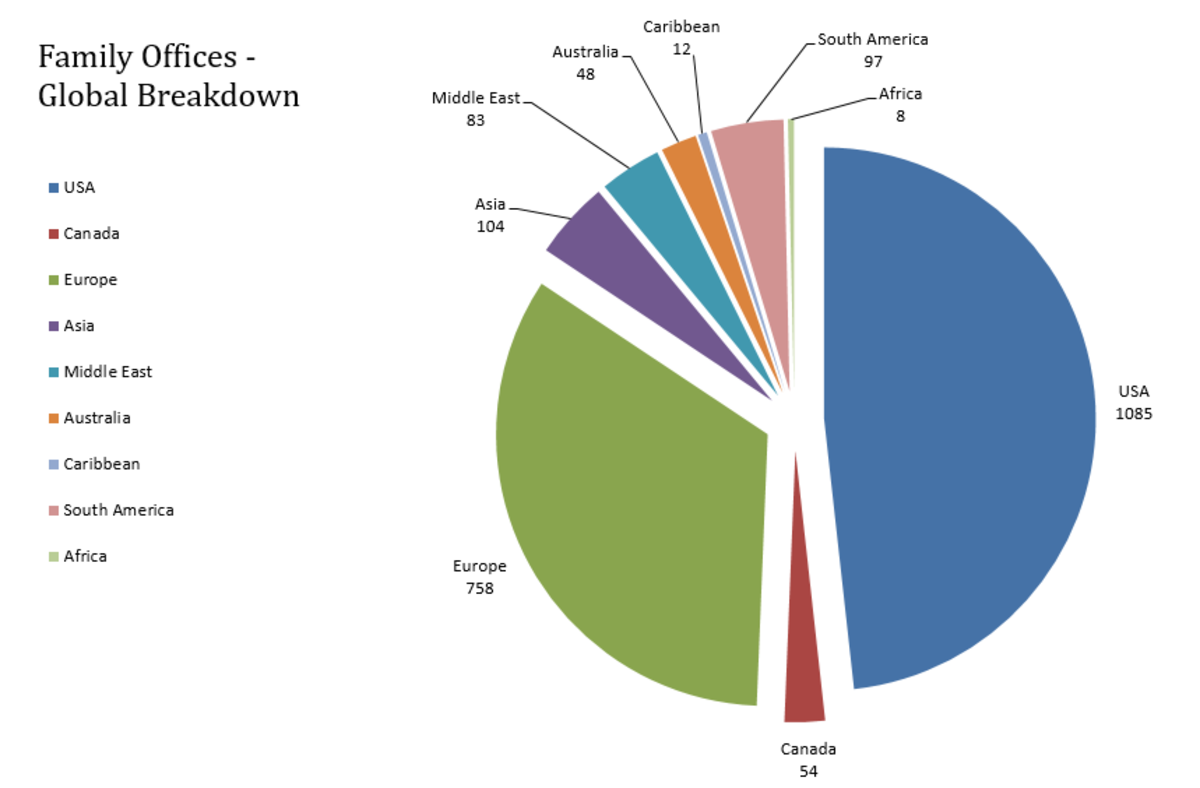

With cryptocurrency investing becoming increasingly mainstream, it’s important to understand the types of potential investors waiting on the sidelines. One largely untapped investment group would be a “family office” (FO), which is a private wealth manager of investments and trusts for ultra-high net worth individuals (UHNWIs). In 2015, UHNWIs included almost 173,000 individuals whose wealth accounted for $20.8 trillion. FOs can represent a single-family office (SFO) or multi-family office (MFO), with the former being the largest group that represents one extremely wealthy single family.

The Family Office Databases reports that most FOs reside in the United States.

