Bitcoin price action has triggered a technical momentum signal that in the past appeared within four to six months from each cycle peak. Could the next crypto bull market top be in so soon when the rally barely feels underway? Let’s take a look at the 1M Stochastic Momentum Index and the supporting data.

A Crypto Cycle Peak In Less Than Six Months? No Way!

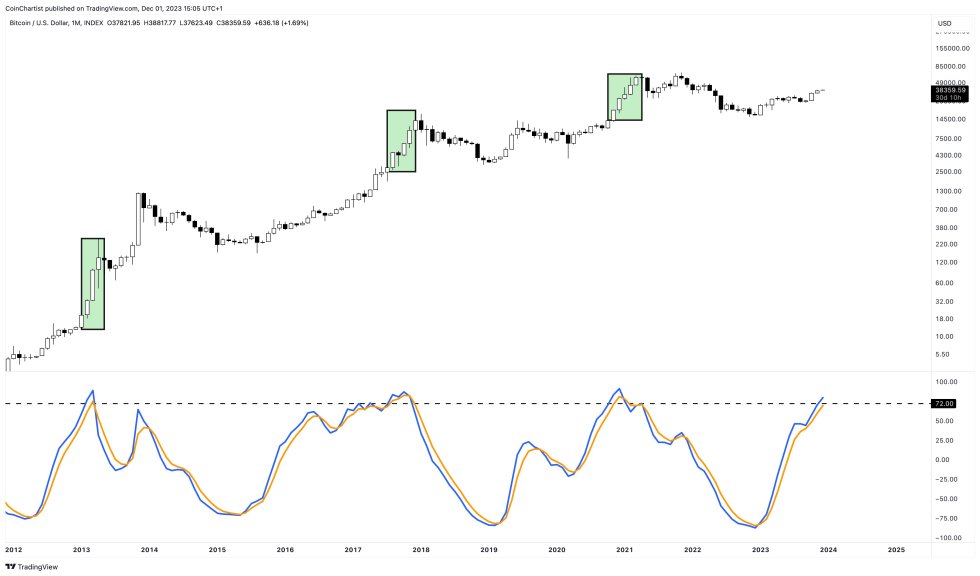

The idea of a crypto bull market peak in less than six months more than likely sounds ridiculous. But when looking at past data, the implications of the chart below could catch a lot of Bitcoin investors off guard who aren’t expecting price to move until after the halving.

The 1M Stochastic Momentum Index, which measures trend strength based on price momentum, is now above a reading of 72. While this doesn’t on its own have any significance, looking back at past results when BTCUSD soars above this level on the oscillator tells another story.

Bitcoin has only reached such momentum levels three times in the past, and all three times the top cryptocurrency made a swing high within the next four to six months. The signal is now back again, suggesting that a peak could arrive within four to six months.

Why The Window To Buy Bitcoin Is Closing Fast

A window of four to six months doesn’t leave much time to accumulate BTC for those who haven’t already been doing so. For the most of the cryptocurrency’s existence, prices tend to appreciate the fastest and steepest after the block reward “halving.” This has become so obvious to onlookers, that it has become expected and is the consensus among most crypto investors as to what drives supply and demand.

With today being December 1, Bitcoin’s next halving event in April 2024 falls right within the sweet spot between four and six months to a swing high.

There’s no telling, however, if the signal from the Stochastic Momentum Index will produce the same results. Currently, both the Stochastic Momentum Index and the halving have accurately predicted a bull market in the past. The only difference is that the signal is here well before the halving.

Whatever the case may be, the tool at the very least suggests that momentum is on the bullish side, and it’s increasing towards the highest readings ever historically.