At a recent Bitcoin meetup in Hong Kong, a serial bitcoin/blockchain angel investor gave a talk. His investment framework consisted of investing in companies that had low margins but could scale easily.

One audience member asked what he would do in a situation where margins went to zero or even negative. Many blockchain application businesses fall into this category. Part of his response was that due to quantitative easing (aka money printing) money was free, so investing in businesses with zero or negative gross margins can be done. If rates are more negative than the cash flow burn of the company, in our bizarro world, the investment actually is outperforming.

When asked how his thesis would be impacted if interest rates rose, he responded that in the near future, that wouldn’t happen — and even if it did, policy makers would realize their error and quickly revert back to printing gobs of money.

Whenever someone completely dismisses the possibility that a central tenet of their investment thesis could be invalid, alarm bells should ring. During the 2003–2007 U.S. subprime housing bubble, the common refrain was that housing prices NEVER went down. By 2008, that central tenet of faith was proven grossly erroneous.

Central banks over the past 25 years have conditioned investors to expect lower interest rates every time there is a financial hiccup. In 1990, the U.S. 10-year Treasury bond yielded 7.94 percent; today it yields 1.75 percent. The effect of falling interest rates has pushed investors further out on the risk curve to generate stable income.

A Thought Experiment

Bitcoin/blockchain startups primarily fund themselves by selling equity to investors, by issuing tokens through Initial Coin Offerings (ICO), or through retained earnings (assuming the company is profitable). Most startups in the early stages sell equity.

Assume you are an angel investor and you share the worldview of the aforementioned speaker. Essentially, you invest in scalable Bitcoin/blockchain businesses with the hope that a greater fool will emerge, allowing you to exit your investment. Remember, it’s the Fourth Industrial Revolution. You don’t want to miss out. You have a pool of capital that you will spread amongst various startups. Here are some assumptions about your investing strategy:

- Initial post-money valuation: $5 million.

- Years to exit: Seven.

- Your portfolio’s performance is benchmarked against owning high-yield U.S. corporate bonds. While many think that money is “free”, it definitely is not unless you are a AAA-rated developed market corporation. Everyone else must pay to play.

As an example, let’s use the Bank of America Merrill Lynch U.S. High Yield Effective Yield as a proxy for what an investor can earn buying riskier corporate bonds. Investing in startups is infinitely riskier than buying high-yield corporate bonds, as these companies produce actual cash flow.

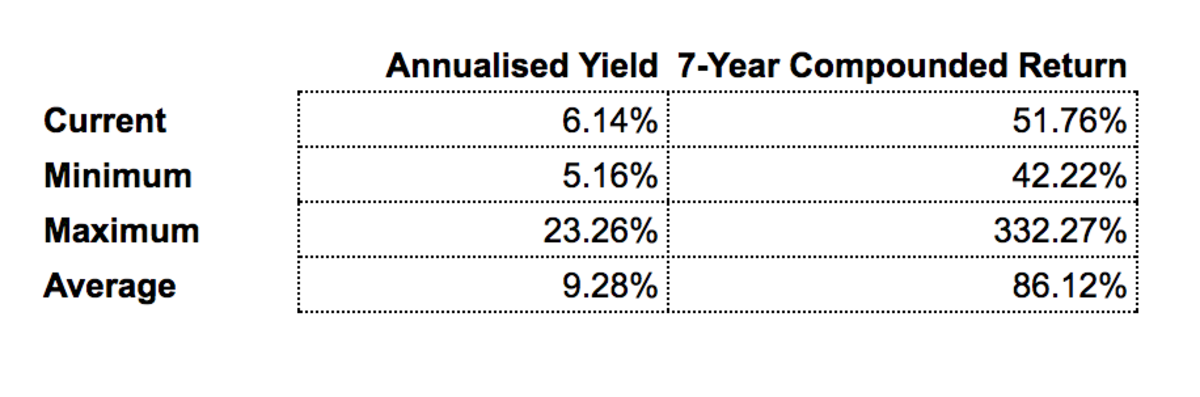

The Federal Reserve Bank of St. Louis publishes the historical effective annualized yield. The table below lists current and historical annualized yields for the index.

The majority of the startups that you invest in will die within seven years, and you will lose 100 percent of the money invested. A small percent will exit at a valuation that is several times higher. Your performance depends on your ability to pick winners.

