This piece was written by Ryan Strauss

Hello again! Checking in here from TNABC Day 2 in Miami. It was a lot of fun writing yesterday. I’m going to try and keep the style the same today; honest, open reporting about what’s actually being discussed here at a Bitcoin conference. There’s a lot more going on here than you may think! While the media often turns their attention to huge shows like DevCon and ComicCon, these Bitcoin conferences fly relatively under the radar.

Also read: The North American Bitcoin Conference 2016: Day 1

TNABC Day Two: Getting Started

How are there only ~300 people here? Surely, there are more people in the world who could benefit from attending a Bitcoin conference, who want to go and who have valuable ideas to contribute. I am hoping that this recap today entertains, provokes thought, and also encourages you to attend a Bitcoin Conference in the future. This is the best place to actually learn about Bitcoin: In person. Sit back and relax. Here we go.

Morning

[8:10 AM]: Wake up to the third of many snooze alarms going off. We had intended to wake up at 7:45 AM. Oh well.

[8:10 AM]: Wake up to the third of many snooze alarms going off. We had intended to wake up at 7:45 AM. Oh well.

[8:11 AM]: Stumble over to Sanna. Tell him to wake up. Am going off of literally 1.75 hours of sleep after I was up very late last night writing my “In Defense of Greek Life” post for my blogging campaign (#100DaysOfBlogging) on Medium (follow me on Medium! @ryanstr).

[8:15 AM]: Nothing better than a shower in the morning to wake you up. This has literally been one of the busiest, craziest weeks of my life (was co-best man for a wedding in Chicago last weekend, too).

[8:47 AM]: Finally get into Sanna’s car. It’s raining heavily in greater Miami. Respond to multiple Facebook Messenger messages. Head downtown.

[9:10 AM]: Get dropped off by Sanna somewhere near 12th street and 3rd avenue. It was somewhere not far from Brickel. Yes, the streets here in Miami actually are grid-intertwined with “Avenues” on one side and “Streets” on the other. This was very confusing. Thought through how a blockchain could help remedy some of the problems presented here around naming streets, identifying houses, identifying who owns what and where that property is.

[9:11 AM]: Saw a turf soccer field surrounded by a fence next to a busy intersection where I was dropped off. Got really excited by this. Took a picture of it. Wondered why they don’t have something like this in Ann Arbor, particularly that spot right next to Lorch Hall. Start walking towards the James L. Knight Convention Center.

[9:14 AM]: A large bus passes by in the rain. I start thinking about how cool it would be if a city like Miami started accepting Bitcoin on all their public transportation systems. This requires software upgrades and integration with the blockchain. Guessed in that moment that this may not happen in Miami until 2026.

[9:15 AM]: Saw parking meters not being used and slanted over in a decrepit manner. Thought how Bitcoin and a blockchain could alleviate the problems of knowing where to park, having to run out to your car to put more money in the parking meter, and of having to drive and park your car in the cold (in Chicago).

[9:20 AM]: Noticed how low the gas prices were. What effect does this have on the price of Bitcoin?

[9:39 AM]: Sitting outside of Capital Grille in Brickel, marveling at the luxurious nature and grandeur of all the swanky high rises which surrounded me. Watched as the bridge opened across the river/channel that divides the convention center from where the Capital Grille is in Brickel.

[9:46 AM]: People waiting for the boat bridge to close, so that they can walk across, are getting impatient. One man tries to start biking across the bridge even though the gates to access the bridge are still closed. This gave me a flashback to the time when I was in San Diego last month and witnessed someone try and climb under the train outside of the convention center where ComicCon is held. This person nearly died, as the train started up with an intensely loud screech just as this person was crawling under the train.

[9:52 AM]: Arrive at Day 2 of TNABC. Right now, it’s a lot less crowded than yesterday.

[10:00 AM]: Speak with Julio of Bitcoin.com about tips to improve my writing. Discuss how Bitcoin.com is different than Bitcoinist.net.

[10:16 AM]: Mate offers to buy me a bagel and cream cheese. I reluctantly accept this generous gesture. Bagels… For free. 0 satoshis spent. #HelllllYeah!

[11:55 AM]: FINALLY am done with my “In Defense of Greek Life” post on Medium. I initially wrote this out here as “In Defense of Bitcoin.” That is now a post for another day. For today, time to get back to Bitcoin and TNABC, Day 2.

