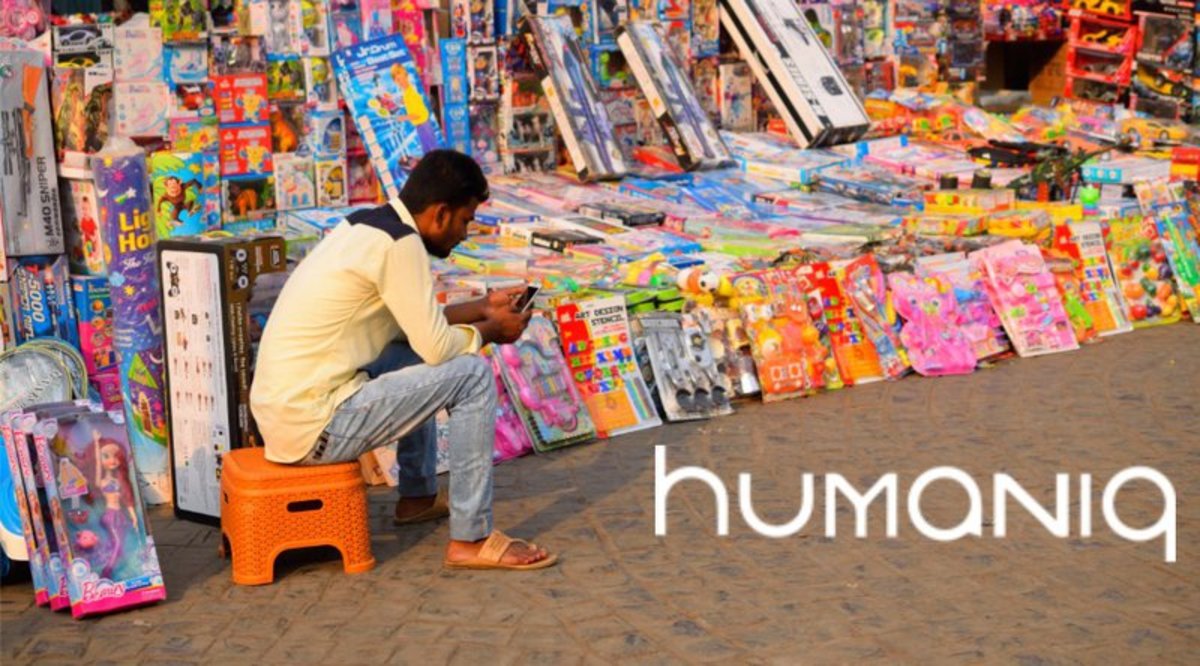

According to a 2014 World Economic Forum report, there are two billion unbanked people around the world who have no access to banking services. In Southeast Asia, only 27 percent of the region’s 600 million people have a bank account, while in poor countries such as Cambodia, that number is just 5 percent, according to another report issued in 2016 by KPMG.

Yet, it is in these countries that mobile phone use is often high. In Sub-Saharan Africa, of the 350 million adults who lack a bank account, 155 million are reported to own a mobile phone. Whereas in India, the number of mobile subscribers reached the one-billion milestone last January, according to a report from Forbes, revealing huge opportunities to build on its financial inclusion. With mobile phones often costing no more than $20–30 at the low end, mobile banking is becoming a viable option.

Launched in 2016, Humaniq is designed for those who don’t possess identification, with the mobile app utilizing a new reputation concept based on facial recognition for identity management. The fourth-generation mobile bank is based on the Ethereum blockchain and is attempting to tackle the global problem of financial exclusion for those who don’t have bank accounts. It is set to launch the first version of its mobile app on iOS and Android.

Initially, the alpha version of the application is by invitation only to 1,000 people; however, they expect to conduct a global rollout by October.

Speaking toBitcoin Magazine, Alex Fork, founder of Humaniq, said that when he was talking with Ethereum co-founder Vitalik Buterin at a conference last year, he was struck by how blockchain technology can be a solution to improve the lives of disadvantaged people. After seeing that the current system doesn’t work, Fork decided to create his own tool.

