Executing a hedging transaction can be a type of insurance contract on another investment or on an entire investment portfolio.

The crypto bear market in 2018, which saw the price of bitcoin drop by over 73 percent and those of altcoins drop by over 90 percent, made an excellent case for the need to hedge digital asset portfolios.

And with bitcoin’s meteoric 2019 rally in the first half of the year, protecting those gains from a sudden and potentially steep drop in value may be prudent. Fortunately, as the crypto asset trading ecosystem has evolved over the past 10 years, there are now several bitcoin derivatives that investors can use to protect their positions or potential profit from bitcoin’s price swings.

This article will focus on how to hedge your digital asset portfolio using bitcoin futures and options.

What Is Hedging?

In financial markets, hedging refers to making an investment that reduces the risk of another investment. Executing a hedging transaction can be considered a type of insurance contract on another investment or on an entire investment portfolio.

For example, an equity investor can decide to hedge their portfolio composed of U.S. large cap stocks by shorting S&P 500 futures. That way, if the U.S. stock market experiences a correction, the drop in value of their portfolio will be offset by the profit on the short futures position.

Deciding how much of your portfolio you want to hedge is called the hedge ratio.The hedge ratio compares the amount of a position that is hedged to the entire position. If you want to hedge your entire portfolio, that would be considered a hedge ratio of one. Should you only hedge 50 percent of your portfolio against a drop in value, that would be considered a hedge ratio of 0.5.

While hedging has been a popular investment strategy in established financial markets for decades, it was not available to cryptocurrency investors in the early years of bitcoin. Fortunately, as the crypto asset investment ecosystem has grown substantially in the past two years, crypto investors now have the ability to hedge their digital asset portfolio using both bitcoin futures and options.

How to Hedge Your Portfolio Using Bitcoin Futures

Futures contracts are financial derivatives that provide an agreement between two counterparties to buy or sell an asset at a specific time in the future for a predetermined price. Futures enable investors to speculate on the price development of an asset without actually owning the underlying asset or to hedge an existing position in the underlying or a highly correlated asset.

In the commodity markets, for example, hedging makes up a substantial amount of futures trading as farmers sell futures on the commodity they produce to “lock in” the price that they will receive for their production at a specific point in time in the future.

In the case of crypto assets, you can use bitcoin futures to hedge your digital asset portfolio against a collapse in the crypto markets by selling (or going short) bitcoin (BTC) futures. In that case, should the crypto asset market drop in value, this decrease would be offset by the profit generated on the short bitcoin futures position. Given that most digital assets have a strong correlation with bitcoin, BTC futures may provide an excellent hedging tool for crypto investors.

Currently, investors can choose between trading regulated bitcoin futures on the Chicago Mercantile Exchange (CME), TD Ameritrade or on a crypto exchange such as Kraken or BitMEX (Neither is available to U.S. residents). Bakkt, a new regulated digital asset exchange based in the U.S., is being launched by the Intercontinental Exchange (ICE), the operator of the New York Stock Exchange, and is set to begin testing the first daily settlement and physical delivery of bitcoin futures contracts in late July 2019 (Monthly contracts will also be traded).

