In 2021, cryptocurrencies and blockchain have already captured the entire public space. They are now integrated into all spheres of life, finance, business, and attract even the most distant people from fintech and financial markets.

At least, any Internet user feels this way, and this is not far from the truth. What was discussed only by tech geeks and IT anarchists in 2011, as well as speculators and lovers of easy profit in 2017, has now become an integral part of our modern world.

Blockchain has proven itself to be a technology with virtually unlimited potential, and the idea of decentralization has once again led people to believe that freedom, anonymity, and equality are still possible. Certain protected, decentralized, and p2p networks of users who are equal in rights and opportunities, have the possibility to remain incognito and are not controlled by the authorities – this is blockchain’s main purpose and idea.

However, in practice, everything turned out to be a bit more complicated: regulators are trying to control the market, bans on crypto-transactions are rising all over the world, and cryptocurrencies themselves have turned out to be not as decentralized as the creator and developer of Bitcoin Satoshi Nakamoto had envisioned.

Fortunately, the ideas proved to be stronger than the pressure from the outside, and the community which consists of thousands of talented and dedicated developers are to this day working on creating and improving the principles of blockchain that were left to us by the anonymous crypto genius.

DeFi at the forefront of blockchain development

This is how Ethereum appeared – the first cryptocurrency to offer the community the creation and implementation of smart contracts. In addition to that, DeFi also appeared – decentralized finance, whose main principle directly refers to Bitcoin’s idea that there is no need for intermediaries and decentralization: the more people involved in the network, the less control each of them has over it. In essence, decentralized finance shows how traditional financial, trading, and exchange services can exist without control from a single central hub.

DeFi-lending has become the first sign of a new phenomenon in the world of cryptocurrencies. Some people invested in cryptocurrency, while others used them as collateral – still in crypto. Everything worked without any third-party control, as was set by the terms of public smart contracts. Then came decentralized exchanges – DEX. Such sites became the first exchanges in history that could do without brokers. Automatic market-making (AMM) protocols ensured transactions between different trading participants, and liquidity was provided by users who added their assets to the pool and earned on network commissions. At the same time, the exchange did not own users’ funds, nor could it steal or block them thanks to competent implementation, the traders’ assets were stored only on their personal wallets or in liquidity protocols. These technologies lingered in the shadows for only a few years – from 2017 to early 202 – and then struck like lightning out of the blue, with billions of dollars flowing into DeFi from people all around the world.

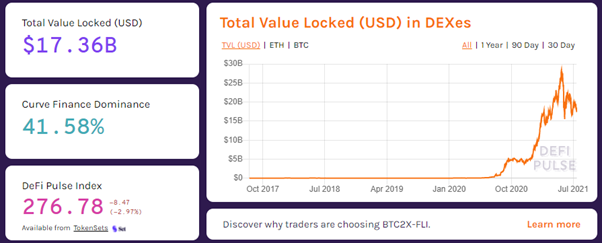

More than $55 billion – this is the volume of the DeFi sector as of 2021. Over $17 billion of them are blocked on decentralized exchanges.

Source: DeFi Pulse

The absolute leader among all DEXs, without a doubt, is Uniswap, which supports the Ethereum protocols. But a relatively new decentralized exchange based on the BinanceSmartChain “PancakeSwap” blockchain is already lurking behind it, looking to catch up. Despite the extremely high competition, the exponential growth of market volumes allows even new, young projects to firmly occupy their niche and expand their spheres of influence. This is an opportunity that smart and successful people are making use of as much as they can.

People who made history

The best minds in the tech industry have joined the ambitious new direction of decentralized finance. Now thousands of professionals, entrepreneurs, and developers are working on true decentralization, developing the original ideas of Satoshi Nakamoto.

One of them is Janis Balodis, an entrepreneur, expert, and marketer. Janis graduated in business economics and management and has over 35 years of experience in large companies as a business consultant and project manager. The main advantage of Janis is his design expertise, which has always allowed him to create a simple, understandable, and convenient product for a mass audience.

The entrepreneur developed projects in the field of international trade, which became leaders in the East African market, held the post of a member of the Latvian Chamber of Commerce, and was the owner of a couple of IT companies.

