Nasdaq Inc’s SMARTS trade surveillance technology is now employed by five cryptocurrency exchanges, according to reports. Last week it held a closed-door meeting to help improve the profile of cryptocurrencies in global markets.

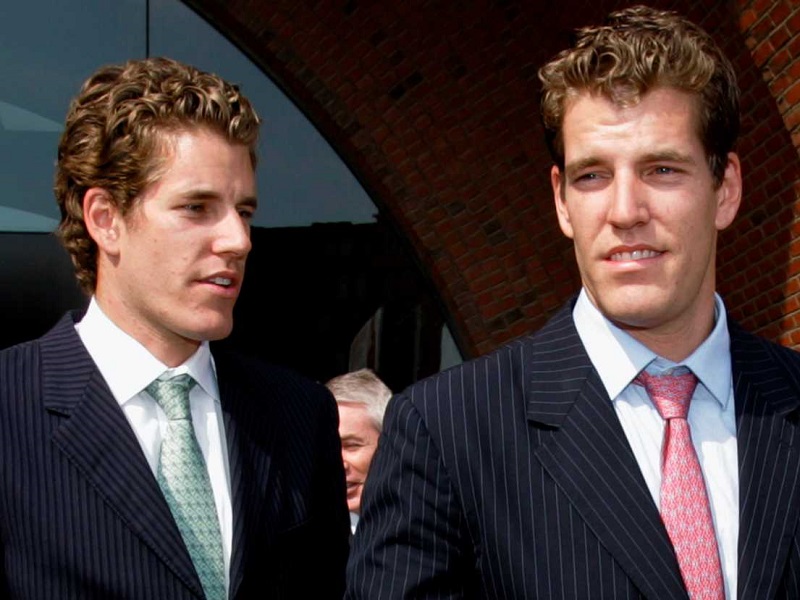

According to Bloomberg reporting, Nasdaq Inc recently organized a meeting between its experts and cryptocurrency exchanges. Confirmed in attendance were representatives from Gemini, the exchange launched by Tyler and Cameron Winklevoss in 2016. In April 2018, Gemini contracted Nasdaq Inc in order to utilize its SMARTS trade monitoring technology.

Preventing Market Manipulation

Security and preventing manipulative trading must be key considerations for the Gemini exchange as it helps to provide a market price of bitcoin for Cboe Global’s bitcoin-based futures. Providing tangible price points for bitcoin is a critical consideration in whether the US Securities and Exchange Commission (SEC) take the step from allowing bitcoin-based futures, to finally approving bitcoin-based exchange-traded funds (ETFs).

Winklevoss Bitcoin Trust, alongside Cboe Global, have had bitcoin-based ETF applications pending with the U.S SEC for most of 2018. The Winklevoss application has now been rejected twice. Cboe Global has been working hard to answer the U.S SEC’s concerns over the market valuation of bitcoin and its volatility. If the U.S SEC approve a bitcoin-based ETF, in what could be a critical move for cryptocurrency credibility, the Cboe Global ETF is likely to be the first.

More Exchanges Hire Nasdaq

Nasdaq’s SMARTS technology monitors real-time trading activity and raises alerts with the exchange if it discovers unusual trading activity. Bloomberg reports indicate Nasdaq Inc is now working to protect five cryptocurrency exchanges, but Nasdaq is yet to confirm who three of the new customers are. SBI Virtual Currencies is one exchange now also using Nasdaq Inc’s services.

A Nasdaq spokesperson confirmed to Bloomberg that the meeting took place, but not its content or attendees, saying only that future meetings may also be on the agenda. Topics discussed included the future regulation of cryptocurrencies, and what tools and surveillance methods are needed to police cryptocurrency trading effectively.

Nasdaq’s prominence and expertise as a global trading giant means involvement in cryptocurrencies is to be expected. Nasdaq has partnered with DX to offer a powered cryptocurrency exchange which uses some of Nasdaq’s trading platform technology.

The meeting may have a two-fold effect, increasing Nasdaq’s involvement while also helping to boost the security and credibility of the exchanges seeking input from trading experts.

Will Nasdaq’s involvement boost institutional interest? Tell us your thoughts in the comments below.

Images courtesy of Shutterstock