Solana remains the fourth largest blockchain platform, excluding USDT, which is third in the market cap. Over the past year or so, SOL, the native token of the modern network, has been on a tear, outperforming even Bitcoin. This expansion is despite Bitcoin racing to print all-time highs.

While optimism is high, the crypto market is generally cooling off, and there are concerns that the next wave confirming those of Q1 2024 could be delayed. However, as crypto analysts keep watch of politics and other factors, Solana is picking up momentum.

Solana Attracts More NFT Users Than Ethereum, Polygon

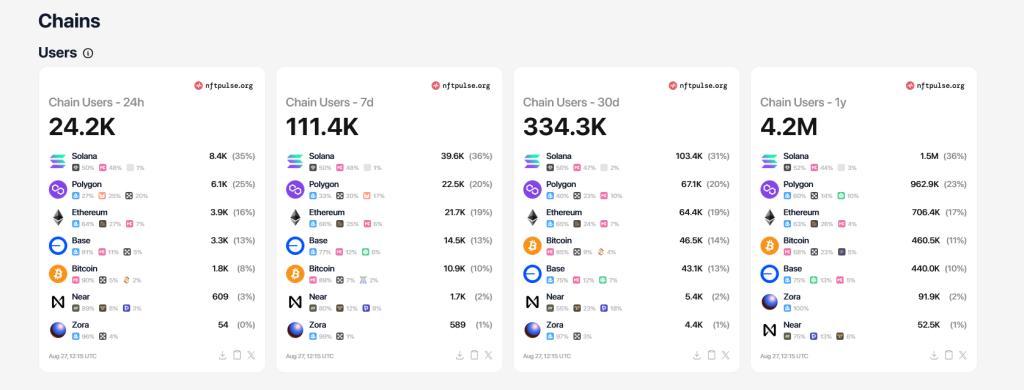

Based on recent on-chain activity, the latest data shows that Solana is the king of NFTs, especially in terms of the number of minted items. When writing, Solana dominates with a 35% market share, nearly double that of Ethereum at 16%.

According to NFT Pulse, Solana drew 8,400 users in the past day. Meanwhile, others choose Polygon, the Ethereum sidechain, as their preferred platform. There were 6,100 active users in the last day.

At this pace, there are roughly 40,000 active users in the past week on Solana, pushing those to over 1.5 million year-to-date. Interestingly, there are users on Ethereum in the same timeframe, at around 706,000 every year.

Ethereum Generates The Most Trading Volume In USD Terms

However, looking at trading volume, Ethereum leads. Over the last day, nearly $4.7 million in trading volume has been generated on the first smart contracts platform, over 2X more on Solana at around $2.1 million. Over $7.3 billion worth of NFTs in the last year have been traded on Ethereum, more than 3X on Solana at just $2 billion.

The shift in user count, favoring Solana, is primarily due to the network’s low transaction fees and high scalability. Although Ethereum fees might be higher, gas fees have been on a downward trend over the months.

Dropping fees could be partly due to efforts done by Ethereum developers to enhance user experience. Early this year, the smart contracts platform activated Dencun, a hard fork that made layer-2 transactions cheaper.

The cheaper it is to deploy smart contracts and mint NFTs, the more users there are. Over the last week, Base, one of the largest Ethereum layer-2s by total value locked (TVL), drew over 14,500 users.

As Solana chain activity ramps up, traders watch whether bulls will push higher, breaking above $190. A break above this level could see SOL soar to 2024 highs of $210.