Just as the market was digesting the harsh news from Italy yesterday, it seems another curve ball was thrown into the mix, this time from Spain.

As we know, there was a setback in Italy, and though it seemed last week like they would be on a fast track to having a stable government, we may now be weeks, if not months away.

Now, it seems that a rather old conspiracy regarding the Prime Minister of Spain is manifesting itself at the worst possible time, and tomorrow the country will hold a “no confidence vote” for their leader Mariano Rajoy. Should the vote carry, Spain’s political quagmire could make the Italian issues look minor.

Investors are frantically trying to understand the economic impact of all this, and there’s some extreme volatility at the moment. Let’s take a look at the charts below.

Today’s Highlights

- Euro Issues

- Cherry Picking

- Ether Driven Selling

Please note: All data, figures & graphs are valid as of May 29th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

An Italian issue may have remained an Italian problem. However, now that Spain may be facing its first regime change since 2011, some are again questioning the stability of the entire Union.

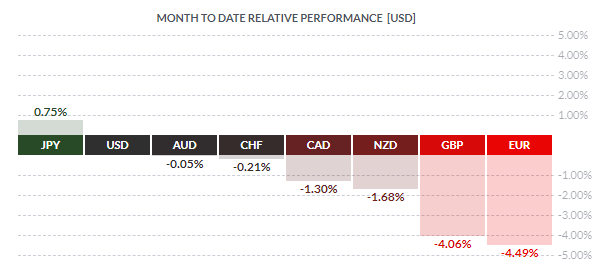

Though a total collapse of the EU should be seen as extremely unlikely, the Euro is seeing what might be its biggest test since 2012. Since the beginning of May, the Euro has lost 4.5% against the US Dollar, which is a huge move. The fall below 1.16 this morning was rather rough.

To be fair, the Dollar has been getting stronger lately and also made some notable gains against the British Pound.

Zooming out on the charts, it seems that both the Euro and the Pound are much higher than they were a year ago but nowhere near the levels of early 2014.

The silver lining to all of this is that the ECB had been searching for a way to weaken the Euro as it tries to unwind QE stimulus measures. The strong Euro was a rather uncomfortable pain in Draghi’s side so as scary as this slide might be, it may actually be a good thing for the EU once calm returns.

As radical as the currency market moves may seem, it’s the bonds that are grabbing most of the headlines as yields in Spain and Italy are soaring. And when it rains, it pours. Global stock indices are down considerably today.

There doesn’t seem to be much in the way of a flight to safety either. Perhaps a bit with the currencies but Gold just isn’t budging.

Crypto Compare

Though there’s absolutely no comparison between the stability of fiat money and cryptocurrencies, it’s still fun to compare them on the charts.