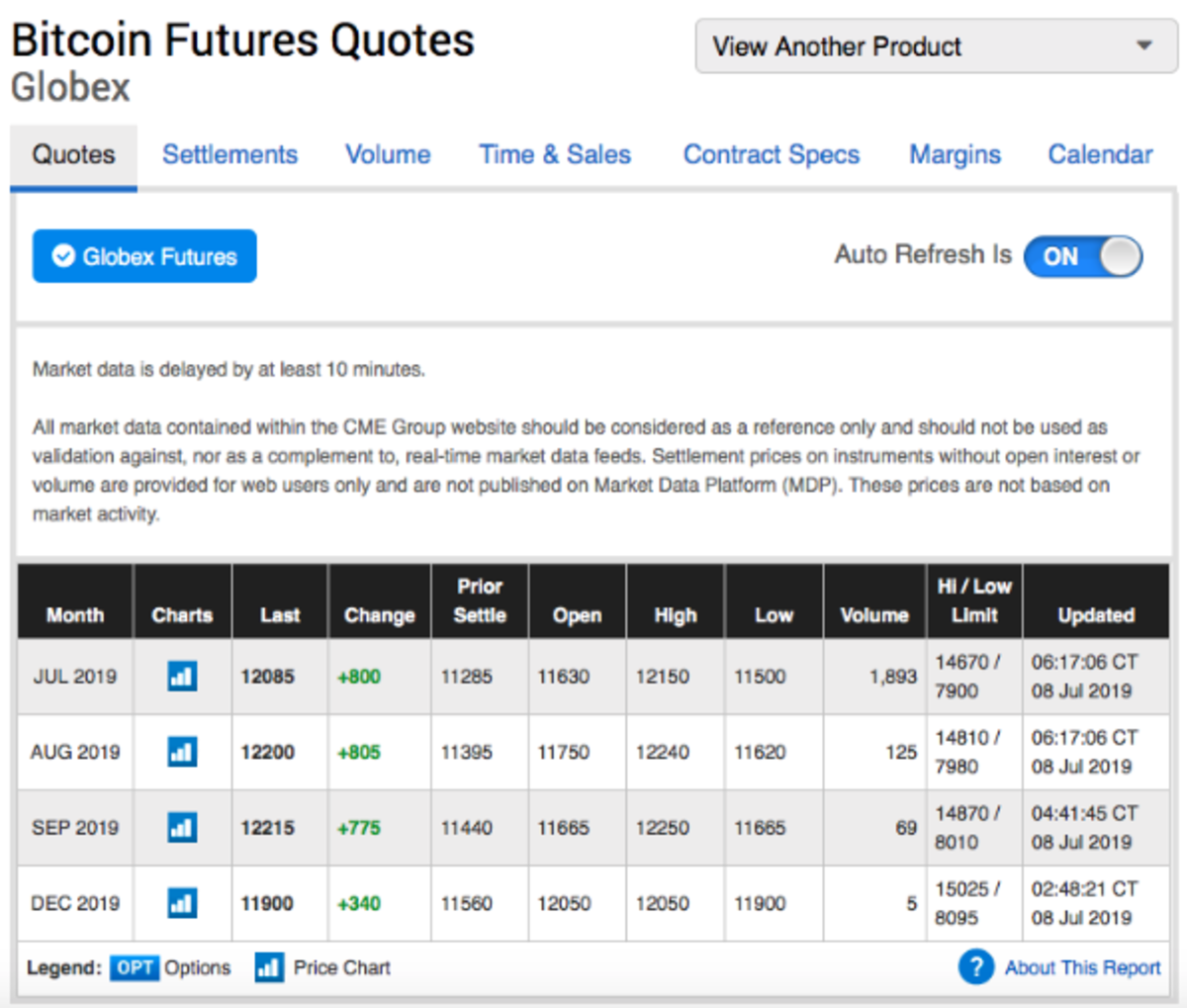

Image: CME Group

Example of a Bitcoin Futures Hedging Transaction

If you want to hedge 50 percent of a diversified digital asset portfolio from a potential drop in value over the next three months, you could short September 2019 CME BTC futures through an online broker that provides access to CME futures with a hedge ratio of 0.5.

The current mid-price of September 2019 BTC Futures is $12,215 (as seen in the image above), which means that you would have to purchase the BTC futures contracts you sold today in three months time at that level.

Should the crypto asset markets collapse within the next three months by, for example, 25 percent, around 50 percent of this drop in value would be offset by the gain made on the futures contract.

So, if bitcoin had dropped by 25 percent during that three month period (in line with the rest of the market), you could buy bitcoin for around $9,187.50 that you have sold for $12,215, thus generating a profit of $3,062.50 on the hedging transaction.

In this example, this should cover around half of the losses you incurred from the drop in portfolio value.

It is important to note that when hedging your digital asset portfolio using bitcoin futures that it will be impossible to cover precisely half of the losses in your portfolio (in this example). The correlation between bitcoin and the rest of the crypto markets (and your portfolio) is not 1:1 and, even more so, correlations change over time. Hence, it is difficult to calculate in advance exactly how much of your crypto portfolio will be hedged when using BTC futures.

Also, we know that altcoins tend to go up and down more than bitcoin when the market moves. Hence, there will always be a certain margin of error when it comes to hedging your crypto portfolio using bitcoin futures.

How to Hedge Your Portfolio Using Bitcoin Options

Options are financial derivative contracts that give the holder the right but not the obligation to buy an asset for a predetermined price at a specific time in the future. Options, therefore, provide investors with more flexibility than futures when it comes to their hedging strategies.

For example, an equity investor who wants to hedge their U.S. stock portfolio could buy S&P 500 put options with a strike price that is 20 percent below the current value of the S&P 500 Index. Should U.S. stocks crash and drop by more than 20 percent, the investor would then be “in-the-money” on their S&P 500 put option, which would offset the loss on their stock portfolio. Should the stock market not collapse, the investor will lose the premium (a small fee) they paid for the put options when the options expire.

