- Bitcoin has seen a stark correction since peaking at $12,400 early last week.

- The asset plunged as low as $11,150 earlier this week, falling below pivotal support levels.

- BTC has since bounced back to $11,500 as of this article’s writing, with positive fundamentals pushing Bitcoin higher.

- Bitcoin remains in no man’s land; it is above the low-$11,000s but below $11,500.

- An on-chain trend suggests Bitcoin has a higher chance of moving higher than lower.

- Add to this a positive fundamental case and the asset could reverse back to the local highs.

Stablecoins on Exchanges Are Up, and That’s Good for Bitcoin

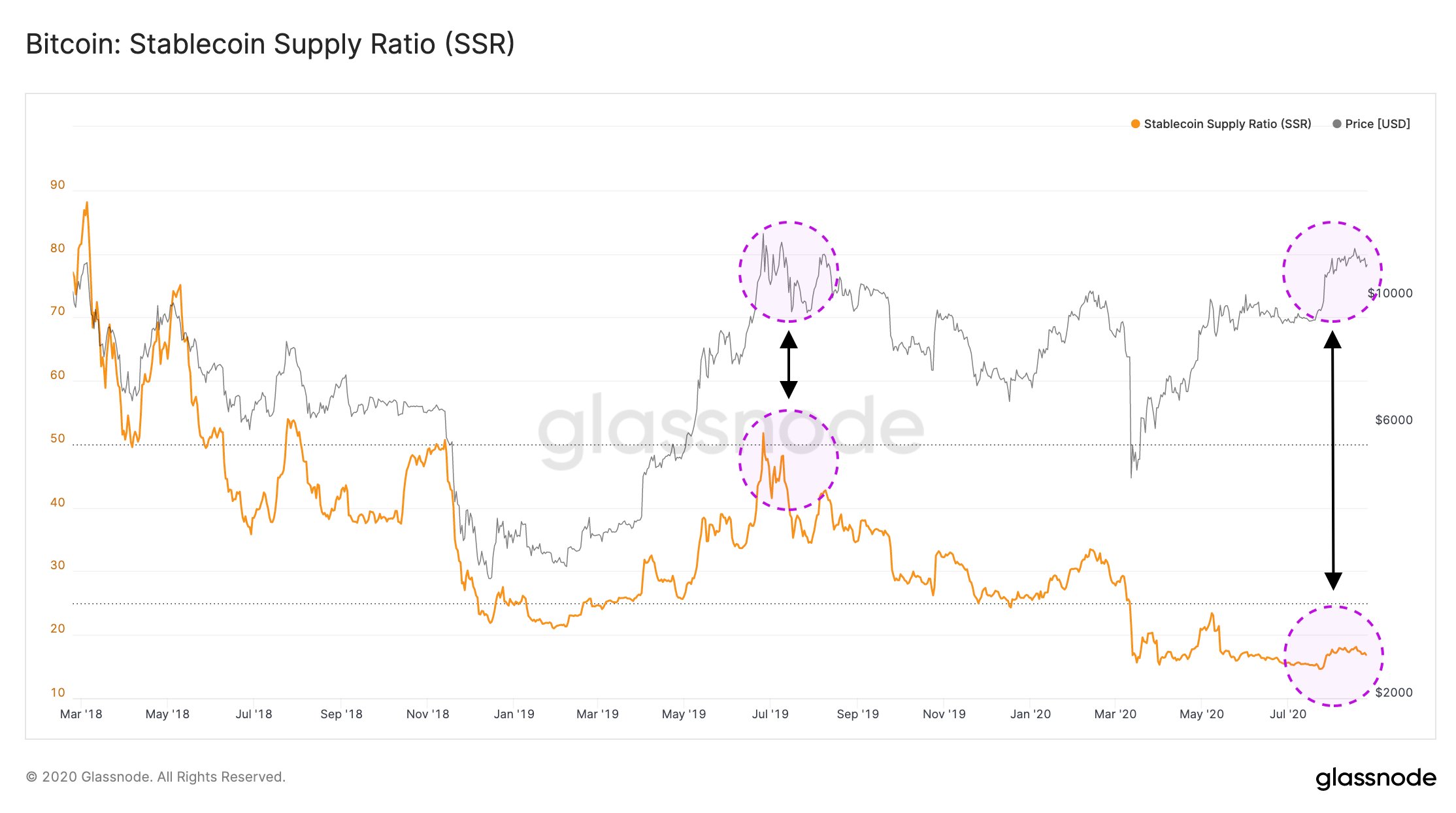

According to blockchain analytics firm Glassnode, the amount of stablecoin in circulation and on exchanges relative to Bitcoin has remained high.

The firm believes that this suggests there is an “increased potential for an upwards movement” in the BTC market.

This is because stablecoins deposited on exchanges effectively represent demand for cryptocurrency (most often Bitcoin or Ethereum).

“The current Stablecoin Supply Ratio (SSR) indicates a high buying power of stablecoins over #Bitcoin – and therefore an increased potential for an upwards movement of $BTC. SSR is 3x stronger than it was when $BTC hit these price levels over a year ago.”

Chart of the Stablecoin Supply Ratio with the bitcoin price from crypto analytics firm Glassnode.

Adding to this, the number of Bitcoin held on exchanges has decreased massively over recent months. This is in response to a number of factors, but an increase in fiat supply (demand) and a decrease in BTC supply should lead to higher prices in the coming months and years.

It isn’t clear how much of an effect these on-chain trends will have on price action, though.

Jackson Hole Meeting Could Boost BTC Further

Set to boost Bitcoin further is the impending Jackson Hole symposium for central banks. This symposium will be digital, of course, but the effects of the decisions/discussions at the event are expected to be as influential as ever.

The market is seemingly pricing in the expectation that Jerome Powell and other central bankers will target higher levels of inflation.

Inflation will boost all asset prices. Bitcoin and gold, especially, stand to benefit from this as they are both seen as hedges against inflation and hedges against fiat systemic risk.

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com This On-Chain Trend Shows an "Increased Potential" For Bitcoin to Rally Higher