2021 was a major year for Bitcoin mining. The third halving in May 2020 brought broader attention to mining at large, and the growing interest has never subsided.

In 2021, favorable economics made mining profitable for almost all participants, drawing in more and more participants. The emergence of flare-gas mining, Elon Musk’s comments about Bitcoin’s ESG footprint, the creation of the Bitcoin Mining Council and a western migration that accelerated as a result of Chinese regulation all contributed to a rapidly-expanding and shifting mining landscape marked by greater transparency.

In spite of all the attention that the historically-opaque market received last year, volatility, regulation and supply chain disruptions made 2021 one of the more surprising years in the history of Bitcoin mining, and one of the most formative.

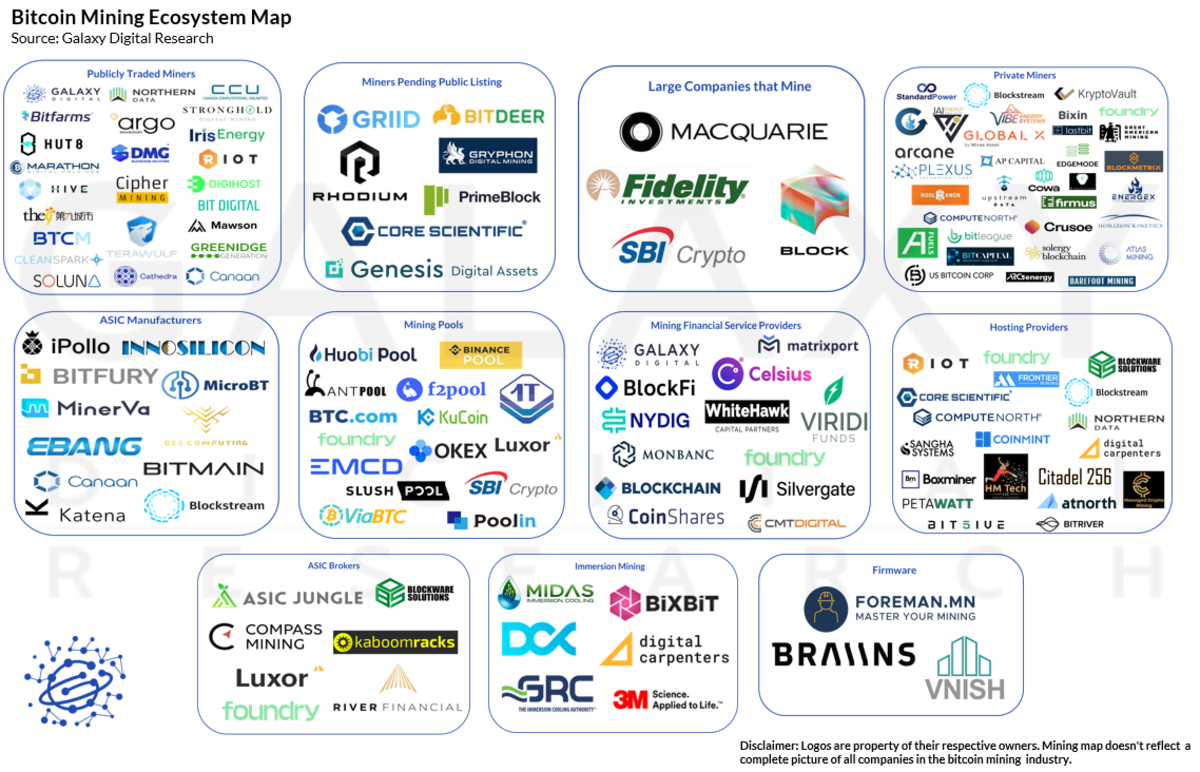

Today’s Mining Ecosystem

Several verticals, including brokerage, off-grid mining and hosting, saw significant numbers of new entrants. Most notably, the industry has seen large capital inflows through a record number of public listings, driven by demand for liquidity and capital that only the U.S. public markets are able to provide.