Afternoon

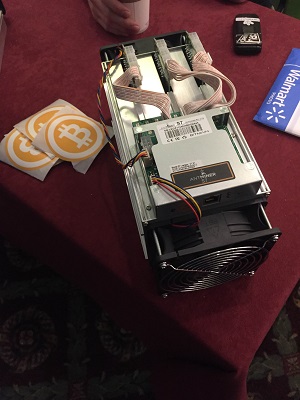

[12:07 PM]: Start talking with the team at BitMain. Get into a deep discussion about Bitcoin Mining. Get to see an up-close look of what an actual bitcoin miner looks like. This was no communal mirage, like what happened in 2013. This was a multitude of miners, sitting right in front of me, right before my eyes.

[12:07 PM]: Start talking with the team at BitMain. Get into a deep discussion about Bitcoin Mining. Get to see an up-close look of what an actual bitcoin miner looks like. This was no communal mirage, like what happened in 2013. This was a multitude of miners, sitting right in front of me, right before my eyes.

[12:14 PM]: Start talking to Hayden Gill about bitcoin mining. We unearthed some amazing insights that I had not previously internalized. This made Jordan Birnholtz’s “Bitcoin is a donut” blog post from March 2013 make that much more sense. We discussed trends in mining currently; how the mining difficulty has risen by so much since September 2015, and how this was also around the same time that the Bitcoin price started rising again. We discussed how bitcoin mining is at the core of Bitcoin, at its heart. Without these seemingly useless computers, there would be no Bitcoin, no accountability or trust over the web without having to rely on centralized institutions, no TNABC. Mining is the culmination of 40+ years of computer science research. It is the physical manifestation of both the Bitcoin software and Bitcoin itself. Miners are crucial, they are insanely important to the future of Bitcoin.

[12:25 PM]: Hayden and I still talking here. We discussed how the United States Dollar equivalent value per day generated by Bitcoin miners confirming transactions from blocks remains essentially the same, all the time. Whether the price of Bitcoin is at $100, $200, $400, or $2,000, either way the price will create an incentive that will either attract miners or it will not. The electricity costs involved in running a Bitcoin mining operation are now huge! Therefore, depending on the price of Bitcoin, individuals will be tempted differently to either turn their miners on or not. Similarly, only some people went west in the 1840’s, during the Gold Rush, which was based out of San Francisco.

[12:26 PM]: There are certainly parallels to Bitcoin with this analogy here, too. Because of this, the difficulty of Bitcoin adjusts to the decisions made by individuals as to whether or not they want to use their miners. With this, there is a tradeoff; mine or not mine? Increase the difficulty and lower the amount you receive in raw-bitcoin per day by mining more (which will also drive up the price), or lower the difficulty on the network by not-mining, therefore increasing the amount in raw-bitcoin you’ll receive when you do solve a block (and the subsequent lowering of difficulty will also help lower the USD/BTC exchange rate). This is a really difficult tradeoff to internalize; it took me about 3.5 years of following Bitcoin closely until I really got it. Until I spoke with Hayden at TNABC, Day 2, in Miami, Florida. It took me 3.5 years to really realize that the USD equivalent value per day generated by miners remains relatively constant. For this reason, bitcoin mining is a zero-sum game; the profits for mining operations in the long run will trend towards zero as the market becomes more and more saturated and competitive* (*as the difficulty increases, oddly, which is a paradox, too).

[12:39 PM]: See Marco Santori walk by out of the corner of my eye. Only knew that this was him because Hayden said so.

[12:40 PM]: Learn that large bitcoin mining operations are starting to find creative ways to form partnerships with energy companies to leverage inefficiencies in the electrical grid. They do this because it is actually mutually beneficial for both the mining companies and the energy companies. At night, energy companies often have to power down large parts of their power grid, which is costly, takes time, and is simply inefficient. Now, to address this, bitcoin mining operations are using this electricity to mine, which it seems lower the costs associated with the power grid. This is a symbiotic and mutually beneficial relationship, one which provides miners with cheaper electricity, encourages the running of more full nodes, and also does not put as much stress on the grid from turning it on and off. On and off. On and off. The cost of electricity is one primary reason why the price of oil does indeed impact Bitcoin’s price (which is a Spectacle, a distraction from the underlying aforementioned realities about Bitcoin Miners).

[12:40 PM]: Learn that large bitcoin mining operations are starting to find creative ways to form partnerships with energy companies to leverage inefficiencies in the electrical grid. They do this because it is actually mutually beneficial for both the mining companies and the energy companies. At night, energy companies often have to power down large parts of their power grid, which is costly, takes time, and is simply inefficient. Now, to address this, bitcoin mining operations are using this electricity to mine, which it seems lower the costs associated with the power grid. This is a symbiotic and mutually beneficial relationship, one which provides miners with cheaper electricity, encourages the running of more full nodes, and also does not put as much stress on the grid from turning it on and off. On and off. On and off. The cost of electricity is one primary reason why the price of oil does indeed impact Bitcoin’s price (which is a Spectacle, a distraction from the underlying aforementioned realities about Bitcoin Miners).

