Semiconductor chip manufacturer Intel could be jumping into the crypto space. The company has purchased around $800,000 in exchange Coinbase (COIN) stocks on June 26th, 2021, per a report filed with the U.S. Securities and Exchange Commission (SEC), financial news website Barrons published.

According to Form 13F filing with the U.S. regulator, Intel holds 3,014 common class A shares from the crypto company Coinbase Global Inc. The report highlights other stock investments made by the chip manufacturer in companies such as Maxlinear Inc. (MXL), Shift4 Payments Inc. (FOUR), and McAfee Corp (MCFE).

Intel owns over $100 million in publicly traded investments, Barrons claimed. Therefore, the company had to disclose those investments to the Commission. The report speculates on the possibility that Intel could have pre-purchased the stocks, before Coinbase debuted in the U.S. public market in April 2021.

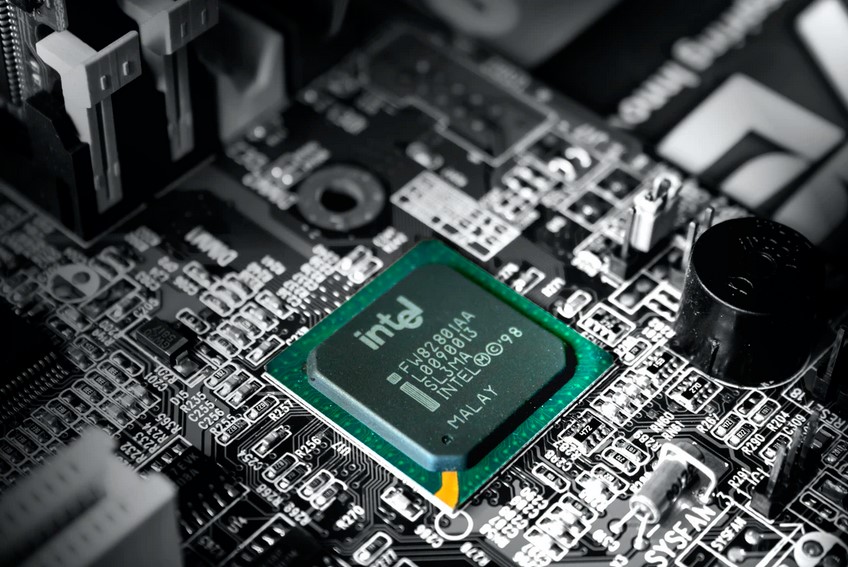

Although this constitutes Intel’s first major investment in a crypto-related company, the chip manufacturer has been interested in Bitcoin, cryptocurrencies, and blockchain technology for years. In 2019, the company filed for a patent on Bitcoin mining.

The document presented to the U.S. Patent and Trademark Office described a “system-on-a-chip (SOC)” that optimizes BTC miners’ power consumption. The company was awarded the patent.

In addition to that, an official blog post on their website describes the underlying technology that supports Bitcoin. In the post, Intel attempts to describe how this technology can be applied to many business sectors:

The value of blockchain lies in its ability to provide a secure platform for exchange while reducing the cost and complexity of transactions by eliminating the need for intermediaries and third-party verification. Blockchain has the potential to not only transform asset and data exchange, but also change business processes, trade, economic and social systems.

Crypto Exchange Coinbase Stocks Make A Comeback After Debute

As Bitcoinist reported, Coinbase published its quarterly earnings report. The platform surpassed everyone’s expectations by achieving $462 billion in trading volume. As a result, the price of COIN rallied from the lows at $200 to almost $300.

The earnings report also showed an increase in institutional demand for cryptocurrencies, primarily Bitcoin (BTC) and Ethereum (ETH). The latter outperformed BTC in terms of trading volume for the first time on the platform.

BTC & ETH still make up ~50% of our trading volume. The other 50% is the long tail of all the other assets. No single one of those long tail assets accounts for more than 10% of our trading volume.

At the time of writing, BTC trades at $47,582 with a 7.3% profit in the daily chart.