Bitcoin has been an object of serious criticism across the board for a range of reasons. Most notably, though, the first and foremost cryptocurrency faces a barrage of judgment due to its price volatility. Traditional and more conservative investors are taking the chance to label Bitcoin as an incredibly risky investment, as the cryptocurrency lost around 70 percent of its value since January. But how risky is Bitcoin exactly?

Cryptocurrency Investing is Gambling

A recent article on popular finance insight publication The Motley Fool expressed serious concerns about investing in cryptocurrencies. Bitcoin, the largest digital currency by means of market capitalization, was the main object of criticism.

Arguments were made about its volatility as the authors pointed out that it lost around 70% of its value since its all-time high in January. The authors even referred to cryptocurrency trading as “gambling”.

The article suggests three “traditional” investment opportunities, each recommended by one of the authors.

Traditional Companies vs Bitcoin: Which is Safer?

Chris Neiger, Jeremy Bowman, and Danny Vena, all contributors at The Motley Fool, expressed their skepticism regarding Bitcoin. They suggested alternatives in the face of publicly traded companies, namely, Amazon, JD.Com, and iQiyi, respectively.

Amazon

Chris Neiger was the first one to suggest an investment alternative to Bitcoin, pointing out its high risks associated with volatility. He went with Amazon, noting its stable growth. The company’s shares have increased in value with almost 300 percent over a three-year period from 2015 to 2018.

Neiger went on to safeguard his statement with what seems much like a disclaimer:

Of course, there’s no guarantee that Amazon will continue growing at the same pace that it has in the past, but when compared to the current volatility of bitcoin, it looks like a much safer bet.

Amazon has truly marked an impressive increase throughout the last three years, but so has Bitcoin. In fact, on July 4, 2015, the cryptocurrency traded for $256.66. As it stands today, Bitcoin’s [coin_price coin=”bitcoin”] marks a staggering 25x increase, despite the major correction it’s going through since January.

In other words, despite the “current volatility of bitcoin” it has clearly outperformed Amazon across the board. Not only that, but Amazon itself has revealed plans to accept Bitcoin payments.

JD.com

Jeremy Bowman was the second to dismiss Bitcoin’s impressive performance, suggesting JD.com as an alternative.

Bitcoin mania seems to have come and gone, but China’s blockbuster economic growth is here to stay. – He noted.

He chose not to make any further clarifications justifying his claims that “Bitcoin mania” has come and gone. Instead, he went on

JD.com is China’s biggest direct retailer. Much like Amazon, it sells its products both directly and using a third-party marketplace. Bowman makes a myriad of arguments why it’s a stable investment opportunity. However, the hard financial data shows otherwise. This is how JD.com’s 3-year price chart looks like:

In July 2015, JD.com’s shares traded for around $28. Currently, they stand at $38.38, which doesn’t even compare to Bitcoin’s growth over the same time period. Going further, the company’s shares have obviously taken a rollercoaster ride during the last 11 months. As it stands, they trade for the same price they did back in August 2017, marking absolutely no progress whatsoever. In August Bitcoin peaked at $4430, making its current price around 45% higher.

iQiyi

Last to suggest an alternative to Bitcoin was Danny Vena. He posed iQiyi, a streaming service which is commonly referred to as “The Netflix of China”. It recently had its IPO and its shares currently trade for $32.98. The company’s stocks reached their all-time high just a few weeks ago on June 20, when they traded at $45.49, which implies a decrease of more than 25 percent. For the same period, Bitcoin has only declined with around 5 percent.

A Clear Winner?

Bitcoin has definitely had a rough two quarters in 2018. Nevertheless, despite having lost around 70 percent of its all-time-high value at the beginning of the year, it’s evident that it heavily outperforms each of the abovementioned companies.

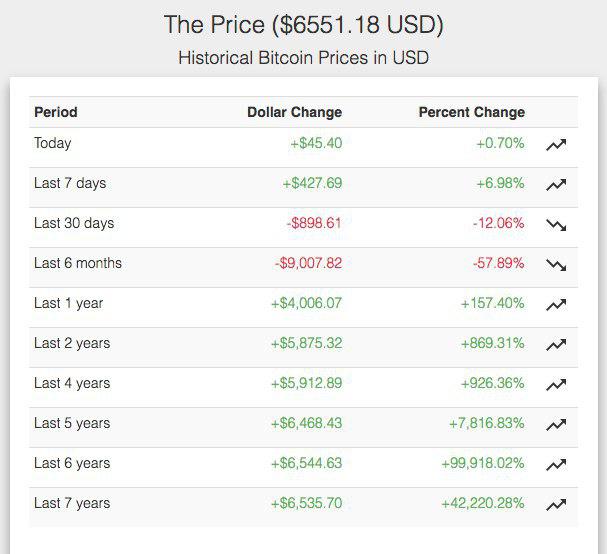

As it turns out, though, the first and foremost cryptocurrency also performed thousands of times better historically, turning it into a much better long-term investment. This is how Bitcoin has performed in the last seven years:

For the last seven years, Bitcoin’s price has grown by more than 42,220 percent. Let’s compare these numbers to the respective performance of each of the abovementioned stocks.

Amazon stocks peaked at $227 in July 2012 which means it’s marked roughly around 650 percent growth in the last seven years. It’s impressive, but not nearly as impressive as what Bitcoin’s achieved.

JD.com had its IPO in 2014. In May 2014, its stock peaked at $25.69. Up to date, it has grown with a little over 50 percent – a number insignificant compared to Bitcoin’s growth.

iQiyi only had its IPO in March 2018. It sold its shares at $18 which means that it has managed to see a growth of around 80% in the last three months, which is undoubtedly impressive. And while the company’s stock has performed well for the last months, a historical comparison with Bitcoin is rather inappropriate.

The question is whether long-term gains trump short-term volatility. This would seriously depend on one’s trading strategy, but it goes without saying that Bitcoin has been more than a lucrative investment for all those who bought in early.

Growth in Unregulated Market Conditions

What seems even more impressive is that Bitcoin’s price increase happens amid market conditions with little to no actionable regulations. While Amazon, JD.com, and iQiyi all operate within entirely transparent and legislative market conditions, Bitcoin has seen little to no lawful frameworks at all.

The lack of regulation refrains institutional investors from stepping in – something that can’t be said for traditional markets.

Bitcoin is also fairly susceptible to FUD (Fear, Uncertainty, Doubt) because of the sheer lack of knowledge amid regular retail investors.

And despite all of the above, it managed to outperform Amazon, a company with long-standing history, currently occupying spot number eight on the Fortune 500 list. And it did so with a factor of a few hundred.

Denying Bitcoin’s volatility is undoubtedly inappropriate, but so is denying its growth.

Do you think Bitcoin is a risky long-term investment? Don’t hesitate to let us know in the comments below!

Images courtesy of Pixabay, TradingView, Bitcoinist Archives, Coin.Dance