The anticipated approval of a spot Bitcoin Exchange Traded Fund (ETF) has dominated discussions among traders, analysts, and market observers over the past few days. With many speculating on the potential impact, the age-old strategy of “buy the rumor, sell the news” has been at the forefront of many conversations. Will the strategy push the Bitcoin price down once BlackRock, Fidelity, Invesco, Bitwise and other financial giants list their spot ETFs on the market?

Spot Bitcoin ETF Approval: A ‘Sell The News’-Event?

Notorious financial expert and Bitcoin skeptic, Peter Schiff, questioned the prolonged excitement surrounding ETF prospects, suggesting its approval could mark a peak in optimism. He tweeted, “How many times can Bitcoin rally on the same ETF rumor? Once a US Bitcoin ETF is approved, or GBTC is able to convert into an ETF, there will be no more ‘good’ news for Bitcoin to rally on. After years of buying the rumor, everyone will finally be able to sell the news.”

However, the comparison to the world of traditional finance, particularly gold, challenges Schiff’s views. Cozy The Caller, a prominent crypto analyst, retorted, “Gold kept rallying after its ETF approval. You are always contradicting yourself Peter.”

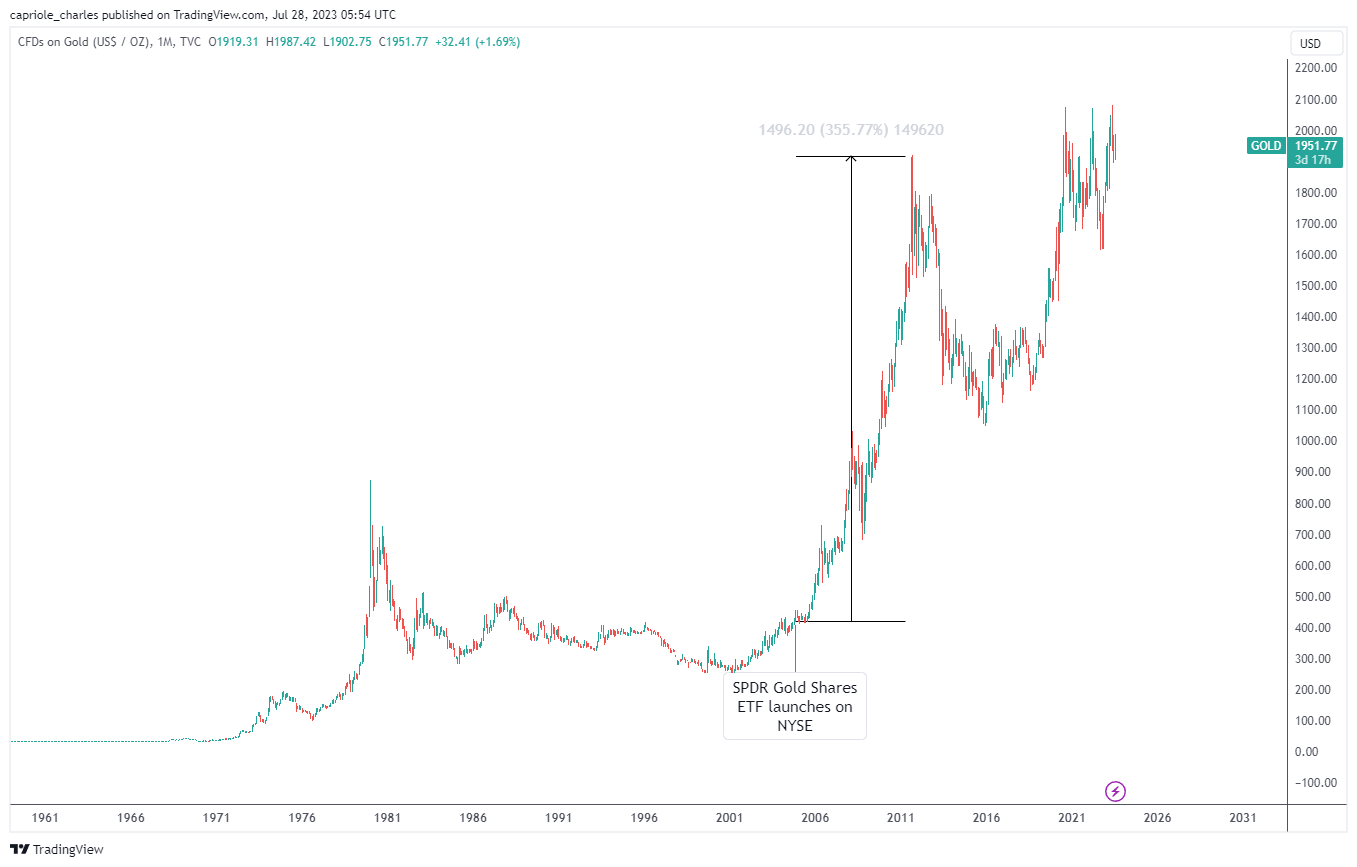

This sentiment is echoed by Charles Edwards, the founder of Capriole Investments, who recently noted the historical parallels between BTC today and Gold in 2004.

Edwards highlighted:

