Only weeks ago, it seemed impossible for the digital art market to cool off. Throughout February, the non-fungible token (NFT) craze was in full spotlight, with the mania reaching its peak with the record setting $69 million Beeple auction. At its height, even Tesla’s CEO Elon Musk tweeted about selling his NFT.

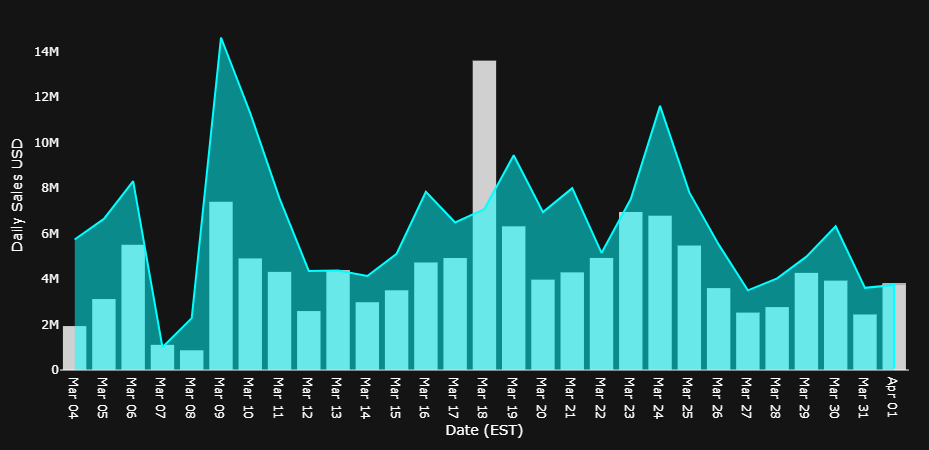

But as the novelty began to wear off and speculators moved on, the NFT market has been in a continuous downtrend. Sales figures across online marketplaces for digital art and collectibles have dropped precipitously, potentially exposing the absence of organic demand in the NFT space.

According to figures from NonFungible, the average daily value of NFTs sold across marketplaces fell from $19 million to $3 million on March 25th — approximately an 85% decrease. Other major metrics have flashed worrying signs.

In the past week alone, the gross number of sales and unique buyers declined by 30% and 35, respectively. These figures have left speculators and market participants questioning whether the NFT space is experiencing a temporary pullback, or if its hype was merely a flash in the pan.

Despite Worrying Indicators, NFT Marketplace NBA Top Shot Shows Signs of Strength

NBA Top Shot, an NFT marketplace for NBA trading cards, has seen the total value of NFTs in circulation (represented by total market capitalization) shed $800 million — dropping from a high of $1.85 billion to $1 billion. According to evaluate.market, the total value of sales suffered a similar decline, as demand waned on the secondary market.

What’s interesting, however, is that demand is still relatively healthy in the primary market. New releases from Top Shot continue to sell out almost instantly. Considering this, it’s likely that the speculative frenzy for NFTs had overheated the market — leading the space to only experience a temporary pullback.

This also seems to be a sentiment shared by venture capitalists. Dapper Labs, the parent company of NBA Top Shot, recently raised $305 million in funding – not a paltry sum by any measure. Despite the recent pullback, other NFT marketplaces such as OpenSea have raised funds to expand their businesses. This is clearly a sign of confidence from investors, as they have bet on the long-term sustainability and growth of the NFT industry.

More likely than not, non-fungible tokens will continue to exist within the broader crypto ecosystem. Whether it will surpass its recent highs anytime soon, however, remains to be seen.

Featured image from UnSplash