Breakeven Success Rate = (1 + Opportunity Cost) / (1 + Exit Return)

Breakeven Success Rate: The success rate at which you are indifferent to investing in startups versus buying high-yield US corporate bonds

Success Rate: Defined as the percentage of startups in your portfolio that complete a successful exit

Opportunity Cost: The seven-year compounded return of the high-yield index

Exit Return: The return generated after the startup has completed an exit

Exit Return = (Initial Valuation / Final Valuation) – 1

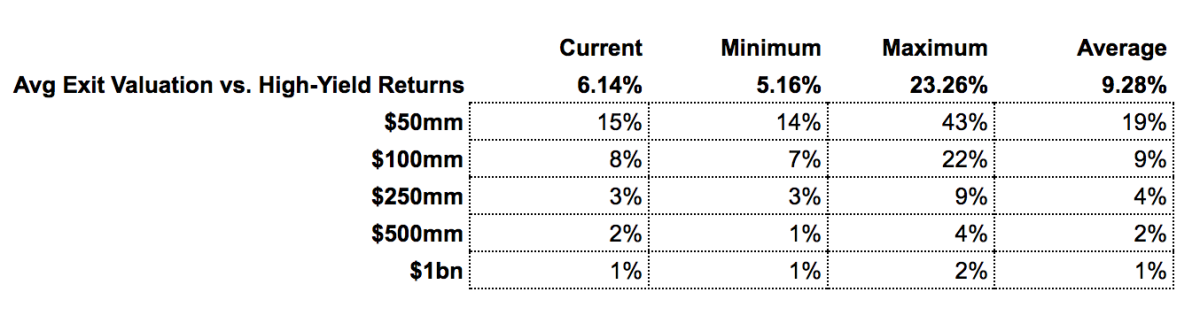

The below table lists the Breakeven Success Rate under different scenarios

It is hard to pin down the global average exit valuation for startups. From various articles I have read, startups on average exit with valuations between $50 million and $100 million. If we assume bond yields normalize near 10 percent per annum, nine percent to 19 percent of your startup portfolio must successfully exit. Even in the current “low” interest rate environment, you still must be a very skilled investor to break even (eight percent to 15 percent success rate).

Achieving a $50 million+ exit valuation is no easy task. Most likely after your angel / seed investment, the company will subsequently attempt to raise a Series A and then B round to grow into a juicy acquisition target. Most likely after each round, your equity stake will be diluted.

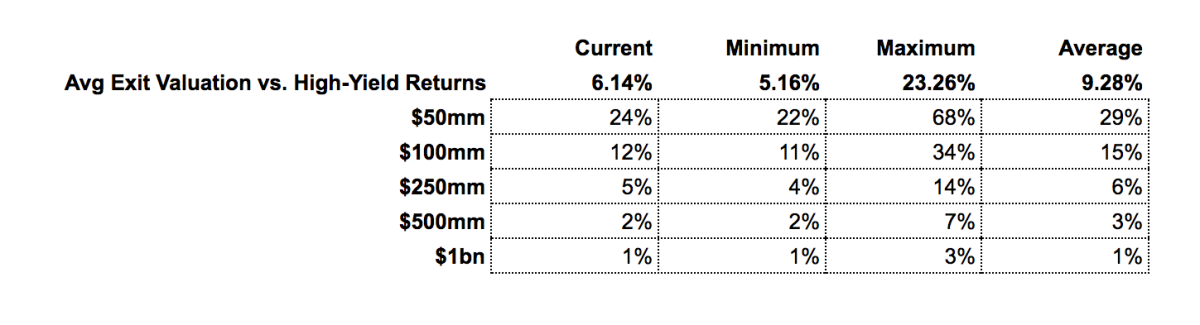

The below table reproduces the breakeven success rate, assuming each successful startup does two subsequent financing rounds and existing investors are diluted 20 percent in each round.

Instead of achieving a nine percent to 19 percent success rate, you now must achieve a 15 percent to 29 percent success rate if interest rates normalize. Remember, you are only breaking even. For all the hard work of identifying promising startups and mentoring them, you have not generated outsized returns. Wouldn’t it be much easier to log onto Interactive Brokers and buy a high-yield bond ETF?

Because you invest in companies with low to zero gross margins, your only hope is to pass the hot potato onto investors who are more risk-seeking than yourself. You have no expectation of dividend income. As interest rates rise, the universe of assets that yield high returns with less risk grows. The pool of fools will decline, and your portfolio will struggle to break even versus investing in a basket of high-yield corporate bonds.

There are many Bitcoin/blockchain businesses and business models that generate real revenue, and are defensible. One only has to look at Bitfinex to see how profitable a “properly” run Bitcoin exchange can be. For the full year 2015, Bitfinex generated $7.03 million of Net Income on $9.35 million of revenue.

Do The Twist

The Bank of Japan was the first central bank to explicitly target a steeper yield curve. In a recent speech, Federal Reserve Governor, Eric Rosengren, stated that the Fed should engineer a steeper yield curve. Many financial analysts are calling this new form of yield curve targeting a “Reverse Operation Twist.” The original “Operation Twist” involved the Fed buying long-dated bonds and selling short-dated ones in order to lower long-term interest rates.

Banks need a steep yield curve to make money. After printing money to stave off insolvency of commercial banks, central banks must now steepen the yield curve so that their stakeholders can return to profitability. The effects of a steeper yield curve are already working. JP Morgan, Bank of America Merrill Lynch and Goldman Sachs have all reported impressive 3Q16 earnings.

As yields on the long-end rise, it will be easier to find positive yielding investments that are not as risky as the strategy of punting startups that have no plan to ever generate a profit.

This op-ed is a guest post by Arthur Hayes. The views expressed are his own and do not necessarily represent those of Bitcoin Magazine.