“Unbanked people find it difficult to use banks for three main reasons: lack of ID, lack of minimum funds and geographical distance to the nearest branch,” he said. “We’re using facial and voice recognition technology for new user sign-up.”

How It Works

Users need to complete the bio-identification process, which takes around 20 seconds and doesn’t require a passport or email. With the use of a smartphone, they take a photo of themselves, record a video of them smiling and grinning, and pronounce the randomly selected text shown on the screen to record their voices.

Using modern face-recognition algorithms for neural networks, Humaniq states that it can identify a user with incredible accuracy.

“Our user interface is not at all text heavy, but rather it’s focused on using images that provide clear instructions even if the user has low literacy,” Fork said.

Humaniq is also offering users an initial deposit of Humaniq tokens (HMQ) once they pass the bio-identification process. It will also support bitcoin and ether. The HMQ tokens will be used as a medium of exchange for users on the platform, where they can get paid for tasks by third party services that plug into Humaniq such as insurance, data security, small business loans and pensions. Fork says that HMQ has already been approved for trading on several cryptocurrency exchanges, notably SpaceBTC, and that as this is the first time their target users will be experiencing digital currencies they wanted to provide something that was simpler than bitcoin or ether to get them started.

Using HMQ tokens will seed the economy of the financial ecosystem, so that it can grow faster, says Fork. As Humaniq envision that microtransactions are going to be the most common ones, bitcoin is cost prohibitive for seeding a new economy. Furthermore, bitcoin has a problem with transaction processing speed and the fees attached to it, but Fork says he’s not ruling the currency out.

“Humaniq absolutely allows bitcoin as a payment method between parties on our network, and we foresee it being used as a form of wealth storage for users once they’ve built up enough capital to make it worthwhile.”

Fork states that size of the network will be the primary driver of the tokens value. For the ICO stage, due to take place on April 6, they will be tied to the value of ether as a benchmark, but once the project goes live, the market will determine their value.

“After the ICO, the only way to generate new tokens is for new users to sign up, and we have a cap on the maximum number of tokens, so once the network has disbursed all the coins, their value will go up due to the economics of scarcity,” he adds.

As the coins can’t be mined by pools, there is no fear that a handful of organizations will dominate the economy.

Earning Tokens

Users will also have the possibility to earn more tokens by performing simple tasks using the app. This is going to be done through a variety of ways such as verifying information about geographic locations to improve google maps, going through websites and checking to see if the links work or moderating comments and videos on YouTube.

With money coming in from companies and individuals requesting work to be done, they offer a task and the currency they want to pay for it in such as HMQ, bitcoin or ether. Users then select the task they want to do, agree on a price with the requestor and once the task has been completed satisfactorily, they get paid.

“Most of these tasks are very low pay, but they represent a significant opportunity to earn income for people who might be earning less than $1,000 a year in equivalent currency,” said Fork. “An extra $30-60 a month is huge for them.”

With over three billion people living on less than $2.50 per day, and at least 80 percent of humanity living on less than $10 per day, income differentials are widening, wrote Fork in his white paper.

Metcalfe’s Law

Fork states that when people see that they can earn real money and participate in the worldwide economy, they’re going to show this app to others, getting them to use it too.

“It’s Metcalfe’s Law, in that the value of a network grows disproportionately larger as the size of the network grows,” he said.

Fork is keen to stress, though, that Humaniq is not a cute app that’s a solution in search of a problem. After visiting slums in India, he knows that the people there are poor, but not incompetent or unclever.

Humaniq will start their Initial Coin Offering (ICO) on April 6, when they will be sponsoring a startup competition at BlockShow Europe 2017 in Munich. They have already raised over $110,000 in bitcoin and ether during their pre-ICO crowdfunding in a December campaign, beating their target of $68,000, which went toward the development process of the app and website development and participation in conferences.