NextBank, the world’s first Bitcoin bank, has announced that they will be stopping their public crowdfunding campaign, due to a recent injection of $1.4 million from 2 venture capitalists for 4% of the company.

Disclaimer: This article was provided by Bitcoin PR Buzz. Bitcoinist is not affiliated with NextBank and is not responsible for its products and/or services.

NextBank has a now has a total of $2.35 million in funding, with $.95 million brought from private VC investments coming from small time investors. The small time investors can choose to either be minority shareholders or to be refunded in full. NextBank in the press release stated that they “will continue funding through venture capitalist avenues to ease the concerns of the public”.

NextBank has a now has a total of $2.35 million in funding, with $.95 million brought from private VC investments coming from small time investors. The small time investors can choose to either be minority shareholders or to be refunded in full. NextBank in the press release stated that they “will continue funding through venture capitalist avenues to ease the concerns of the public”.

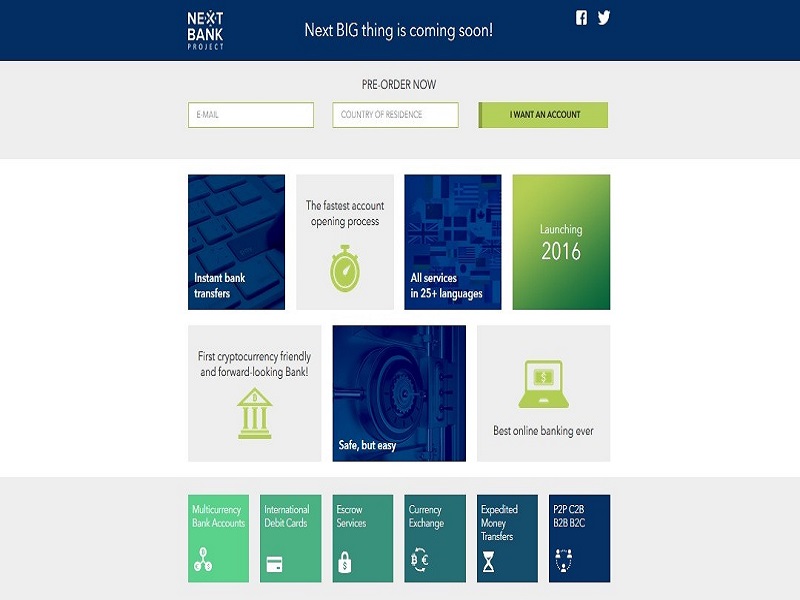

NextBank is still scheduled to launch 2016, with fees 15x less than the competitor’s 3-5% typical rates. Furthermore, offices will be established in UK, France, Germany, Spain, China, Malaysia and Russia the following year.

Even with the new private investments, NextBank has not changed to please shareholders, something that frequently occurs with startups.

“NextBank’s main goal is still to provide advanced banking services for Bitcoin and cryptocurrency clients around the world. NextBank accounts will be able to support 75+ currencies and precious metals. The modern Bitcoin bank will also offer global Debit Cards, accounts denominated in both fiat such as USD and various cryptocurrencies, SWIFT transfers, an escrow service, currency exchange, and much more.”

About NextBank:

Bitcoin bank NextBank will be operational in early 2016 and offer cryptocurrency users worldwide International Debit Cards and private bank accounts. NextBank accounts will be designated in both popular fiat currencies and digital money such as Bitcoin. NextBank will offer fiat currencies, cryptocurrencies and precious metals such as Bitcoin, Litecoin, gold, silver, platinum, palladium, GBP and USD on single multi- currency accounts. A single NextBank account will be able to support over 135 currencies and precious metals. NextBank will also allow SWIFT transfers, offer an escrow service and be a fully functional currency exchange. NextBank will offer market competitive rates from 0.2% for the most popular currencies to 0.4% for less popular currencies. Fully focused on the international market NextBank will be able to assist clients in 50+ languages. Dedicated bank managers will be able to guide customers in their own language; making NextBank a valuable asset in international, multilingual co-operations. For the ultimate international banking experience NextBank plans to launch 7 regional offices worldwide in 2016: in the UK, France, Germany, Spain, China, Malaysia and Russia.

The Original Press Release Source is Bitcoin PR Buzz

About Bitcoin PR Buzz:

Bitcoin PR Buzz has proudly served the PR and marketing needs of cryptocurrency and Bitcoin tech start-ups for over 2 years.