On-chain data shows that stablecoin exchange inflows have seen a sharp drop recently. This could be bearish for the Bitcoin price.

Ethereum-Based Stablecoins Have Seen Low Exchange Deposits Recently

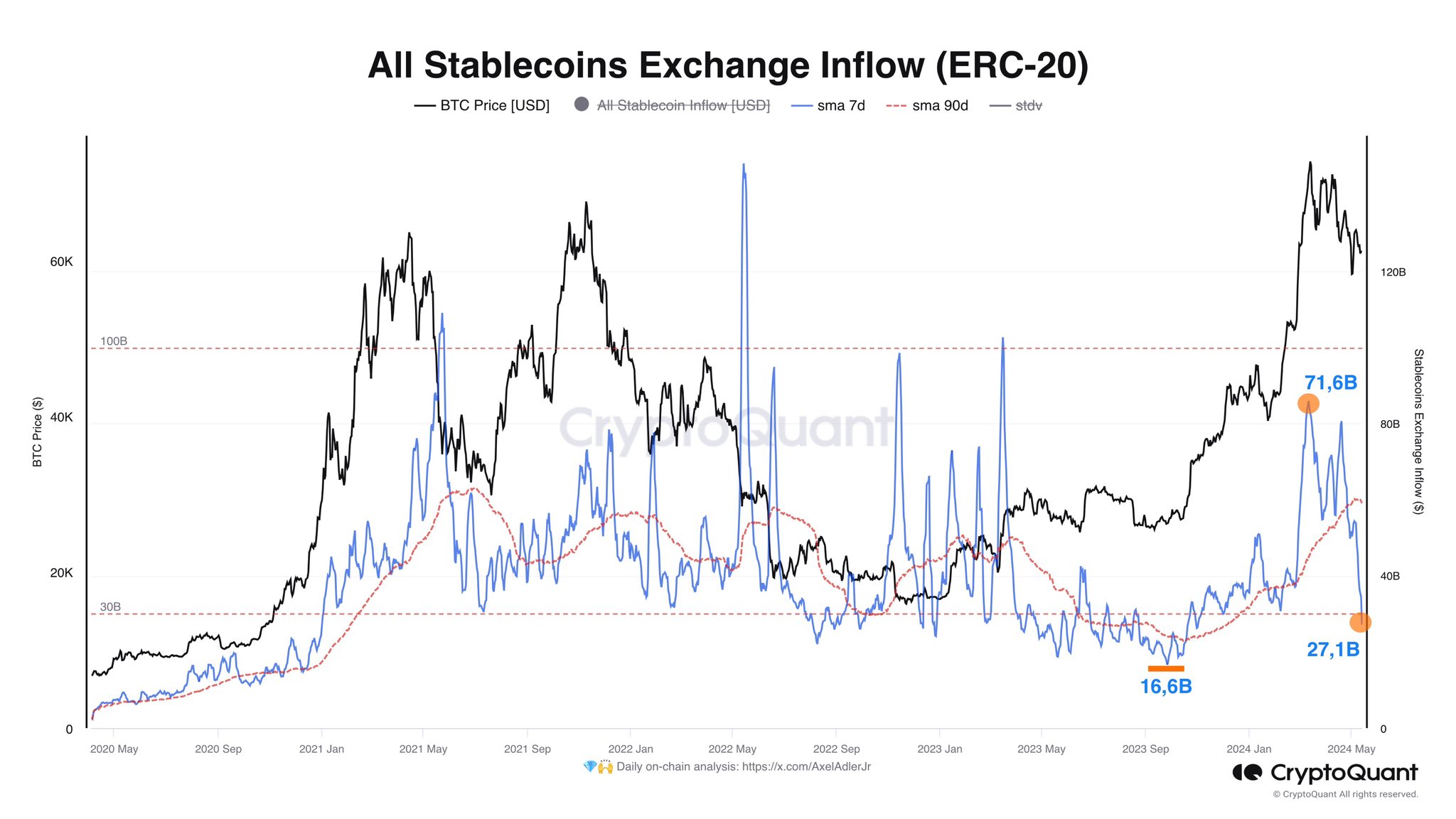

As CryptoQuant author Axel Adler Jr. pointed out in a post on X, the exchange inflows of Ethereum-based stablecoins have recently dropped below the 90-day average.

The “exchange inflow” here refers to an on-chain indicator that tracks the total amount of any given cryptocurrency being transferred to the wallets associated with centralized exchanges.

When the value of this metric is high, investors are now depositing large amounts of the asset into these platforms. Generally, holders send their coins to the exchanges for trading purposes, so this trend can show high demand for exchanging away the cryptocurrency.

Exchange inflows’ implications for the wider market, though, depend on the type of asset in question. For volatile assets like Bitcoin, inflows may have a direct bearish effect on their prices, as they imply selling is happening.

BTC, in particular, is a major doorway for capital to move in and out of the digital asset sector, so selling it can have cascading effects on the prices of the altcoins.

Selling stablecoins doesn’t affect their prices as they are, by nature, “stable” in value at the $1 mark. Exchange inflows of them are still consequential for the market, however, as they suggest the stable holders are looking to make a swap.

If investors are making the inflows to withdraw into fiat, then the market as a whole would see a bearish effect as it implies a net amount of capital is exiting the sector.

In the scenario that the deposits are being made to purchase Bitcoin and other volatile coins with them, the prices of these assets would register a bullish effect.

The latter may be more likely anytime large stablecoin exchange inflows take place as, generally, investors interested in the sector store their capital in the safety of these fiat-tied tokens, waiting for the right opportunity to buy into the volatile side.

Now, here is a chart that shows what the trend in the exchange inflow has looked like for the Ethereum-based stablecoins as a whole:

As displayed in the above graph, the 7-day moving average (MA) of the stablecoins exchange inflow has recently sharply declined and fallen below the 90-day MA.

This suggests that stablecoin users have significantly less demand for buying into Bitcoin and others now than during the rally that led to BTC’s new all-time high. “The drop in volume below the quarterly figure is a negative signal,” notes the analyst.

BTC Price

Bitcoin has been attempting another recovery push during the past day, and its price has now returned above the $63,000 mark.