would be “me too” copycats. I was wrong.

The innovation score is based on my evaluation of the ICO and its level of innovation relative to its non-blockchain competition. For example, DigixDao received an innovation score of 2 because it isn’t much different than a gold fund. So, the innovation ratings are not scientific – they are not meant to be. But please, if you agree or disagree with my evaluation, let me know in the comments.

I love sharing what I discover, and I love to learn from your challenges and objections. So, let’s look at the Top 25 ICOs and compare your analysis with mine as I dive a little deeper in below.

ICO Analysis Results

If you had purchased $1000 in each of these 25 ICO’s you’d be worth millions today. But if you had only analyzed Etheroll, the highest performing ICO on our list, you’d be forgiven if you called bullshit on the entire ICO scheme and skipped it altogether. Etheroll is just a dice game after all!

The fact is, a lot of these companies are not going to make it. We’ve seen this movie before and many people have lost money.

Does this mean you shouldn’t invest in ICOs or that you should skip them until there are more regulations in place? Perhaps, it depends on your risk threshold.

Yet, I believe we are on the verge of a completely new business evolution and I don’t see this as a fad. Far from it.

The economic value most of the 25 companies above are providing is real. Real disintermediation, real cost-cutting, and real efficiency that can’t be provided by anything but a blockchain.

There are going to be thousands of winners.

Summing It All Up

From an outsider’s perspective, ICOs look crazy. Admit it. But it was once crazy to invest in Kickstarter campaigns. It was crazy to invest millions in a twenty-year-old’s startup. It was crazy to buy Bitcoin.

Maybe ICOs are not so crazy.

As Jas Dhillon, a Principle at Moneytips told me:

Blockchain and ICOs are the undiscovered country. Together they will drive a sea-change of innovation that will upend traditional power structures and enable the Internet to achieve its original dream of empowering individuals and transforming civilization. But it’s still uncharted, so investors beware.

The best way to navigate these new waters is to identify the ICOs backed by experienced teams with legitimate business models. The odds of success go up dramatically. If you start with a strong crew, you can make a lot of money investing in ICOs or any business endeavor for that matter.

No matter your personal view on the situation, big companies like American Express, Amazon and Microsoft are moving into the blockchain space. The question is, what’s going to happen with that space and will you be there to take advantage of it?

What do you think of the analysis of the Top 25 ICOs? Do you agree or disagree with any of the findings? Let us know in the comments below.

Images courtesy of Mark Fidelman, AdobeStock, Coinmarketcap