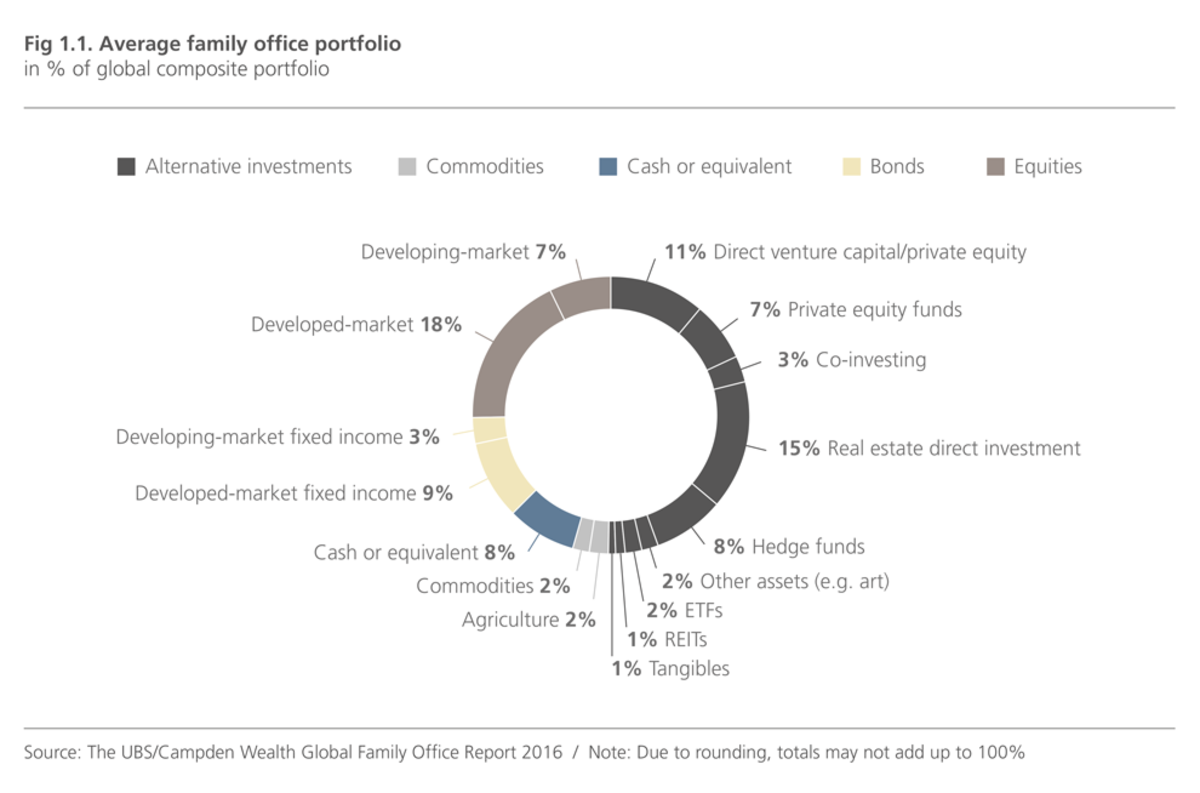

According to UBS and Global Wealth, the top three investments of an average FO portfolio are in the developed market, real estate, or venture capital and private equities.

Cryptocurrencies would be classified as a commodity, whereas initial coin offerings (ICOs) would represent venture capital. Furthermore, most ICOs are deemed securities based on the parameters of the Howey test. Cryptocurrencies themselves are still very new and highly complex, and innovation is happening every day. Few people understand them deeply due to the intense learning curve.

Being decentralized and transparent on a blockchain with low transaction fees means cryptocurrencies have attractive properties for UHNWIs. Cryptocurrencies provide FOs with diversification from traditional assets usually in an average portfolio. However, the risk of investing remains high, especially if there is a lack of understanding around how cryptocurrencies work or how to secure them properly.