What is the most similar asset to Bitcoin? Gold. What happened when the Gold ETF launched? In November 2004, Gold was in a bear market, down -50% (much like Bitcoin is today). When the ETF approval hit, what followed was a massive +350% return, seven-year bull-run.

Notably, after the debut of the first gold ETF, Gold surged by over 8% in the subsequent five weeks. This was followed by a minor retracement of around -10% in the weeks that came after. However, post this dip, Gold experienced a monumental rally, as described by Edwards.

BTC Community Is Divided

The Bitcoin community is notably split on how the spot ETF approval will influence the BTC price. Crypto Chase believes a move into the mid-$30,000s may indicate a pre-emptive rally before the ETF approval. He stated, “If BTC moves into the mid 30K’s, we have officially front run the ETF approval and I wouldn’t be surprised if it becomes a sell the news event.”

However, Bit Paine, another highly regarded Bitcoin analyst, emphasized the transformative nature of an ETF approval, suggesting that critics underestimate the magnitude of new capital that will flow into BTC.

He stressed, “If you think the ETF approval (which will begin trading within DAYS) is a sell-the-news event, you simply do not have any conception of the size of the capital pool that is about to gain access to spot BTC relative to the amount of spot BTC available for sale.”

Furthermore, Robert L. Peters highlighted other bullish factors for Bitcoin, including the upcoming halving, worldwide potential central bank interventions, and a brewing global crisis. When asked who might sell amidst these bullish indicators, Bit Paine tersely responded, “Idiots.”

