The general cryptocurrency market has been quite unpleasant as major crypto assets have seen extended negative trends, fueling uncertainty within the sector. With the recent upsurge in the stablecoins dominance, which is considered a negative sign for cryptocurrencies, the broader ecosystem could be poised for additional pessimistic behavior.

Stablecoin Dominance Growth Poses Risk To Cryptocurrencies

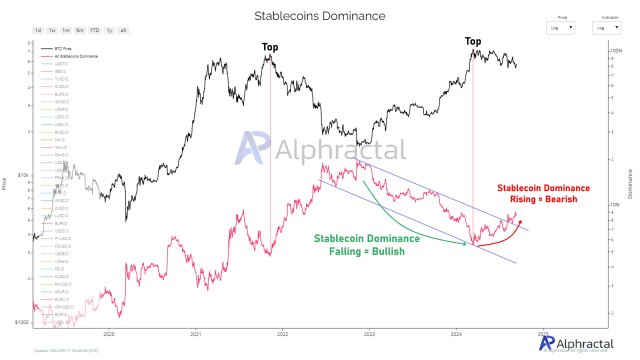

Recent reports from Alphractal, an advanced platform for investment data analysis, show that the dominance of stablecoins is increasing rapidly amidst price fluctuations. Historically, a drop in stablecoin dominance is a bullish indication for cryptocurrencies, as observed from late 2022 to early 2024, while an increase in dominance is a definite signal of a bearish trend.

As market volatility persists, investors appear to be turning to stablecoins in greater numbers, hoping to elude the uncertainty that is affecting larger assets like Ethereum and Bitcoin. This change implies that institutional and retail investors are losing confidence in the current market condition.

According to the platform, the overall market cap of stablecoins is currently over $170 million, indicating 8.62% of the entire cryptocurrency market with Tether (USDT) leading the charge with $118 billion, which represents about 69.6% of all stablecoins market.

In the absence of the USDT and USDC coins, Alphractal noted that the total market cap of stablecoins will decrease significantly. The decline shows that the constant issuance of these two major coins, especially USDT on the TRON blockchain, has been the main driver of the stablecoin market’s growth in the last two years.

Furthermore, the platform highlighted that the stablecoins’ 30-day market cao is another notable factor to watch out for. While an increase in this aspect frequently indicates bullishness in the long term, a decline has historically had a negative impact on the crypto market, drawing attention to a previous incident in 2021.

Alphractal mentioned that in 2021, stablecoins saw a substantial spike, followed by a decline, signaling the start of the crypto bear market. Meanwhile, in 2024, two similar but lesser peaks occurred, which could account for Bitcoin’s lengthy sideways trend since the start of the year.

With the market waning, the platform believes since stablecoins directly affect liquidity and prices they are worth exploring, and understanding their fluctuations can aid in risk management and provide clear trend indications.

Social Media Market Sentiment Is Bearish

Alphractal also revealed in another research a worrying trend about the market on social media platforms and the news. According to the platform, traders’ and technical indicators’ sentiment about the crypto market at present is neutral, indicating a balance or uncertainty.

However, the average sentiment in the news and on the X (formerly Twitter) platform is still bearish. This decline implies a growing pessimism among enthusiasts as conversations regarding the market are constantly dropping on social media platforms.