When DeFi appeared, Janis was one of the first to see the huge potential of the technology, and after some time of studying and diving into the new industry, he returned to the market with fresh ideas and his own unique vision of decentralized ecosystems. Together with a group of developers and blockchain experts, he managed to create a strong new brand in the DeFi world called, DEXIMUM, and the DexiSwap decentralized exchange, which we will talk about in more detail.

DexiSwap features

DexiSwap is a breath of fresh air in the DEX sector. The exchange is built on the competent use of liquidity pools and automation of the trading mechanism for conducting transactions. The instantaneous speed of exchange operations with cryptocurrencies protects users from one of the most critical problems of exchanges – the loss of funds as a result of slow processing of the transaction and “freezing” of the order.

Liquidity on DexiSwap is provided by the Market Making Pool – users provide assets to the pool, which in turn will be used by other trading participants. After the use, the former will then receive material compensation.

The 3 main principles of DexiSwap:

- Progressive decentralization: Holders of the internal token receive governance rights that allow them to take part in the direct development of the exchange by supporting or blocking initiatives.

- Reducing risks: The predictive profit maximization mechanism allows you to recognize and minimize the risks of volatile losses by constantly balancing assets.

- Liquidity crowdsourcing: Trading algorithms increase the productivity of the exchange by using investors’ liquidity to close traders’ transactions with minimal price “slip”.

The platform’s earnings consist of trading commissions for operations with the company’s liquidity. 0.2% commissions from each transaction – this is the main intra-economic model of DexiSwap. While the exchange is occupying its niche in the decentralized market, they decided to follow the Uniswap path: at the initial stage, now the most popular DEX gave 0.3% from each exchange operation to liquidity providers.

Over time, this approach increased Uniswap’s turnover by 150,000 times – up to $ 6 billion!

Now, thanks to DexiSwap, crypto investors have another opportunity to join the upcoming DeFi wave that is set to follow the path of Uniswap.

In addition to all that, the team places a lot of importance on the growth of capitalization, the popularity of the platform, and its trading volumes on the internal token DSTo. Its growth can be profitable both for the company and for all its holders and users of the exchange.

DSTo token. DexiSwap’s financial strength

The ETC20 issue of the DSTo token is flexible and occurs only at the moment the profit is accrued to market makers – investors who have provided assets to the liquidity pool. In the early stages of DexiSwap’s development, liquidity is the only way to become a coin owner.

This model of issuing tokens has a direct impact on their value – limited availability and high demand due to the benefits for all holders.

DSTo guarantees:

- Participation in the development and management of the platform;

- Remuneration for liquidity providers

- Cashback on commissions

- Cross-platform in the DeFi ecosystem.

Tokenomics ensures the release of real financial assets, behind which the collateral lies, and not some random dummy tokens.

If in the early stages the tokens bought out by the team from the market were to be saved to create liquidity on the exchanges, then in the future, it is planned to burn the remains of coins monthly to create a deficit.

The deflationary mechanics will constantly push the price of the coin upwards, which will ultimately bring more returns to investors than liquidity fees. According to preliminary estimates of analysts, in the near future, the token price is predicted to grow by more than thrice its original value: from $ 0.15 to $ 0.50. And this is in the context of the current crypto market, which fluctuates between sideways movement and a bearish trend.

Early-adopters receive more

Using a strategy tested by Uniswap and 1inch, DexiSwap delivers more value and benefit to early adopters of the exchange.

The strategy of promotion in the community is based on a system of additional rewards for liquidity providers. In the first version of the protocol, all commissions for operations with liquidity are distributed among the users of the exchange!

It’s a great opportunity to join the project early on for anyone who has watched Uniswap flourish from the outside.

In the future, after a sufficient amount of liquidity has been collected and the company has switched to the Layer-2 protocol (v 2.0), the ratio will be changed to guarantee the company’s profit.

To top it all off, the Referral Airdrop program offers additional bonuses for providing liquidity. There’ll be 35 levels of the progression system, depending on the number of funds provided and the total turnover of the exchange, this can bring every participant from $15 to $100,000,000 in bonus!

As a matter of fact, decentralized finance is in its earliest stage of mass adoption, even with billions of dollars in market volume. And the biggest barrier to distribution is usability and clarity in the eyes of the average user. If DEXIMUM and projects with the same attitude towards the audience continue to remain true to their ideas, “DeFi mass adoption” is not far off and will overtake us in the following 5-7 years.