Source: Galaxy Digital

2021 Trends In Bitcoin Mining Going Into 2022

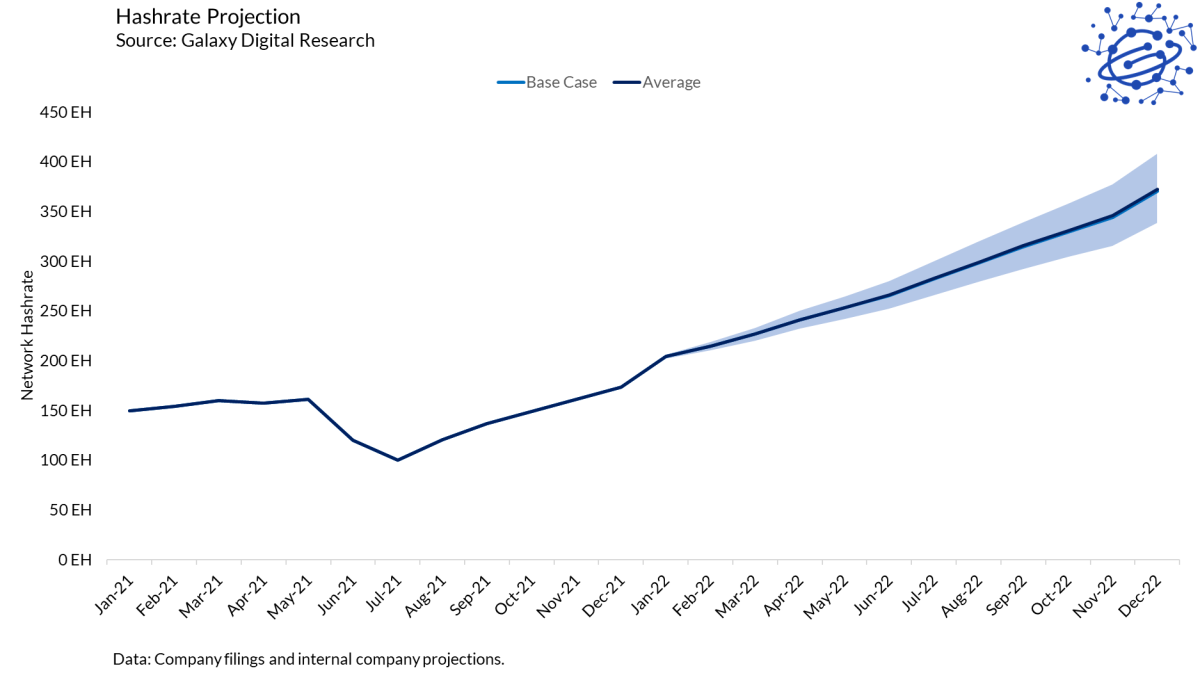

Mining profitability in 2021 benefited from a combination of bitcoin price reaching new all-time highs and idiosyncratic events, such as the convergence of the global chip shortage and a ban on mining in China. Despite the China ban, we witnessed a V-shaped recovery in hash rate and ended the year back near all-time highs, and substantially above where it started the year.

In 2022, we at Galaxy Digital expect the hash rate to grow substantially, and operating margins to compress if price stays constant. Given the amount of hash rate on order by public miners, we expect hash rate to continue to dislocate from price. We see network hash rate landing somewhere between 300 exahashes per second (EH/s) and 370 EH/s by the end of the year, with a baseline estimate of 335 EH/s. Even with projections of strong hash rate growth, it’s likely that many of the publicly-traded miners will still remain highly profitable.

