Bitcoin’s price action has been extremely boring over the past two months. The crypto has been range-bound, barely deviating from a medium-term range as bulls and bears duke it out.

This comes in spite of the fact that by multiple on-chain measures, Bitcoin is stronger than ever.

On-Chain Case For a Bitcoin Bull Market Grows Even Further

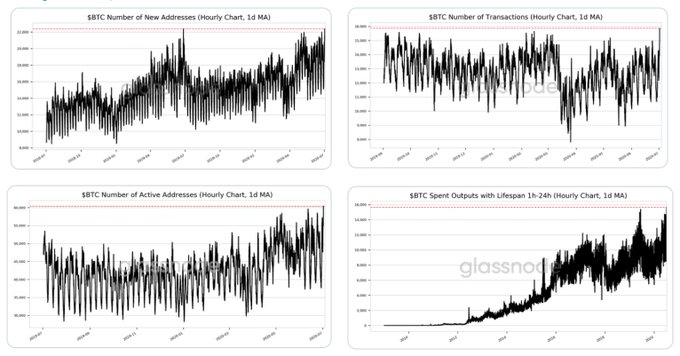

The CTO of blockchain data firm Glassnode, Rafael Schultze-Kraft observed on July 1st that Bitcoin is strengthening from an on-chain perspective. He observed the following four statistics, all of which have reached notable highs:

- Hourly new BTC addresses: two-year high

- Hourly active BTC addresses: one-year high

- Hourly count of transactions: 10-month high

- Hourly spent outputs with a lifespan between 1 hour and 24 hours: an all-time high

It isn’t clear why this taking place now, yet there are other on-chain trends signaling fundamental strength for Bitcoin.

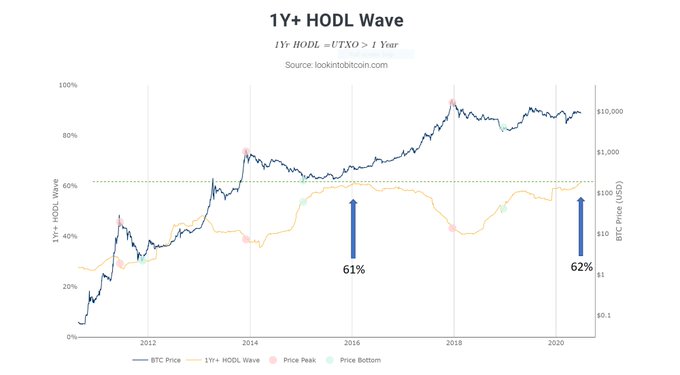

As reported by Bitcoinist previously, on-chain analyst Philip Swift noted that the amount of BTC being “HODLed” has reached an all-time high.

“Bitcoin 1yr HODL new ATH!! We have reached a new all-time high, with 62% of bitcoin not moving on-chain for at least 1 year. Strong hands from hodl’ers! Such high levels of HODL’ing have been present at the start of previous Bitcoin bull runs,” Swift wrote on the matter.

A separate analysis from Schultze-Kraft corroborated this trend.

Data from Glassnode he shared indicated that HODLers have accumulated Bitcoin 90% of the days in 2020. Adding to this, there has been a mass exodus of BTC from exchanges, indicating a decreasing propensity to sell the cryptocurrency.

What’s Holding BTC Back?

If the cryptocurrency is seeing increased usage as both a medium of transfer and a store of wealth, what is holding Bitcoin back?

At least for the time being, it seems to be uncertainty in traditional markets.

Analysts have observed over recent months that a correlation has formed between the S&P 500 and BTC. That’s to say, the cryptocurrency’s directionality has effectively been decided by the equities market.

The image below from digital asset manager Charles Edwards depicts this correlation.

JP Morgan analysts have also observed the correlation. A group of strategists at the bank argued in a June 11th note that since March’s crash, “Cryptocurrencies have traded more like risky assets like equities—a significant change relative to the prior couple of years.”

With the S&P 500 still ping-ponging between 3,000 and 3,200 while pandemic fears still exist, BTC has stagnated as well.

Featured Image from Shutterstock Charts from TradingView.com Price tags: xbtusd, btcusd, btcusdt Stuck in the $9,000s, Bitcoin Isn't Reacting to Strong On-Chain Stats