Despite the recent setback in the price of Solana, which saw a 10% decline to fall below the $100 mark in the first week of the new year, the overall resilience and vitality of its ecosystem remain remarkably robust.

This pullback represents a notable retracement from its recent peak of $115 on January 3, prompting market observers to closely analyze the factors influencing this correction.

Interestingly, while the price may have experienced a temporary dip, the fundamental indicators within the Solana ecosystem paint a contrasting picture of strength and growth.

Solana: Record Transaction Volume Signals Resurgence

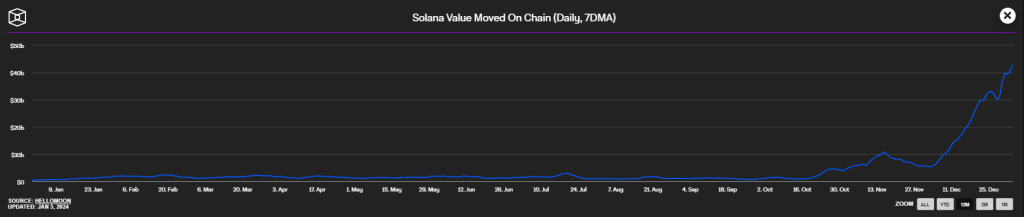

Transaction volumes on the Solana blockchain have surged, showcasing increased activity and utilization of the network. This uptick in transaction volume not only underscores the continued interest and engagement within the Solana community but also suggests a broader adoption of the platform for various decentralized applications (dApps) and financial activities.

Solana’s transaction volume has hit its highest level since December 2022. According to The Block’s Data Dashboard, transaction load registered a solid 700% surge in just 30 days, with daily economic activity on the network surpassing $42 billion. This isn’t just a blip – it’s a potential signal of Solana’s resurgence.

This increase suggests rising adoption across DeFi, NFTs, and other applications. More people are choosing Solana, validating its scalability and transaction processing prowess. It could also be a vote of confidence from investors, potentially boosting SOL’s price and sending positive ripples through the ecosystem.

One of the best-performing cryptocurrencies in 2023 was Solana, which saw an incredible increase of around 1,000%. Even though the majority of this expansion happened later in the year, it was accompanied by a rise in network activity and a revival of Solana’s DeFi sector.

Based on early evidence, a number of commentators had predicted that this upward trend would continue into the new year. SOL was trading at $103 as of December 31. By January 2, it had rapidly increased to $115.

At the time of writing, SOL was trading at $94.81, up 2.3% in the last 24 hours, but shed 7.0% of its value in the last week, data from Coingecko shows.

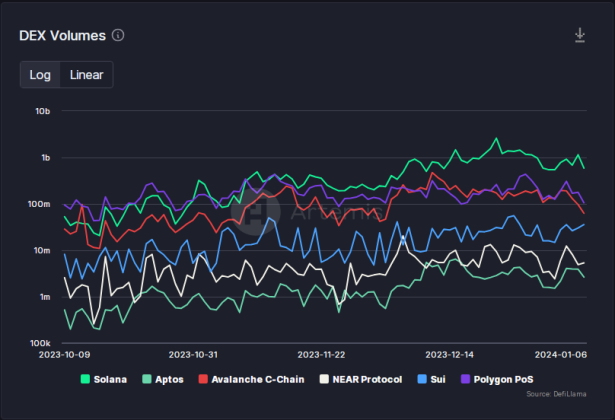

Solana DEX Boom: 40% Surge In Transactions

Decentralized exchanges (DEXes) hosted within Solana have completed over 40% more transactions overall, according to data from Defillama. For background, this came to a total of $1.15 billion as of December 5th. Solana’s DEX volume was $813 million one month ago.

Starting with only 1.5 $SOL($92), this trader made $2M in 22 days, a gain of 21,715x!

This trader spotted $SILLY 5 minutes after it opened trading and spent 1 $SOL($62) to buy 43.1M $SILLY.

Then he sold 33.34M $SILLY for $528K, and currently has 9.76M $SILLY($1.5M) left,… pic.twitter.com/ByY1Tpupah

— Lookonchain (@lookonchain) December 27, 2023

Meanwhile, on social media, there have been tidings of substantial gains from profitable memecoin trades headquartered in Solana. Lookonchain, a blockchain analytics tool, reports that a trader who purchased a memecoin made $2 million.

Commencing with a mere 1.5 SOL, this trader achieved an impressive $2 million in just 22 days, marking an extraordinary gain of 21,715 times. This remarkable success story was shared on X by Lookonchain.

Featured image from Shutterstock