Bringing together more than 40 startup pitches on both the retail and fintech verticals at the consortium, the Plug and Play Tech Center Expo day included three keynotes from the founder of Plug and Play Tech Center Saeed Amidi, Managing Director of Citi Ventures Debra Brackeen and founder of the Lending Club Renaud Laplanche.

Saeed Amidi started the day off with remarks summing up the mission of Plug and Play to bring together software for two industries and create a matchmaking haven where corporations could come to find solutions to their vexing technological problems, understand emerging markets and nurture and mentor the next generation of technological advancement.

Debbie Brackeen was excited to describe Citi Ventures fund as a proving ground for startups for early validation of their models. Startups benefit from Citi’s treasure of data and knowledge every step of their growth while Citi strives to “bring the outside in” in integrated value chains.

Citi Ventures is focusing on being an internal acceleration fund that manages funding alongside the incubator as an integrated network. Her remarks touched on Citi Ventures exploration of blockchain technology in its nascent stages to test the potential for solving problems for their partners.

Citigroup has been focused on financial technology that puts consumer experience first in security, analytics, commerce and payments.

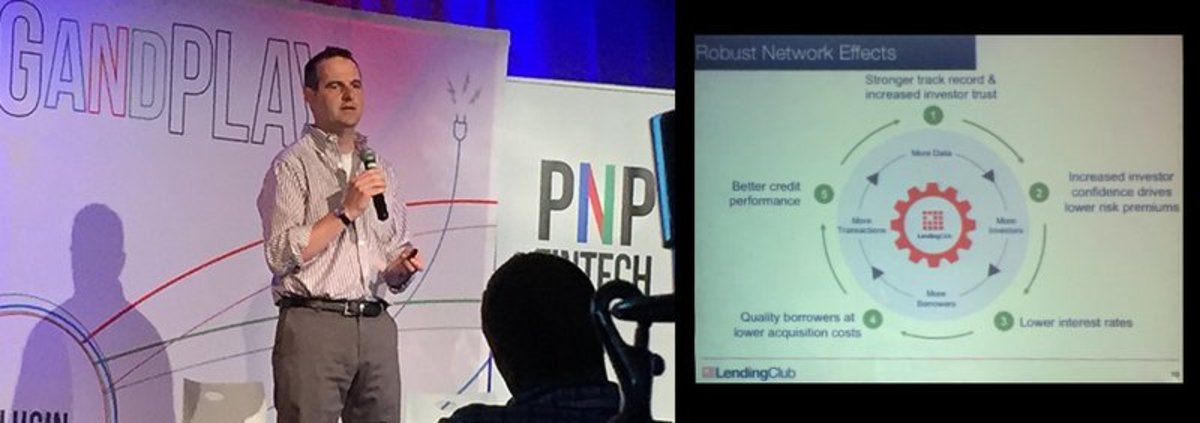

Renaud Laplanche focused on how Lending Club innovated on the existing financial framework by bringing together the lending and the banking side and employing network effects to give investors confidence in their model. Remarkably, he said his company’s biggest turning point was becoming a Facebook app which allowed them to get series A funding and hire top executives: “People are your greatest asset and your founding team has to be top notch.”

Scott Robinson who heads the financial technology vertical for Plug and Play described the marriage between retail and financial software as one born out of necessity as distribution rails turn to mobile and security issues need to be addressed.

Security was the common denominator on both sets of pitches. Notable startups such as Sparkling Logic give actionable advice on fraud prevention, Behaviosec logs and analyzes data such as keystrokes to run real-time authenticity tests, with the U.S. government already as a paying customer, and Debitforward (also known as Pinn) allows users to use a mix of social media data, GPS and the Internet of Things to seamlessly pay for their purchases without ever pulling out a wallet.

Funding is exploding as large companies seek to partner with fledgling startups to innovate in the rapidly changing Fintech atmosphere. Startups along the spectrum of growth face remarkable challenges proving their business model, finding partnerships, proving value to gain funding and getting their big break.

Organizations such as Citi Ventures allow companies to survive in the “lean startup” world by validating the commercial models, consumer pain points and solutions with data and coaching. Plug and Play has produced one “unicorn” with Lending Club and this next wave of startups is looking for their big break, too.

The next round of applications for startups to join Plug and Play are due June 15th.