Cryptocurrency skeptics who only focus on Bitcoin’s immediate price action are failing to see the forest for the trees.

In a recently published op-ed, Bloomberg contributor Leonid Bershidsky advised investors to ignore Bitcoin’s quick ascension to $5,000 as the move was nothing more than a “blip” driven by manipulation. Throughout the article, Bershidsky questioned the logic of investors optimistically viewing “Bitcoin as a better safe haven than other, more traditional investments” which provide more reliable returns and he advised investors to steer clear of cryptocurrency. Unfortunately, this guidance relies on more misconceptions than truth.

Bitcoin Forces Stocks to Play Second Fiddle

Admittedly, last year’s cryptocurrency price action was far from stellar, but viewing 2018 in isolation fails to incorporate Bitcoin’s performance since inception and this stunted view also ignores the technological strides blockchain and the Bitcoin network have accrued over time.

The premise that cryptocurrency investors are essentially putting their money into a slot machine is flawed and while most people will agree that Bitcoin is an extremely volatile asset, conventional portfolio building strategy calls for representation of high growth assets. Since the end of 2017s monster rally a number of financial analysts have suggested that a 1 to 2 percent digital asset allocation should be part of every well-diversified portfolio and considering Bitcoin’s current performance this appears to be sound advice.

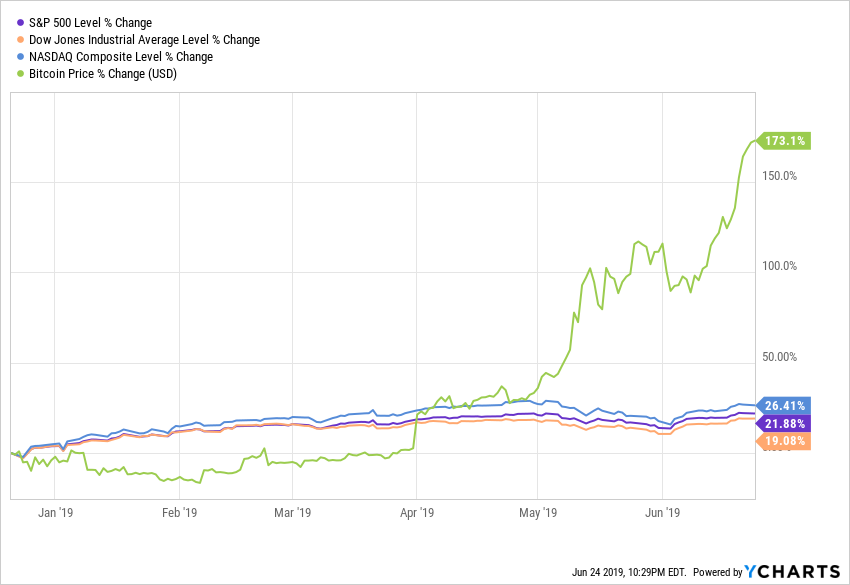

As the chart below shows, the first half of 2019 provided great returns for stock investors and at the moment Bitcoin is strongly outperforming each of these markets.

Bitcoin vs. Major Markets

Bitcoin vs. Major Markets: Source: YCharts

Bitcoin’s rise from $3,200 to $5,000 meant it was time for investors to begin paying closer attention to the cryptocurrency market and investors who followed Bershidsky’s advice in April have now missed out on a 180% gain.

Bitcoin-USD Daily Chart

The Market has Grown Beyond Speculation

According to Bershidsky:

There has been no good news about cryptocurrencies lately — they aren’t acquiring greater acceptance as investments or payments, and the crypto experiments of central banks, governments, and major companies haven’t moved beyond dabbling.

Again, there are numerous inaccuracies within this statement. In reality, the cryptocurrency market is booming and in more ways than one. Venture capitalists, entrepreneurs, financial institutions and numerous governments took note of Bitcoin’s 2017 performance and in 2019 the cryptocurrency market is backed by more than just speculative retail investors.

Fidelity Investments, Goldman Sachs, TD Ameritrade, and the Intercontinental Exchange are just a few of the larger players that have expressed deep interest in Bitcoin investment. Contrary to Bershidsky’s statement, the entire cryptocurrency ecosystem has evolved and also begun to penetrate other sectors.

In fact, less than two weeks ago MetLife announced that it would use Ethereum blockchain to streamline the processing of life insurance claims and StateFarm and USAA are reported to be following suit. Mastercard, Visa, Bank of America, and a growing list of companies are regularly filing blockchain-related patents and hiring blockchain developers at an increasing rate. The mass adoption of blockchain by these massive insurance and banking corporations is no laughing matter as life insurance is currently a $2.7 trillion dollar industry.

Further proof of the sector’s diversification and expansion comes from the rapid growth in the industry surrounding peer-to-peer and institutional-level crypto lending. This multi-billion dollar industry has blossomed to the extent that there are now a number of companies which allow cryptocurrency holders to securely stake and lend their digital assets for an attractive return.

Therefore the one-sided view that cryptocurrency investing is nothing more than gambling is quickly approaching obsolescence. Today investors have a range of crypto-investment options to choose from and it is much easier to align one’s selection with their appetite for risk.

