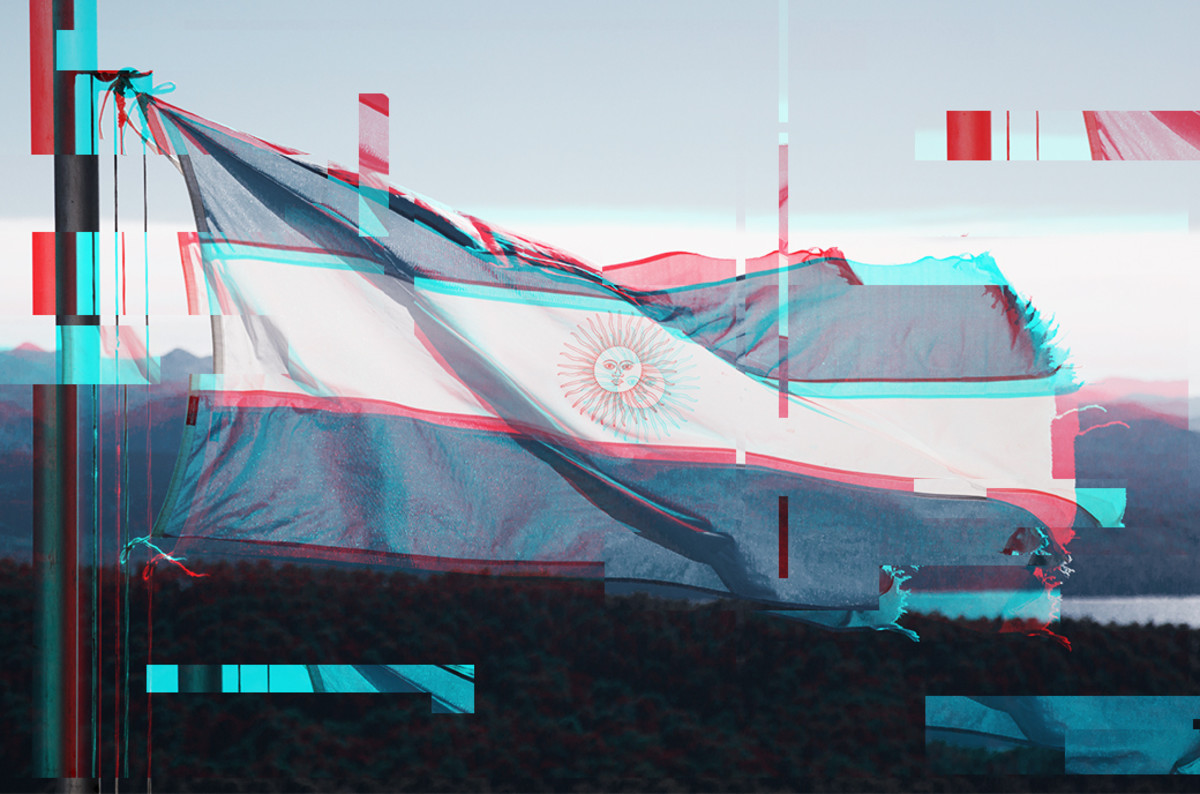

“Thanks to the arrival of bitcoin, Argentines may finally have a sound money alternative before them.”

Argentina’s presidential elections are set to take place on October 27, 2019. Irrespective of who comes out on top on election day, all eyes will be on the country’s economic aftermath.

Argentina’s economy is not in good shape. Inflation is projected to be at 53 percent by December 2019, and there are rumors that Argentina may be about to default on its debt, potentially making it the fifth time it’s defaulted in the last 40 years.

Even with a supposedly reform-minded president like Mauricio Macri, Argentina’s economic flaws persist. Above all, inflation seems to be a constant in Argentina. Argentina’s relationship with inflation has been a prolonged affair. Argentine economist Iván Carrino noted that, as of 2018, Argentines aged 23 to 27 spent more than half of their lives witnessing double-digit inflation. An Argentine born in the 1980s not only experienced years of double-digit inflation but also lived under two cases of hyperinflation. The 1990s — which saw President Carlos Menem introduce some reasonable market reforms, such as creating a fixed exchange rate with the peso and the U.S. dollar to tame hyperinflation — was the only decade to see the specter of inflation disappear for any length of time.