[12:50 PM]: Lunch time. Bump into Tone Vays in line.

[12:51 PM]: Get a tuna sandwich for lunch with chips. Talk to the friendly woman working the cashier. Joke with her asking if other people here have been joking about how the conference center in Miami does not accept Bitcoin. She was not amused, and just smiled instead.

[1:40 PM]: Heading into Bitcoin related panels now.

[1:47 PM]: I lied. Just spent 7 minutes of bliss jamming to @BroJoeDroJoe. Now heading into the big room with the Bitcoin related panels.

[1:56 PM]: I lied, again. Spoke with Mia Molnar of Genesis Mining. Learned that she is organizing a music event in Munich. Reached an interesting insight about differences in music culture between Europe and America. Thought to myself how cool it would be if a smart contract controlled the possibility to reward bitcoin to a crowd or a musical artist based off of the sound patterns present and crowd noise. Felt excited that LivelyGig is helping to make this a reality. Mia also handed me a “paper wallet,” which at a Bitcoin Conference is hilarious and an amazing marketing tool.

[2:10 PM]: Finally actually-in the big auditorium with the panels. The gentleman speaking, Jerry Brito of Coin Center, made a comment that around how any attempt to regulate Bitcoin technology is futile; the cat is already out of the bag. The technology of trustless distributed systems is already out there. If we want to talk about “regulating” Bitcoin, then we need to do this in the context of regulating Bitcoin as a currency, which is fundamentally different than regulating Bitcoin/blockchains as a technology.

[2:13 PM]: Jerry: “The U.S. is the leader when it comes to regulation.” The US issued the first guidance on how a regulation applies to Bitcoin, in 2013. And the Bitlicense was the first measure passed of its kind anywhere in the world. The US is a leader in the regulatory community on many issues, so it would make sense to see it here.

[2:16 PM]: Jerry: The Bank Secrecy Act is a crucial act in the history of the United States of America. It is a law that requires information about all parties involved to be obtained from any country in the world. This are known as AML checks, Know-Your-Customer (KYC), and Suspicious Activity Reports (SAR). In enforcing this law, OFAC (Office of Foreign Asset Controls) has a legal responsibility to identify the identity of all parties involved. This law was designed for a world of wire transactions, not Bitcoin. Using Bitcoin, which is inherently-semi-secretive, poses challenges to identifying the information of and location of the parties involved. Our approach when regulating Bitcoin companies is often, in ways, like trying to fit a peg into a round hole.

[2:21 PM]: Jerry: Consumer Protection is a very important area for the Bitcoin community to work hand-in-hand with the legal community to make progress on. Right now, for almost every form of investment, consumers are protected. This earns these associated forms of investment respect among the legal community and increased usage among more mainstream users more largely.

[2:23 PM]: Jerry: Right now, the attempts to regulate this take place on the state level. This is a hangover from a previous era of financial infrastructure. It is difficult to require each and every Bitcoin company to obtain a monetary transmission license from each and every state that they want to legally operate in. Often, these state level licenses are costly to obtain and require knowing lawyers and also meeting a minimum capital requirement threshold.

[2:25 PM]: Jerry: Engaging regulators and getting regulation to come out with new and favorable laws to Bitcoin more quickly will only help the Bitcoin Industry. This is why it is important to be nice to lawmakers and to be honest with them. There needs to be a mutual understanding of how the technology at hand works in order to craft mutually beneficial regulation, which will meet the needs of both government, consumer protection, and entrepreneurs (who often currently operate under grey areas, and this often discourages action too).

[2:28 PM]: Jerry: Multi-Sig, the ability to give control to multiple parties at once, is a fundamentally new concept in IP and Property Law.

[2:29 PM]: Jerry: The Bitcoin community making friends with the legal community, being honest and genuine with them, needs to happen now. This will help protect Bitcoin in the event of a Black Swan event. This is what Coin Center does.

[2:32 PM]: Talk ends around a discussion over the ethics of “money laundering.” Jerry made it clear and the crowd acknowledged that money laundering is, in all cases, illegal. Someone in audience asks Jerry why he is not fighting to change this. Jerry made a brilliant point, that I 100% agree with; money laundering is illegal and will always continue to be illegal. It is for our collective safety, and it makes sense. Rather than trying to fight against this reality, the Bitcoin community should embrace it and form partnerships and have insightful discussions with regulators.