Source: Galaxy Digital

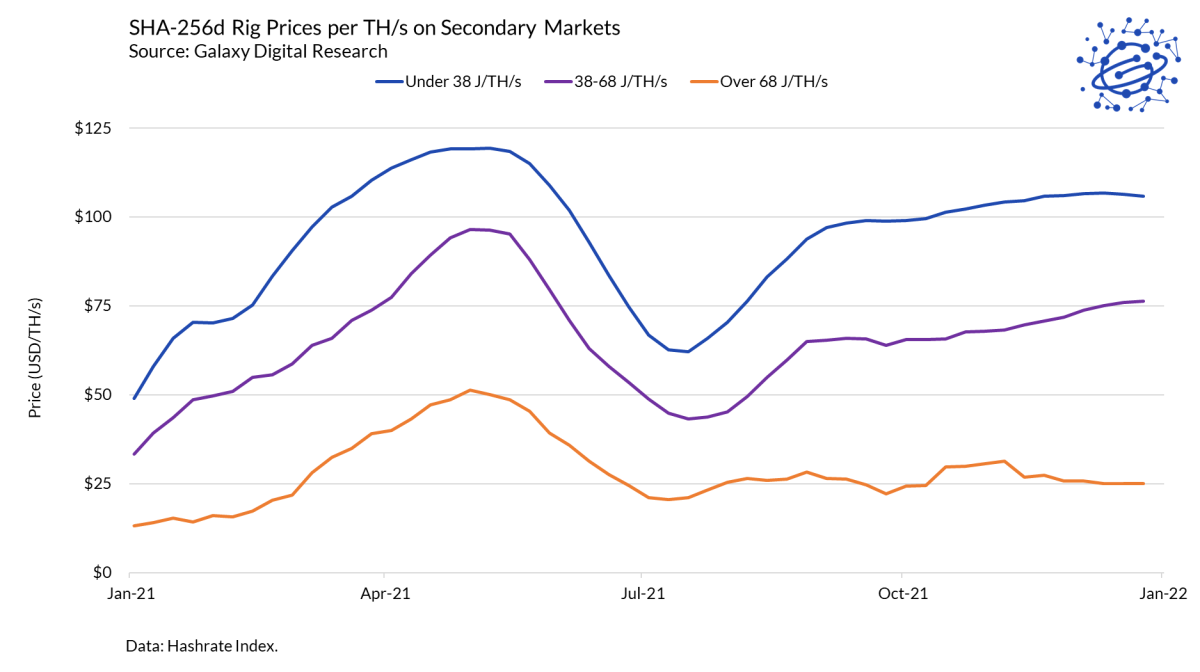

Early in 2021, securing machines was a major bottleneck as a result of supply chain disruptions and a global chip shortage. With BTC trading high in 2021, ASICs were in demand and long lead times became standard. The secondary market, which trades relatively thinly, reflected a strong appreciation in ASIC prices.

Source: Galaxy Digital

While both Chinese miners and hardware manufacturers as well as international competitors had already been expanding operations outside of the country by 2021, the floodgates opened when China announced a ban on mining in May. This ban spurred massive growth in Kazakh, Russian and American mining operations while dramatically decentralizing the network out of China, and also yielded a significant uplift in profitability for the miners that remained online.

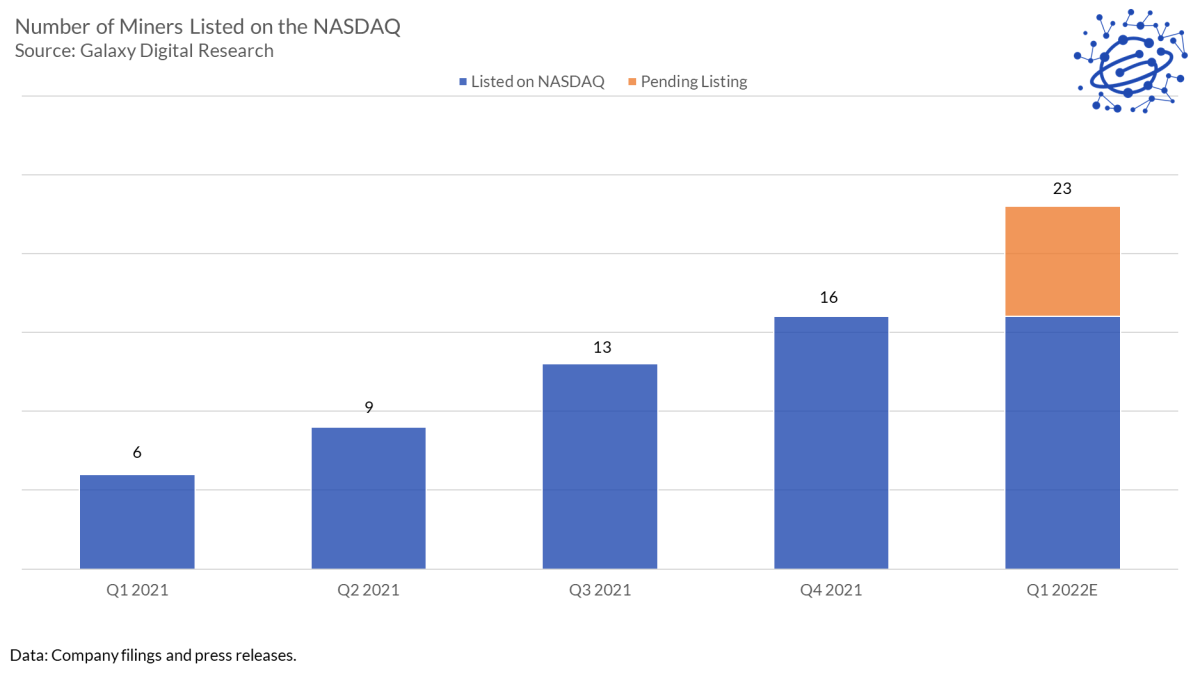

The United States was already gaining market share before the ban as a result of its superior regulatory and financial infrastructure, but at the start of 2021, the U.S. was still a frontier market for mining. Following the ban, North America rapidly became the center of the mining industry, with an increasing number of miners tapping the public markets for both debt and equity financings, typically after selling equity in private markets.

At the start of 2021, there were only two bitcoin mining companies listed on the NASDAQ, Marathon Digital (MARA) and Riot Blockchain (RIOT), with several others trading on Canada’s TSX Venture exchange. As of the end of 2021, 16 bitcoin mining companies were listed on the NASDAQ, with seven additional listings pending.

