Distributed Denial-of-Services (DDOS) attacks conducted against Mt. Gox over the last few days were responsible for server lag and downtime which lead to a ripple of panic-selling and, ultimately, a brief non-sustained drop in the trading price on Mt. Gox and other online exchanges subsequently. The event found mainstream media coverage, with unusual haste, including on CNBC’s website featuring a sensationalized and misleading headline, “Bitcoin Hacked: Price Stumbles After Buying Frenzy.” The day ended with the price on a steady recovery and Bitcoin itself remained unscathed.

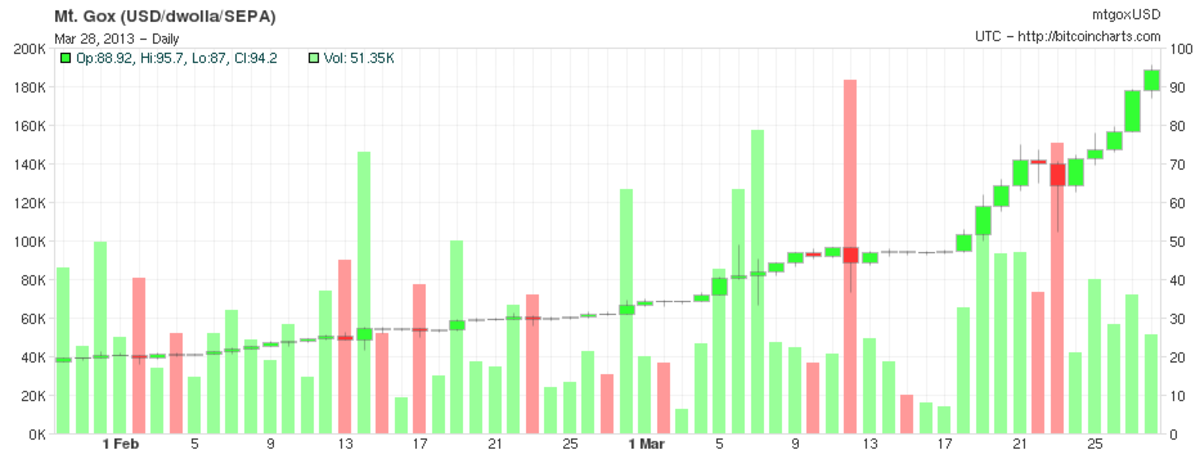

On the morning of April third, the USD trading price at Mt. Gox started at about $115 and rapidly rose above $145 before dropping just as quickly to $127 (bitcoincharts). After a brief recovery, it dropped again to just below $115, floundered for a short time and now appears to steadily rising just over $143, for the moment at least. Other major Bitcoin exchanges saw similar price instability, although to a lesser degree, which can likely be attributed to Mt. Gox’s trading volume. The company claims to serve the vast majority of Bitcoin currency trades, so what happens there is bound to have some effect on overall confidence and speculation. Meanwhile, in-person trade prices held strong.

In a press release that was issued on Thursday, following the blitz, Mt. Gox outlined a specific way that DDoS can be used for monetary gain in the market: “Attackers wait until the price of Bitcoins reaches a certain value, sell, destabilize the exchange, wait for everybody to panic-sell their Bitcoins, wait for the price to drop to a certain amount, then stop the attack and start buying as much as they can. Repeat this two or three times like we saw over the past few days and they profit.“

The use of DDoS is notorious for shutting down websites, often with large numbers of individuals playing a part. These attacks are very common throughout the world wide web, nearly every large website has been forced to confront this problem and, especially when there’s the possibility of financial gain, they should be expected. It would be folly to presume that DDoS assaults will ever cease. In actuality, they will probably increase in magnitude and frequency until a more effective tool is created to cripple websites. Things can be done to mitigate the downtime and server instability but, in the end, no real damage has been done to Bitcoin or the blockchain and the people who did not panic and did not sell, did not actually lose anything.

The reactions to the Mt. Gox website instability illustrate several facets of recent market activities and represents increasingly urgent challenges to the community. First, and perhaps most obvious, is the need for diversification in the exchange space to reduce dependence on a single entity for weighing the value of the currency. If Mt. Gox was not the leading exchange with such a large percentage of currency trades then this would not be as big of an issue and the panic that drove the price down would have been contained to a smaller group of people.

The single most important thing for all Bitcoin users to keep in mind when dealing with scenarios like these is, as Mt. Gox states in the press release, “Don’t Panic! … Bitcoin, despite being designed to have its value increase over time, will always be the victim of people trying to abuse the system, or even the value of Bitcoin decreasing occasionally. These are not new phenomena and have been present since the beginning of time when humans first started trading.”

The recent surge in price, over the last few months, is surely feeding a bit of market anxiety in Bitcoin users, old and new, who may be weary of a possible sudden devaluation as seen in June 2011. A quick enough price drop in a large exchange could, potentially, trigger a very serious panic-induced sell-off, thus flooding the market with cheap coins. Now, things are much different than they were in June 2011, though. The resilience of Bitcoin’s technology, economy and community have been tested many times, in many ways, since its inception and have prevailed, in nearly all instances, with notable grace under fire. The DDoS attack this week now stands as another example of that fortitude.

Mt. Gox deserves some praise for handling the server defence and customer support as well as they did. Without due diligence on the part of the staff there and the support systems of DDoS protection companies like Prolexic the exchange could have suffered much worse, which would, at this particular point in time, almost certainly drag overall Bitcoin confidence down with it.

When it comes to individual self-control and maintaining some level of sanity in an historically volatile market, timid Bitcoiners might consider taking slow, small steps at first and keep some of your bitcoins moving by spending or selling periodically instead of betting your life savings in hopes of turning a quick profit. For price-junkies who follow the market constantly and in several ways, it might be advisable to watch multiple exchanges and, for the sake of your blood pressure, mostly pay attention to the weighted average price rather than the often excessively-hyperactive latest.