[2:38 PM]: Talk by Josh Dykgraaf, Freelance Art Director, on Bitcoin Branding begins. As Josh put it, “The (Bitcoin) logo should instill the confidence and perceived security of a bank… The logo needs to appeal to both developers and soccer moms equally.” Right now this clearly is not the case.

[2:51 PM]: Josh: Mastercard’s logo, two overlapping circles, is simple, technologically thought provoking, and ignites feelings around security and trust within us. It instills confidence in users due to the trust that people have in the brand. An attempt in 2010 to change their logo failed.

[2:53 PM]: Josh: “Mass adoption will be much easier if Bitcoin has the right Branding.”

[2:54 PM]: Talk by Jason King, founder of Sean’s Outpost and Unsung.org. Jason has recently ran across America, from Miami to San Francisco, to help raise awareness around and money for the homeless population.

[2:55 PM]: Jason: “This is my third time here. Moe [Levin] puts on the best conferences in the space.”

[2:56 PM]: Our country throws away millions of pounds of food per year. To address this, Jason has created a sharing-economy based application to share “excess” food and help feed the homeless.

[2:58 PM]: Jason: Often times, restaurant owners have to pay to throw away their own food. They have to pay a specialized professional to pick it up and throw it away. This, additionally, is also costly because the restaurant paid for the food too.

[3:00 PM]: Jason: “Our tagline here is ‘Hack Hunger’.” This received a loud applause from the audience. Jason said that they are helping to game-ify the space by showing leaderboards which in turn put form a social pressure on others to donate their excess food to those who are hungry.

[3:04 PM]: Bitcoin Regulation Panel now starting. Marco Santori, who I walked by earlier, is now on stage with Jerry Brito and Veronica McGregor.

[3:27 PM]: Marco: “Bitcoin is only perceived as a good tool for money laundering. It is not actually a good tool for money laundering.”

[3:33 PM]: Marco: “Remember when we used to call this ‘Bitcoin 2.0’, not ‘Blockchain technology’?”

[3:50 PM]: Marshall Long, CTO of Final Hash, now is speaking. “Mining is not supposed to be a profits game. It is supposed to be a zero sum game.” These words, this realization, really resonated with me, as I first came to this realization earlier today. “Whoever creates the best chicken shed for miners wins the game, right now.”

[3:51 PM]: Marshall: In China, mining companies can obtain subsidized electricity through the local government.

[3:52 PM]: Marshall: Development in mining chips has advanced quickly of late. This, in my personal opinion, has been a huge factor in the recent difficulty increase and subsequent price rise over the past 5 months.

[3:53 PM]: Marshall: Bitcoin mining technology is running into the problems of Moore’s Law.

Evening

[4:29 PM]: I just posted my “In Defense of Greek Life” blog post from Medium (@ryanstr) on Hackathon Hackers. Comments already streaming in.

[4:29 PM]: I just posted my “In Defense of Greek Life” blog post from Medium (@ryanstr) on Hackathon Hackers. Comments already streaming in.

[4:42 PM]: Paying attention to TNABC, Day 2 again now. Feels good to finally be done with that blog post.

[4:45 PM]: The current and also final speaker, Dean, is the President of the Blockchain Education Network (BEN), which was formerly known as College Crypto-currency Network (CCN). I watched CCN start at the University of Michigan. It was really cool seeing it transform from an idea to “Michigan Bitcoiners” in Ann Arbor to CCN being featured in the Wall Street Journal.

[4:46 PM]: Dean: “Our generation will change the world.”

[4:48 PM]: #GenerationBlockchain. This is the first time in my life that I have ever seen this hashtag used. I love it.

[4:49 PM]: Dean: All modern and new financial applications must be global. Given the behavior of young people, this is the only form of financial possibility that is in-alignment with the way that they are used to sharing information (and money is a form of information, too).

[4:57 PM]: Moe Levin now for closing remarks.

[4:57 PM]: Moe (paraphrased): We are now ready for a new form of currency that is in alignment with our heavy-travel-style lives.

[4:58 PM]: Moe: “One of the aims of this conference was to set the direction for the coming year, and I think we have done that.”

[4:59 PM]: “Bitcoin is on the bring of monumental change. We are that change. We are the future of this industry… We are the agents of that change. Thank you guys!”

Thanks for reading our coverage of TNABC 2016!