Source: Galaxy Digital

As the industry becomes more competitive and building economies of scale becomes more crucial, we expect to see even more mining companies attempt to take advantage of the unparalleled liquidity in public equity markets and use the capital raised to invest in additional equipment and infrastructure buildout. This trend will be particularly pronounced if BTC price remains high enough that most miners continue operating profitably. In the event of a sustained market downturn, a spike in merger and acquisition activity seems likely, as larger and leaner miners opportunistically purchase less-efficient competitors for hard assets like machines and transformers.

Source: Galaxy Digital

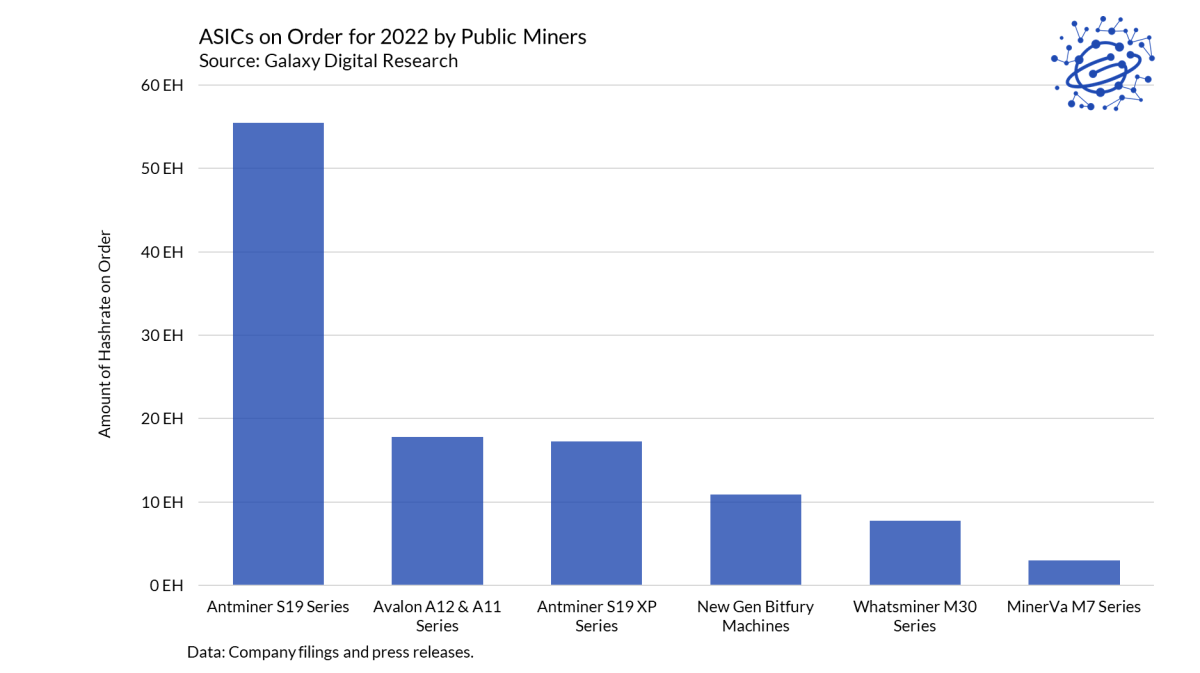

With more bitcoin mining companies now listed on U.S. exchanges, reporting requirements for public companies have opened the door for industry participants to gain key insights into Bitcoin mining operations. One of the biggest benefits of having many publicly-listed miners is that it’s easier for researchers to estimate future hash rate growth and ASIC market dominance by observing press releases detailing companies' machine purchase orders.

Source: Galaxy Digital

We expect the share of hash rate contributed by publicly-traded bitcoin miners to increase to 40% to 45% of the network’s hash rate by the end of 2022 based on the 100-plus EH of machines on order for 2022, per company filings and press releases.

Conclusion

2021 was a very eventful year for mining. Mining has begun to attract more attention both inside and outside of the Bitcoin space, with operators and investors interested in its economics and others concerned about its perceived environmental impact.

As for 2022, we’re bullish. If current trends continue, the industry will continue to professionalize and efficient miners will differentiate themselves from the rest of the pack. North America will play a historically outsized role in the next year, especially as public companies scale up their hash rates and continue to gain market share. The expansion of the industry in the region will bring more jobs to rural communities in the United States and Canada, as miners seek out areas with excess power, including former manufacturing hubs.

Miners will probably have a good year. More likely than not, the ongoing dislocation between hash rate and price will continue as supply chain failures and hardware constraints limit hash rate growth.

This is a guest post by Karim Helmy and Brandon Bailey. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.