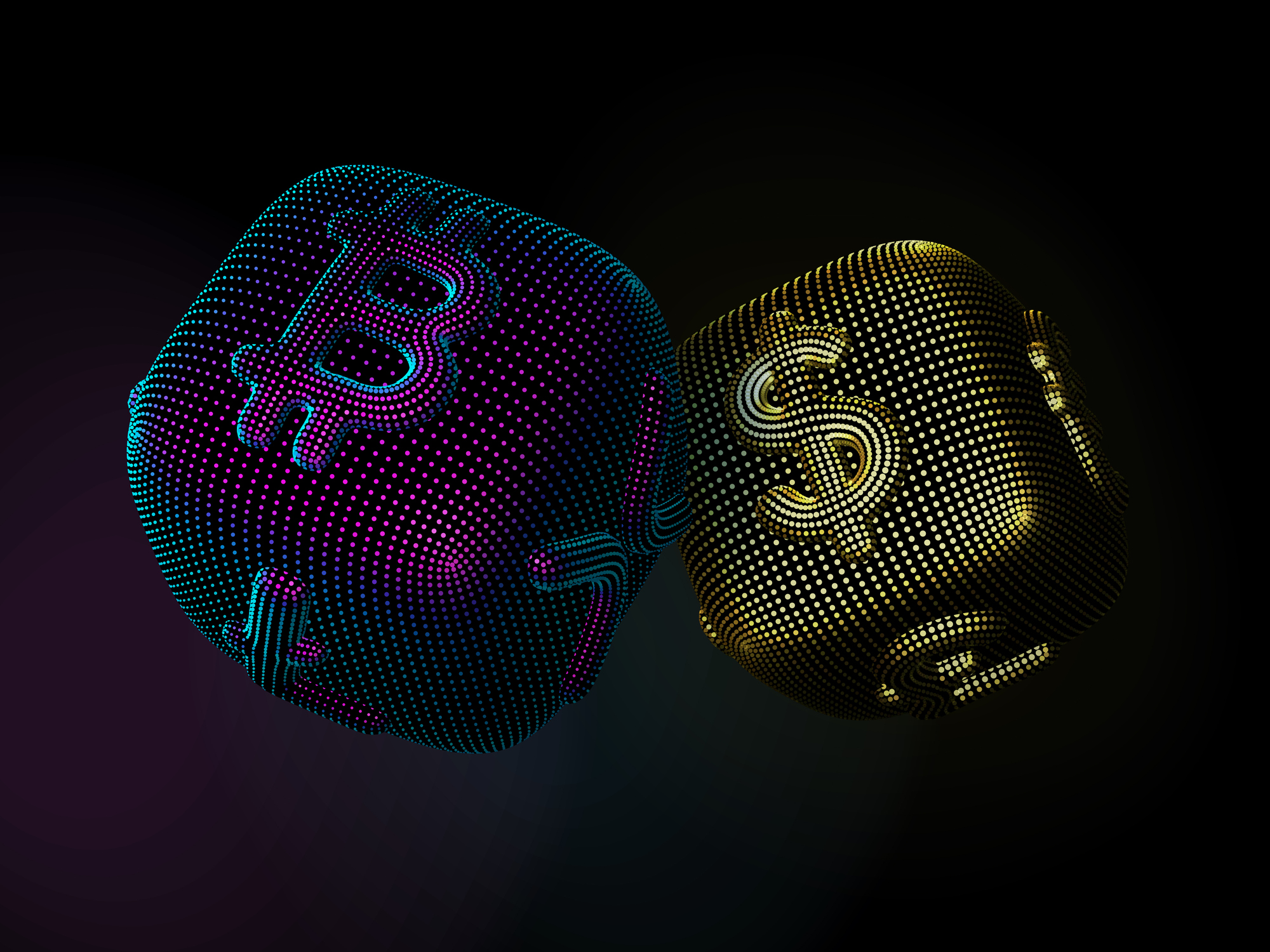

Reinforcing the bullish sentiment, Quinten François, co-founder and chief Brand Officer at WhereAt Social, shared imagery suggesting that the ETF is just one of multiple factors likely to drive Bitcoin’s price upwards.

His stance on those viewing the ETF as a potential sell the news event? “If you think the ETF approval will be a “sell the news”-event, you’re ngmi [not gonna make it].”

The visual he presented indicates that the ETF isn’t the sole positive driver for Bitcoin. Specifically, the anticipated halving set for April next year is projected to elevate the BTC price, consistent with previous halving cycles.

If you think the ETF approval will be a “sell the news”-event, you’re ngmi.#Bitcoin #crypto pic.twitter.com/ZPVwh4ZrU5

— Quinten | 048.eth (@QuintenFrancois) October 24, 2023

In summary, while there are diverse views on the potential impact of a spot ETF approval, the majority of the community remains bullish, seeing it as an additional catalyst in a series of events poised to push BTC’s price upwards. Only time will tell whether the approval will truly be a “sell the news” event or pave the way for further price escalation.

At press time, BTC traded at $34,612.