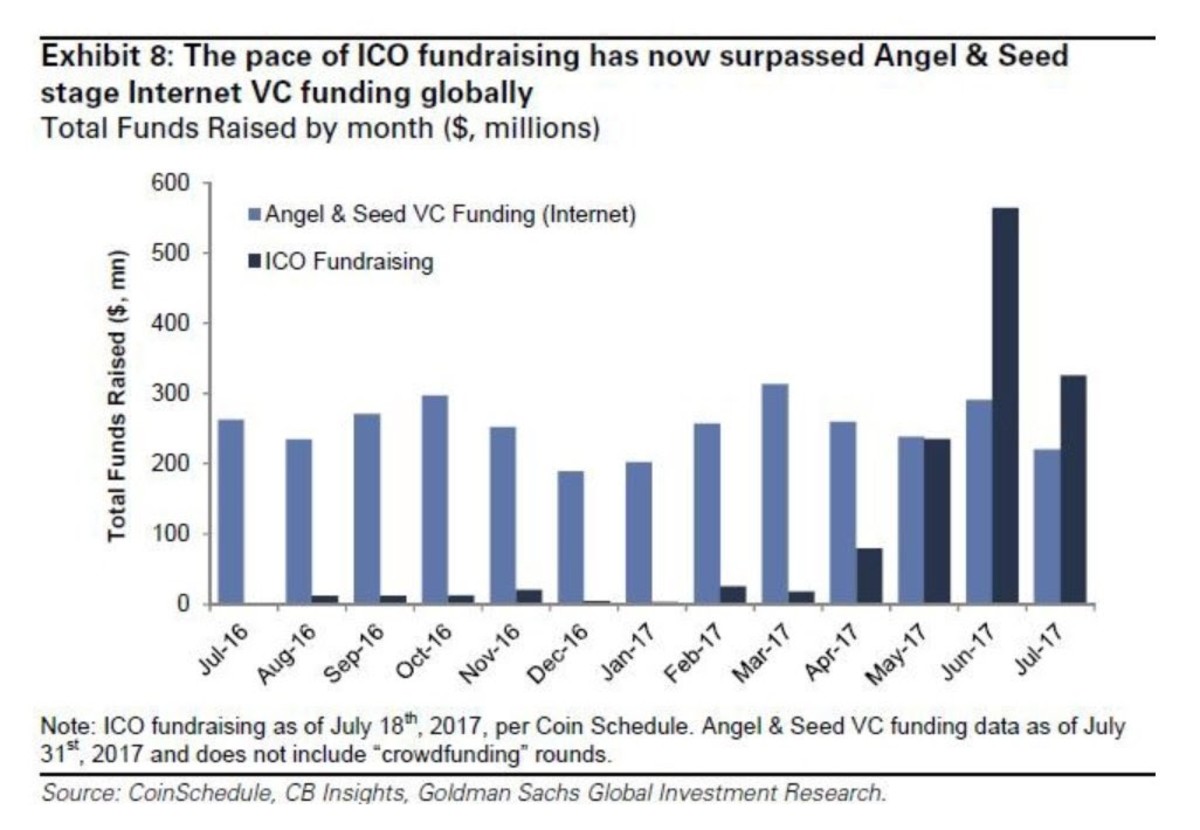

The recent explosion of ICOs and ICO funding represents a growing percentage of investors backing the creation of software or companies that are building the technology and infrastructure. David Drake, managing partner of LDJ capital, whose focus is on compliance and underwriting for ICOs, said to Bitcoin Magazine, “These ICOs need to have a real team and business structure behind them before anyone is willing to invest.”

Drake added that many investors he speaks with “are afraid that they will not understand what is happening with cryptocurrencies, but this is changing very quickly as they become curious about the subject.”

Projects that will be able to cut through the noise and hype with a clear message and identifiable use cases will likely acquire more investors through an ICO. Two such examples of successful ICOs with straightforward use cases include Civic, a project focused on providing proof of identity, which raised $33 million; and Filecoin, a decentralized storage network, which raised $252 million.

Generally, ICOs accept funds through cryptocurrencies only, although this may change to bring in more investors. Kamil Przeorski, co-founder of Experty.io and ReactPoland, told Bitcoin Magazine that “many people I talk with are very interested in my project, but don’t always understand the process and would rather use USD.”

Ultimately, the better the cryptocurrency community can communicate and explain the complexities, intricacies and possibilities, the more potential investors will flock to this space.

This guest post is by Josh Olszewicz, an advisor to Experty.io. The views in this piece are his own and do not necessarily reflect those of Bitcoin Magazine or BTC Media.