Whilst blockchain space is imminently approaching a full switch to Ethereum 2.0, institutions and individuals continue to take on ETH2 staking. Those who are foreign to the industry may think that POS has not attracted as much attention as it deserves, but in reality, Ethereum staking is on track to become a $40bn medium, changing the way institutions operate and further enhancing the blockchain’s adoption.

Together with Launchnodes, the only non-custodial provider of fully independent Ethereum 2.0 staking service on the market, we investigate and derive insights of just how monumental Ethereum staking is to the world of finance, business and fixed income asset classes. Why is the trend of institutional staking set to increase further, and how exactly is it happening?

Ethereum staking insider

First, to better understand who the bearer of the news is, here are a few words on Launchnodes. The company was set up in 2020 in London by software engineers who worked in financial institutions. A year later, it is the only investment-grade Ethereum 2.0 staking validator and beacon node service on the market, and on AWS. Yes, the staking nodes are rolled out on AWS cloud servers, which ensures constant uptime and zero risk tied to missed attestations.

The best part is that Launchnodes’ clients get access to 100% independent staking, which in turn, stands for commission-free APY, no intermediaries and tailored staking architecture. Whilst each validator node requires 32ETH to run, Launchnodes has recently introduced Staking Club, a service similar to standard Ethereum staking pools. Still, unlike the latter, Staking Club retains all the benefits of independent and commission-free staking, being a perfect solution for small to mid-size companies and groups of individuals.

Institutions and Ethereum 2.0 staking

It is pointless to question whether blockchain is an integral part of the future because it already is. Nevertheless, its reach goes far beyond simple use cases that the distributed ledger is currently filled with. This time, it is the investment world, pension funds, nonprofits, companies, and their savings accounts that are involved.

We already provide validator and beacon nodes to major crypto exchanges and staking pools on the market. As of late, a new trend has started to surface, where companies choose to stake pension payouts for their employees, instead of depositing the funds in favour of low yield conventional savings accounts, frequently found with banks and funds.

- Jaydeep Korde, CEO at Launchnodes

This shift changes the paradigm of how we think about Ethereum staking and introduces the notion of ETH2 network participation being used outside of basic speculation purposes. Korde has also added that institutional clients already follow suit, and this is what it leads to…

Do banks and investment funds stake ETH?

These institutions come in all shapes and forms, just like their investment strategies. At the same time, a large part of the managed funds is usually dedicated to safe investments, thereby hedging against risks associated with projects, or equities that promise high returns.

Ethereum 2.0 staking finds itself in the middle, between high and low-risk investment strategies. The safe part is the guaranteed positive APY, regardless of how many validators join the network. On the opposite side of the spectrum lies the underlying price of ETH, subject to fluctuations based on the market news, demand and supply. Regardless of the risks, the JPMorgan report on cryptocurrency suggests that institutions will shoot Ethereum 2.0 staking to a market worth over $40bn by 2025.

The Launchnodes CEO also hints that investment funds specialising in startups already use Ethereum staking as the means of financing these projects. Instead of settling tranches through which the startup is financed, an institutional investor can set up Ethereum staking and let the yield become the main source of funding.

Some of our clients stake hundreds of nodes at a time and we help them to tailor the staking infrastructure, ensuring a highly secure and effective ETH2 staking environment.

Furthermore, cloud staking Ethereum 2.0 does not directly drive demand for new server equipment. This goes in line with Environmental, Social and Governance (ESG) investment strategies, highlighted by JPMorgan as the latest institutional trend that attracts the most attention.

Pension funds and Ethereum 2.0 staking

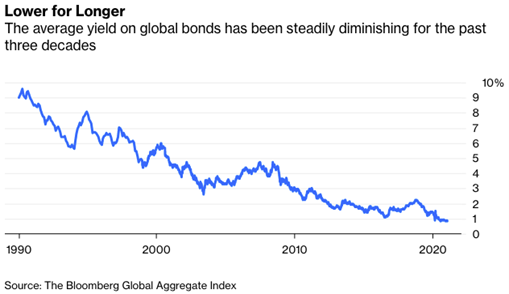

As per recent Bloomberg news, the constantly declining bond yield means that pension funds start to explore other asset classes on the market to stay afloat. Given the fixed yield nature of bonds, calculating future payouts requires no forecasting. And the only summary that can be made when expanding on the subject, is that the interest will only continue moving in a downward spiral. Unsurprisingly, some US pension funds already show negative annual yield results, which will, most likely, not be taken well by the retirees served by these institutions.

This makes pension fund managers look for alternatives, and Ethereum 2.0 staking can be just the right solution. The trend is further complemented by the fact that Ethereum is arguably the safest cryptocurrency that can be staked, since it has already become an infrastructure on which most blockchain projects operate.

Talking to Rajesh Sinha, the COO at Launchnodes, he outlined: Given the zero yield rate tendency of most asset classes that are typically targeted by pension funds, it is very likely that institutions will switch some of their portfolio to Ethereum 2.0 staking. Furthermore, private companies too, are expected to begin such practice and many are already staking ETH2 with Launchnodes.

Private companies stake Ethereum 2.0

DeFi continues to alter the world of finance by offering a new take on how yield, borrowing and lending works. Opposingly, the conventional business savings accounts in the UK and US continue to underperform, with 1.66% and 2% APY respectively. With it, retail investors start to direct their interest to Ethereum staking as a new way to generate additional passive income.

Korde anticipates that staking ETH could be used by private companies to fund employee healthcare and pensions, either directly or through third parties. With the staking returns being analogous to Alaska’s Permanent Fund, the dividends to employees vary each year depending on the price of ETH and the amount of ETH staked on the network. But every year there is something. Organisations and employees will learn and decide the best way to use these returns.

Nonprofits and ETH2 staking

Similar to the use above, nonprofits are also no longer foreign to the world of crypto and blockchain. UNICEF launched its CryptoFund back in 2019 and has already made over 110 investments from it to improve the lives of children across the globe. With Ethereum 2.0 staking, nonprofits get a chance to not only hold crypto but also mitigate the risk of market fluctuations by compounding annual staking yield.

This then becomes much larger than selective donations from crypto philanthropists, and Launchnodes wants to be at the heart of it making the running of nodes easy for any organisation removing the need for any specialist technical skills. After all, the $1.2 billion that Vitalik Buterin donated to India’s Crypto Covid Relief Fund can currently generate around $84 million APY, and serve as a much more sustainable approach to funding.

Final words

Institutions are imminently moving towards Ethereum 2.0 staking. Being the second-largest crypto after Bitcoin, Ethereum has already become a viable alternative to savings accounts and fixed-income financial instruments that struggle to deliver sufficient returns. This means that the adoption of Ethereum 2.0 turns it into an integral part of our economy, carrying benefits that go beyond the general market speculation that the crypto space is known for. As proof, in just one year, the team at Launchnodes has recorded an immense rise in demand for independent validator nodes by private and public companies across the globe, and this trend shows no signs of coming to an end. Therefore, if you run a business that needs a safety cushion, perhaps independent, investment-grade ETH2 staking is already worth taking note of.