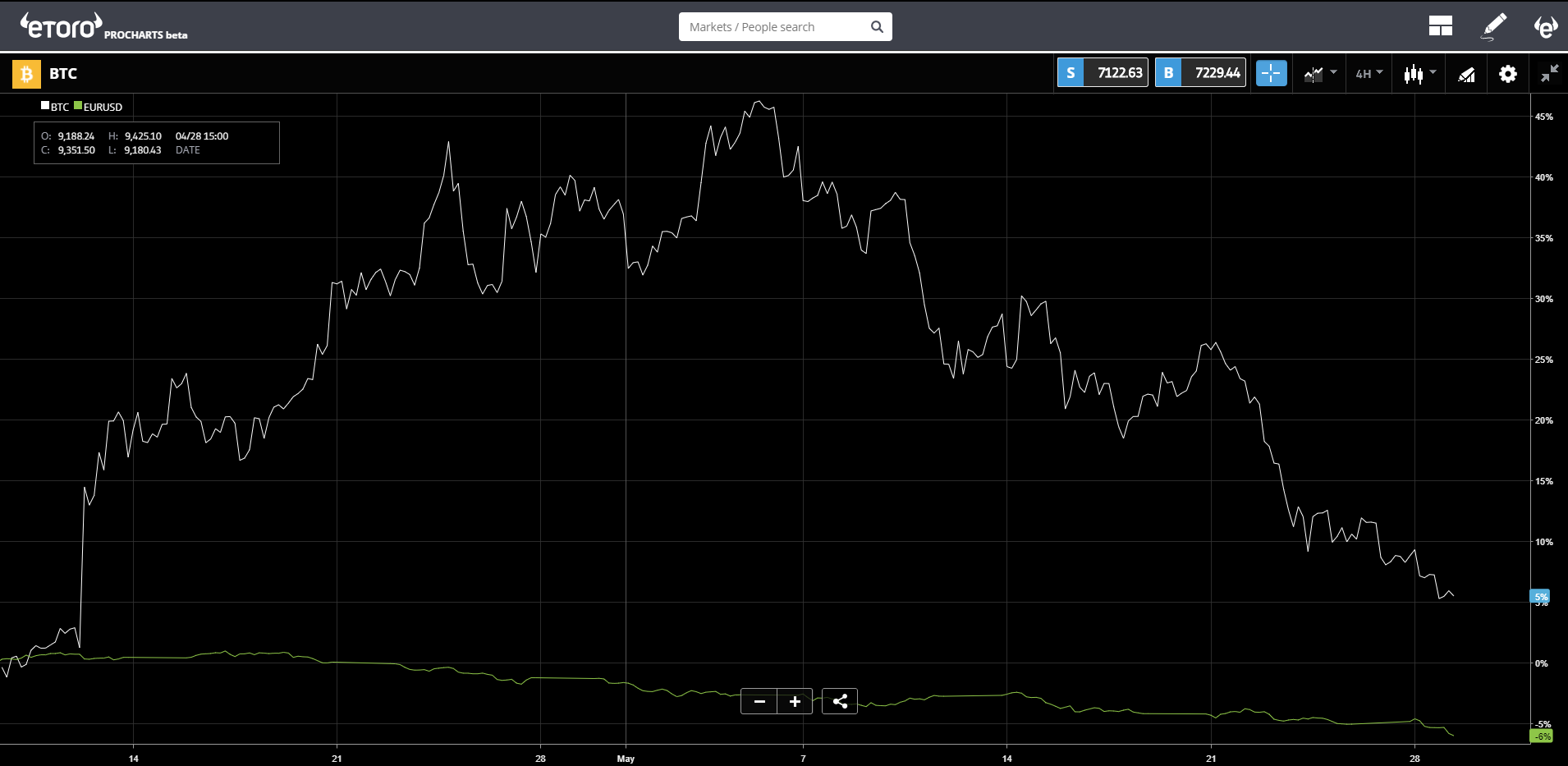

Here is a chart of bitcoin and the Euro since April 9th. As you can see, the Euro has been in a rather stable and steady decline since then, while, erratic as it’s been, bitcoin is still up.

Playing with the scales a bit, we can see both of them declining rather sharply since the beginning of May.

Some of my critics might say that I’m cherry picking data to prove my own point. In this case, they’d probably be right. If we zoom out on the charts, there’s obviously no clear correlation between crypto and fiat, nor is there any comparison. While the Euro and USD have remained so stable, the crypto markets have gained exponentially.

We can see this quite clearly by just glancing at bitcoin’s long-term chart in logarithmic format. The price is up from $1 a coin in 2012 to more than $7,000 today, and while it does have the potential to fall back to zero, it could also see another meteoric surge at any time.

What’s Weighing on Ethereum?

Though it doesn’t seem to have been confirmed as yet, I do feel it’s my duty to also inform you of an emerging theory about Ethereum at the moment. Though all the cryptos seem to be dropping lately, Ethereum is one of the worst performers.

In this case, I’m glad to see Bitcoin as the most stable digital asset, but seeing Ethereum on the bottom is a bit confusing, especially since it consistently maintains the highest level of use.

The leading theory seems to be that this has something to do with the upcoming launch of the EOS blockchain. Not in the sense that speculators are dumping because they feel that EOS will kill Ethereum, though some might be.

It’s simply that the EOS ICO is being conducted on the Ethereum platform and so far, they have raised more than 7 million ETH tokens. The rumor is that many of those tokens are now being dumped on the market.

While we’re on the subject of EOS, we cannot ignore incoming reports that there may be several bugs discovered in the code, that could end up delaying the launch of the main net, a rather sticky situation indeed.

Let’s have an awesome day ahead!

This content is provided for information and educational purposes only and should not be considered to be investment advice or recommendation.

The outlook presented is a personal opinion of the analyst and does not represent an official position of eToro.

Past performance is not an indication of future results. All trading involves risk; only risk capital you are prepared to lose.

Cryptocurrencies can widely fluctuate in prices and are not appropriate for all investors. Trading cryptocurrencies is not supervised by any EU regulatory framework.

Images courtesy of eToro