Don’t Believe the FUD

There’s been bad news, though — more big hacks, more dying currencies, more pump-and-dump schemes (sometimes, the extinctions and the schemes go together). -Leonid Bershidsky

Obsession over the threat of manipulation, hacks, scams, drugs, dark markets, terrorism, and other illegal activities are another frequent set of critiques no-coiners and crypto skeptics often present when lambasting cryptocurrency. While manipulation, hacks, scams and, ransomware does pose a credible threat to portions of the sector, research has shown that less than one percent of Bitcoin is used for the aforementioned illicit activities.

The oft-referenced possibility of the Bitcoin network becoming centralized and susceptible to a 51% attack is also baseless. In reality, the Bitcoin network is stronger than ever and on June 21 the hash rate notched a new all-time high above 65,000,000 TH/s. This means it would take an immense amount of computing power to compromise the network and the fact that other fundamentals like block size and daily on-chain transaction volume are on the rise are all proof that a growing number of people are using Bitcoin.

Bitcoin Network Hash Rate

Bitcoin Network Hash Rate: Source: Blockchain.com

Bitcoin Network Hash Rate: Source: Blockchain.com

Critics unwavering concern with hacks and scams are partially sourced from the trauma some investors publicly endured as the initial coin offering (ICO) era of 2016-2017 imploded and many projects and investment schemes were exposed as nothing more than get rich quick schemes.

Looking to the present, these issues have been addressed and thanks to the ingenuity of large cryptocurrency exchanges, entrepreneurs, and blockchain startups can now safely raise funds through initial exchange offerings (IEOs). Major exchanges like Kraken and Binance have also addressed the threat of hacks by integrating stringent security features to protect users funds.

Kraken upped the ante by providing increased transparency into its reserves through a Proof-of-Reserves audit which is carried out by an independent auditor. Meanwhile, Binance protects investors with its Secure Asset Fund for Users (SAFU). Recently the fund was put to the test when Binance underwent a $40 million hack in May and not a single investor lost money.

Simply put, major players in the sector have worked hard to address the weaknesses that undermined the sector’s credibility and the current state of the market does not align with the dystopian vision that crypto-skeptics frequently project onto the sector.

Ultimately, Things are Looking Up for Bitcoin

A simple investing idiom that many traders throw about is ‘don’t trade against the trend’, especially if it’s pronouncedly bullish. Bitcoin’s recent performance should perk up the ears of any sensible investor and while attempting to counter trade such a strongly established trend is questionable, completely ignoring it is nothing short of foolish. As Bitcoin repeatedly cascaded to new lows in 2018, smart money quietly began to accumulate Bitcoin and institutional demand for the digital asset has steadily risen since November 2018.

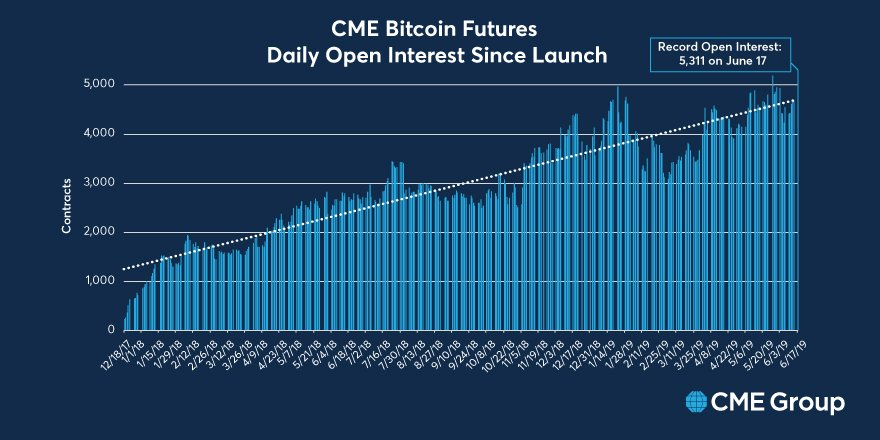

Proof of this comes as recently as June 17 when open interest for Bitcoin contracts at CME Group eclipsed the volume seen during the peak of the 2017 crypto bull market to reach 5,311 contracts totaling 26,555 Bitcoin (roughly $246 million). At the moment the general consensus is that institutions and Bitcoin’s upcoming halving event are fuelling the current rally.

CME BTC Futures Open Interest

CME BTC Futures Open Interest: Source: CME Group Twitter

From a bird’s eye view, the cryptocurrency sector is clearly vibrant and expanding. Crypto-payments and peer to peer transactions are gaining traction across the globe and Bitcoin is fast becoming the preferred store of value and exchangeable currency in economic and politically volatile countries like Iran, Venezuela, Argentina, and Turkey.

At the same time, investors in democratic countries with stable economies now have more credible, regulated options for investing in cryptocurrency and as discussed in this article, investment is merely one component of what has now become a multifaceted sector.

Cryptocurrency is bigger than investing and it’s bigger than just Bitcoin. The narrative that cryptocurrency has no future other than speculation is utterly false and the failure to adopt a long view of the sector’s growth potential means investors and businesses are leaving money on the table.

How do you think Bitcoin will perform over the next two years? Share your thoughts in the comments below!

Images via Shutterstock, Twitter, CME Futures Group, YCharts, TradingView, Blockchain.com