One of the longest-held questions shared by Bitcoin investors is when Wall Street will enter the cryptocurrency market.

The idea goes that once mainstream financial institutions make a foray into this nascent industry, it will be cemented as bonafide, thus resulting in a rally.

According to a recent social media analysis by a blockchain data firm, it’s finally happening.

Wall Street Is Driving Bitcoin More Than Ever Before

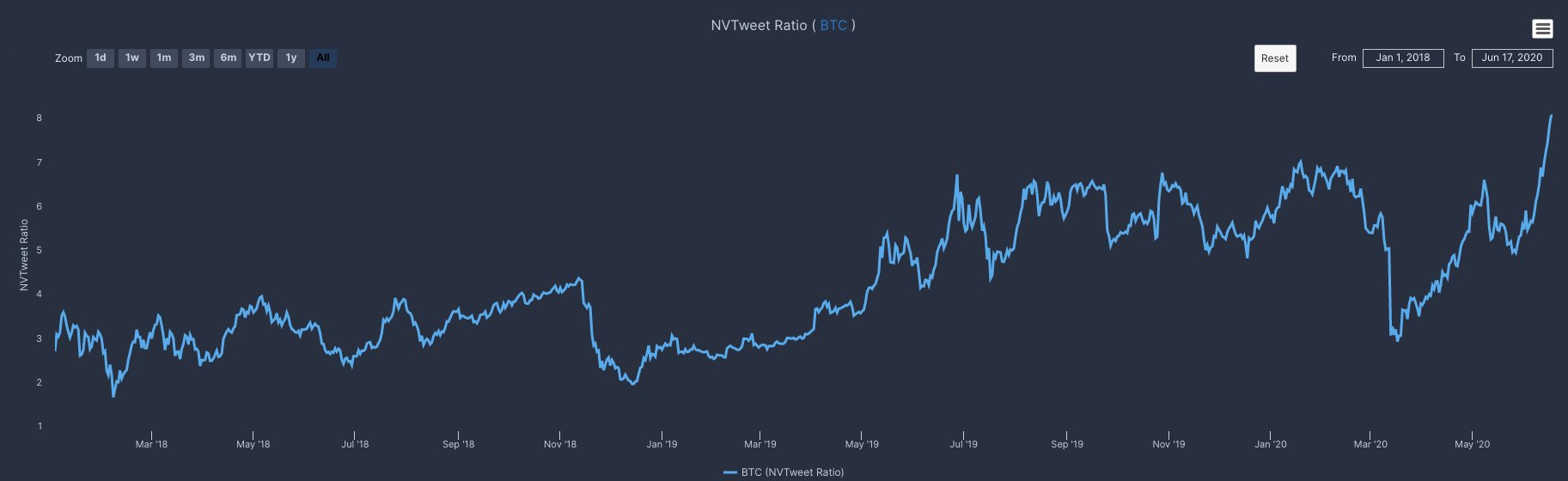

Blockchain data firm The TIE reported on June 18th that per the NVTweet Ratio, which relates Bitcoin’s value and the level of social media mentions of “Bitcoin,” Bitcoin is at an all-time high.

That’s to say, against social media activity, Bitcoin is trading at an all-time high.

The TIE sees this as a sign of increasing institutional interest, at least relative to retail interest in the cryptocurrency space:

“Increasing NVTweet Ratio may suggest BTC is now more driven by institutional trading as market cap is increasing faster than social volume.”

Bitcoin Is Being Traded by Institutions: Data

The data corroborates The TIE’s analysis.

Earlier this month, I compiled a chart using data from Grayscale Investments’ SEC filings and ByteTree, a blockchain data site.

The data suggests that over the past ~12 weeks, the Grayscale Bitcoin Trust has added about 63,000 coins to its holdings. During that same time period, miners accumulated approximately 125,368 coins through mining.

That’s to say, a single entity (on behalf of its clients) are accumulating more than 50% of the coins mined. “Institutional investors are accumulating vast amounts of Bitcoin. Now add exchanges and the halving into the mix,” I wrote to accentuate how institutional players are driving the cryptocurrency market.

62,972 Bitcoin has been added to Grayscale's Bitcoin Trust over the past 12 weeks.

Over the same time frame, 125,368 BTC was mined.

Institutional investors are accumulating vast amounts of Bitcoin. Now add exchanges and the halving into the mix. pic.twitter.com/zueQphXXfl

— Nick Chong (@_Nick_Chong) June 8, 2020

The institutional influence has been further accentuated by data from the CME’s Bitcoin market.

The regulated futures exchange, which is the foremost institutional market for Bitcoin trading, reports that the open interest in its BTC futures contracts is up 310% since the start of 2020.

Open interest in its BTC options contracts is up even more than that of the futures contracts, at least in terms of percentage.

Options are financial contracts that allow the buyer to buy or sell (“call” option or a “put” option) an asset at a specific price in a specified time period.

Institutional Skew Set to Continue

The institutional skew in the cryptocurrency market is set to continue moving forward.

$2 trillion asset manager Fidelity Investments released a survey outlining institutional interest in the cryptocurrency space.

The firm, in association with a data/survey company, found that a majority of institutional investors have an interest in the cryptocurrency space despite not all of those respondents having exposure to the industry.

The respondents said that they’re interested in Bitcoin and crypto assets because they see it as an uncorrelated investment, an innovative technology play, and an asset class with a high potential upside.

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Technical charts from Tradingview.com Key Social Metric: Bitcoin Is Driven by Institutional Trading More Than Ever Before