Bitcoin options function in the same way. They enable digital asset holders to hedge their portfolios by buying put options. Currently, the only regulated U.S. bitcoin derivative exchange is LedgerX. U.S. and Singapore residents can sign up for early access to this trading platform with a minimum deposit of $10,000. Alternatively, retail investors can use specialized crypto derivatives trading platforms such as Deribit and Quedex to execute BTC options transactions.

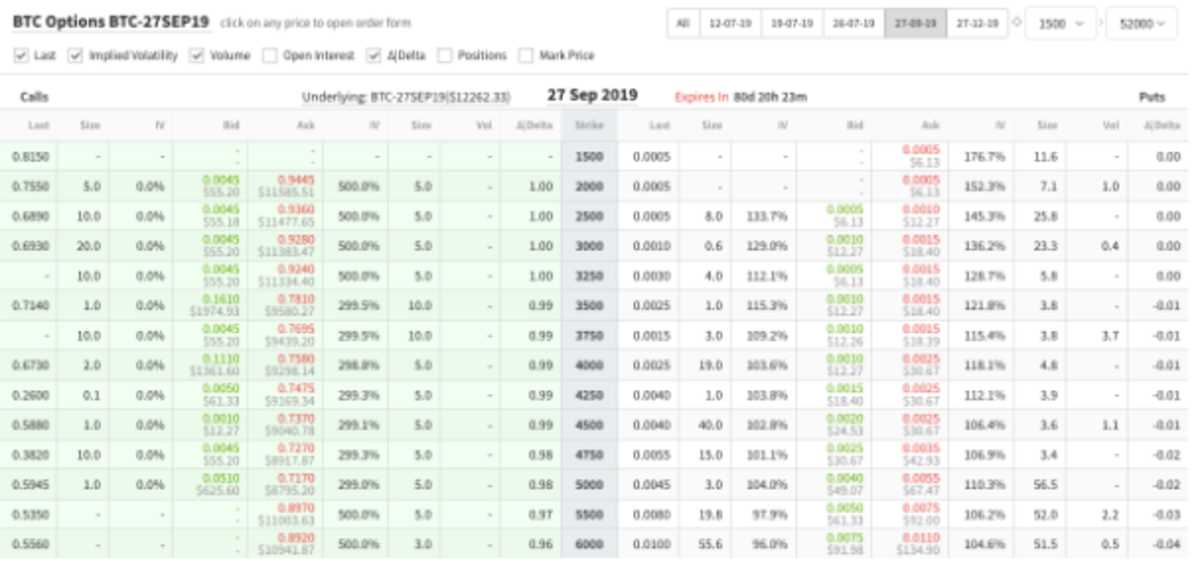

Image: Deribit

Example of a Bitcoin Options Hedging Transaction

If we look at the available bitcoin options on Deribit, we can see a list of call options and put options on bitcoin. Call options enable the holder to buy bitcoin at the strike price at the predetermined dates, while put options enable the holder to sell bitcoin at the strike price at the predetermined dates.

Should you be concerned about a potential 50 percent drop in our digital asset portfolio in the next three months, you could buy September 2019 bitcoin put options with a strike price of $6,000 (which is around 50 percent lower than the current BTC spot price of $11,930) for a premium of 0.011 BTC ($134.90).

Should the market really collapse in the coming three months and bitcoin loses more than 50 percent of its value, your purchased bitcoin put option would be “in the money” and you would generate a profit on your bitcoin options hedge to offset the drop on your portfolio. Conversely, if the market does not collapse, you would lose the 0.011 BTC you paid for the premium.

While hedging with bitcoin futures is relatively straightforward and can easily be executed by retail investors on a number of different platforms today, bitcoin options trading is for more advanced traders who have prior experience with options trading. Hence, it is advisable to first familiarize yourself with terms such as bid/ask, delta and implied volatility before adding bitcoin options to your crypto asset hedging strategy.

This is a guest post by Eric C. Jansen, founder, president and chief investment officer of Finivi | Financial Advisors. Opinions expressed are entirely his own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Trading and investing in digital assets like bitcoin is highly speculative and comes with many risks. This article is for informational purposes and should not be considered investment advice. Statements and financial information on Bitcoin Magazine and BTC Inc sites do not necessarily reflect the opinion of BTC Inc. They should not be construed as an endorsement or recommendation to buy, sell or hold. Past performance is not necessarily indicative of future results.