Arthur Hayes, a crypto millionaire and the co-founder of the BitMEX crypto exchange, has encouraged crypto investors to go long on Bitcoin and other promising altcoins in the market. He encouraged investors to get ready for an imminent Bitcoin bull run this season.

Arthur Hayes: Go Long On Bitcoin And Altcoins

In a recent blog post titled “Group Of Fools,” Hayes has acknowledged Bitcoin’s prospects, highlighting that the crypto bull run was finally reawakening with Bitcoin potentially being one of the most profitable cryptocurrencies during this bull cycle.

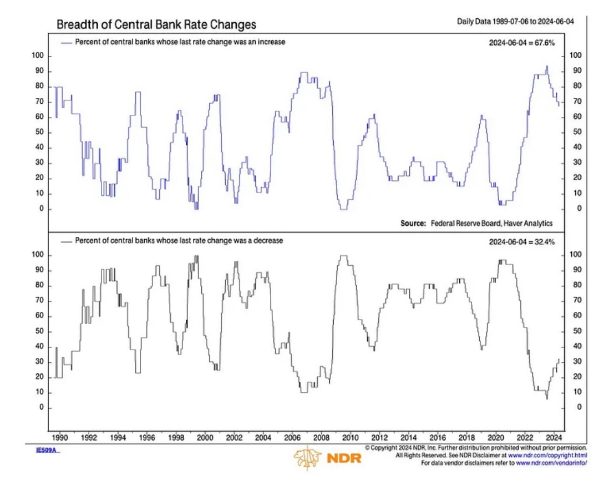

The BitMEX co-founder linked the efforts of the central bank to the performance of the crypto market, suggesting that actions taken by the US central bank could help propel the cryptocurrency’s market to its earlier glory days, with the market recovering from the previous summer slump.

Hayes also disclosed initial expectations of major policy changes in August 2024 during the Federal Reserve Jackson Hole Symposium. However, currently, he has noticed a reduction in monetary policies, and as a result, has encouraged investors to go long on Bitcoin and other altcoins in the market.

In addition, the BitMEX co-founder recommended the introduction of new tokens and the deployment of liquid crypto assets, expressing strong conviction in shitcoins. In his blog post, he declared, “The crypto bull is reawakening and is about to gore the hides of profligate central bankers.”

Furthermore, Hayes believes that the upcoming Group 7 (G7) countries meeting would be an important one. He disclosed that the financial market was more interested in the possibility of the Federal Reserve and The Bank of Japan (BOJ) cooperating to strengthen the Chinese (yuan). He also highlighted in his post that the dollar-yen exchange rate was one of the most important macroeconomic indicators.

The BitMEX co-founder noted that the financial market is also interested in the possibility of a rate cut among the G7 countries, excluding the Bank of Japan. He made his reservations about the prospects of the Federal Reserve cutting rates close to the US Presidential elections scheduled for November 2024, citing the political and economic implications of the move.

Hayes has predicted that neither the Fed nor the BOJ will make rate changes in their June meetings. However, he remains optimistic about the Bank Of England (BOE), suggesting that the BOE may follow in the footsteps of the Bank of Canada (BOC) and European Central Bank (ECB), in cutting rates.

Bitcoin On Track To Reach New All-Time Highs

Sharing a similar sentiment as Hayes on going long on Bitcoin, a crypto analyst identified as ‘Jelle,’ on X (formerly Twitter) has made a bullish prediction about Bitcoin.

According to Jelle, Bitcoin is less than 4% away from surging to a new all-time high. The cryptocurrency witnessed a rally to a new all-time high earlier in March, surpassing $73,000 and outpacing its previous all-time high of more than $69,000 in 2021.

Jelle has stated that the Bitcoin market is getting ready to expand soon, highlighting the cryptocurrency’s strong price fundamentals. Similarly, Michael van de Poppe, a prominent crypto analyst has also expressed bullish sentiments concerning Bitcoin, disclosing that the cryptocurrency is “heavily ready” for a breakout upwards to a new all-time high.

Featured image from Pexels, chart from TradingView