Central Banks and Hyperinflationary ‘Death Spirals’ in Argentina

However, fiscal irresponsibility and exploding foreign debt caused Argentina to default in 2001 and ultimately scrap its currency peg with the dollar. Soon, Argentina reverted to its usual bouts of economic instability throughout the first decades of the 21st century. From the looks of it, inflation appears to be a fixture in the Argentinian political economy that many Argentines casually accept — much to their financial detriment. Indeed, from the historical instability of Argentina's economy to Venezuela’s current hyperinflationary death spiral, central banks have played a significant role in debasing currencies at the expense of their citizens' welfare in Latin America.

Thanks to easy monetary policies that are used as a tool to finance demagogic politicians’ spending programs, inflation has a way of constantly creeping up in the Argentinian economy. Contrary to most conventional analyses explaining the emergence of inflation, inflation is actually the result of public policies that encourage increases in the money supply. Expansions in money supply lead to a drop in the purchasing power of the currency — this case being the Argentinian peso. As a result, Argentines become poorer as their savings in pesos erode in value and the country becomes less attractive for foreign investment.

Bitcoin: A Sound Money Alternative

In many of these countries, there is simply no political will to either call into question central banking policies or promote legislation that puts these countries on the path to sound money. However, the scenario is not so bleak in the 21st century. Thanks to the arrival of bitcoin, Argentines may finally have a sound money alternative before them. Most importantly, they can take proactive steps in using bitcoin and building on it to create a monetary infrastructure without having to wait for the “right” political moment to arrive. Political systems are notorious for institutional inertia and for most people, the process is too cumbersome to operate in.

Bitcoin, on the other hand, offers a dynamic process where people are constantly putting skin in the game and creating a solution to the monetary riddle that has eluded hundreds of nations for the past century. Bitcoin offers unique properties such as durability. It’s not easy to destroy, quite portable, easy to verify, divisible enough to be broken down into smaller units, and most importantly, scarce enough so that it is not easy to obtain or increase in quantity. In fact, Bitcoin’s supply is capped at 21 million, thus reinforcing its scarcity advantage.

The Advantage of Censorship Resistance in Argentina

Due to Argentina’s political instability, bitcoin’s censorship resistance comes in handy. In today’s political world where there is constant surveillance, such qualities in a currency are helpful. The Argentinian government, while not authoritarian, has demonstrated a predilection for overstepping its boundaries when dealing with finances and has had a history of military rule in its recent past. On multiple occasions, the government has seized Argentinian pension funds in response to certain economic downturns. In a similar vein, the Argentinian government has imposed capital controls during times of economic uncertainty, effectively depriving Argentines of some of their financial freedoms to transact in more stable currencies.

On the political side, Argentina recently witnessed the controversial death of federal prosecutor Alberto Nisman, who was investigating the 1994 car bombing of a Jewish center in Buenos Aires. On January 18, 2015, Nisman was found dead in his home, the cause of which was originally ruled a suicide.

Under the administration of Mauricio Macri, however, the Argentinian National Gendarmerie determined that Nisman’s death was a homicide, raising speculation that Nisman uncovered damning information that could have implicated officials of the previous presidential administration in a potential cover-up. All in all, things don’t exactly look bright for Argentina’s political climate.

Such political developments are almost unheard of in countries in the developed world — which face more censorship from corporate actors. However, for developing countries like Argentina, states tend to be the principal agent behind both economic and political interventions that infringe on the rights of citizens. For that reason, Bitcoin offers an alternative that not only protects Argentina's wealth from volatile winds of the Argentinian economy but also enhances their overall freedoms.

Some Argentines already recognize bitcoin’s value. According to Investopedia, Buenos Aires has 130 merchants who accept bitcoin and three bitcoin ATMs. Although it’s still in its infant stages, bitcoin has tremendous potential to be a sound money for Argentina. A digital currency like bitcoin would provide Argentines with a cutting-edge monetary alternative in times when politics remain stagnant and the citizenry cannot rely on politicians to reform institutions anytime soon.

This is a guest post by José Niño. Opinions expressed are entirely his own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.