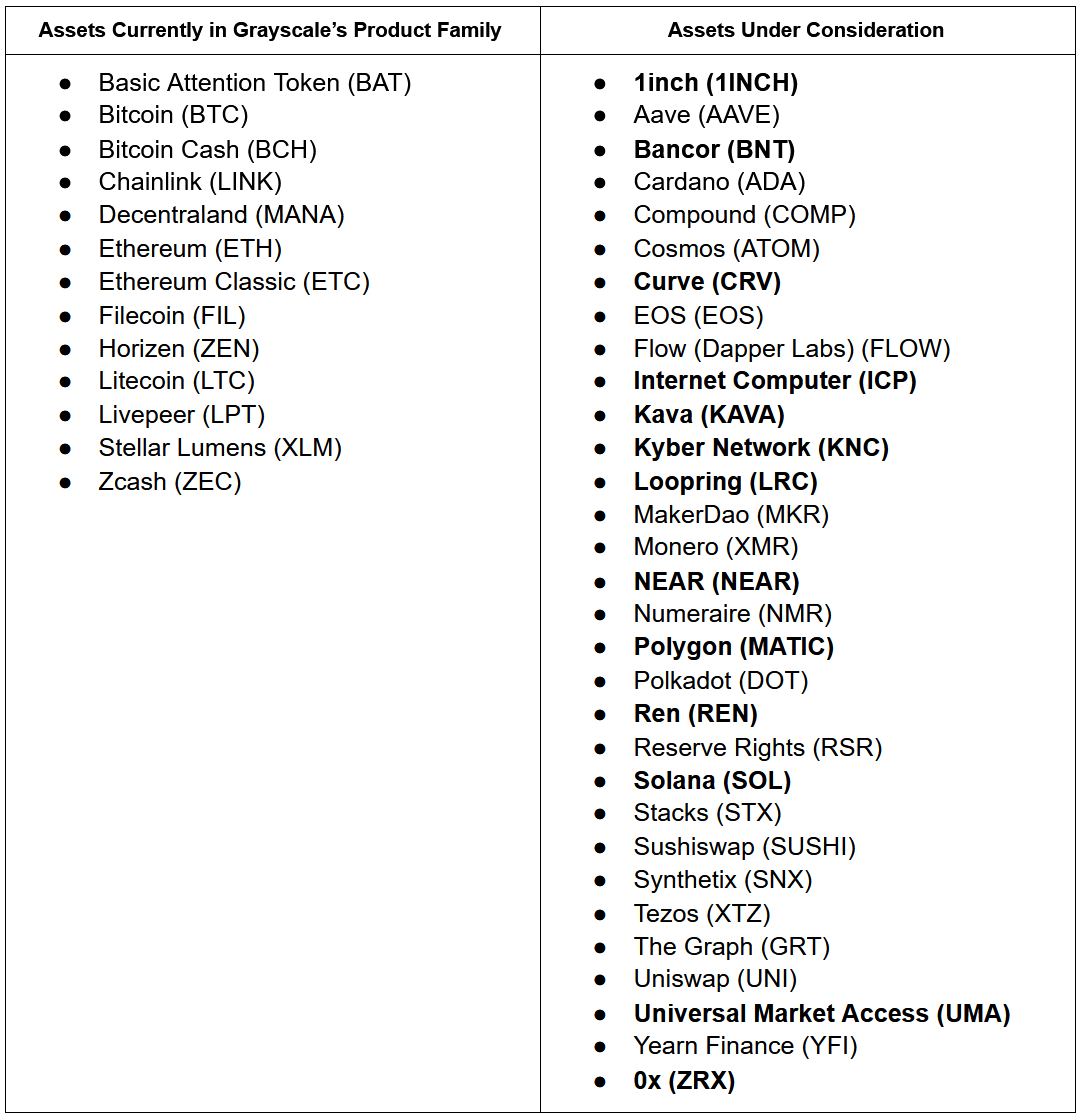

Cryptocurrency asset manager Grayscale Investments announced earlier yesterday that it would consider venturing into new crypto investment products, including ones that would track Solana, Polygon, and Internet Computer, among other tokens.

We’re always exploring new assets that can help us grow our family of investment products. Here are 13 additional we'll explore: $1INCH $BNT $CRV $ICP $KAVA $KNC $LRC $NEAR $MATIC $REN $SOL $UMA $ZRX. Follow along to get updates as we expand this list! https://t.co/5BU92rVZOM

— Grayscale (@Grayscale) June 17, 2021

The other products that are under consideration would be tied to the following cryptocurrencies: Bancor (BNT), Curve (CRV), KAVA (KAVA), Loopring (LRC), NEAR (NEAR), Ren (REN), Ox (ZRX), Universal Market Access (UMA), and Kyber Network (KNC).

Grayscale’s current crypto products include major cryptocurrencies Bitcoin (BTC) and Ethereum (ETH), alongside smaller tokens such as Decentraland (MANA), Stellar Lumens (XLM), and Litecoin (LTC), to name a few.

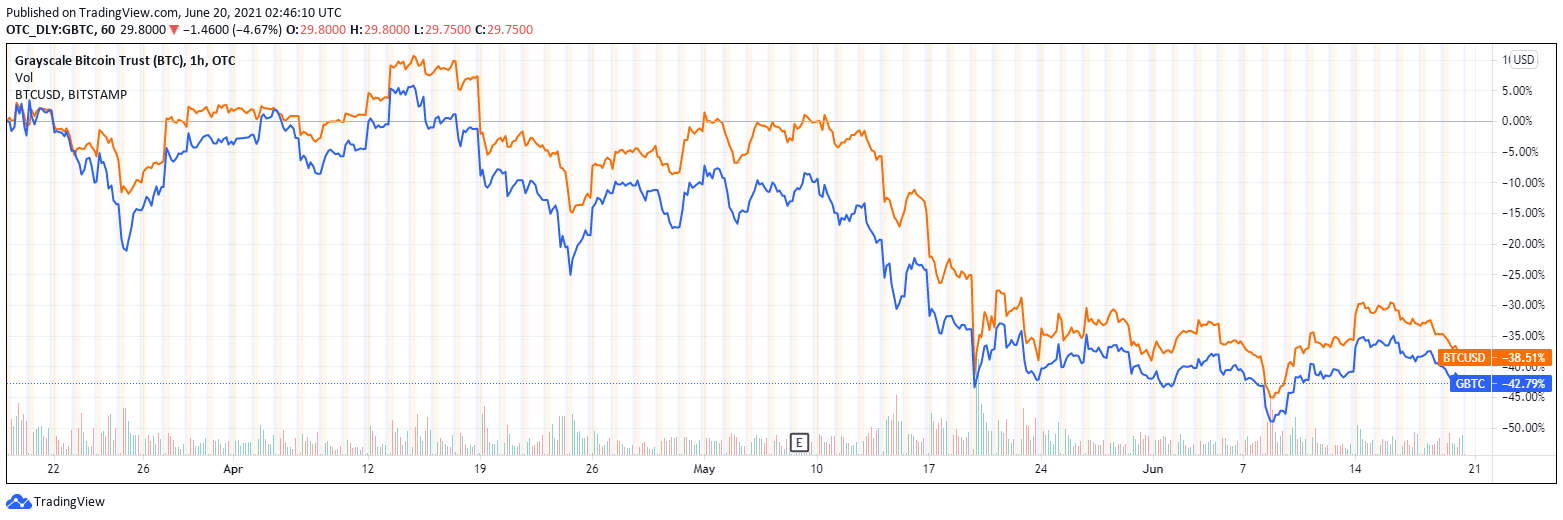

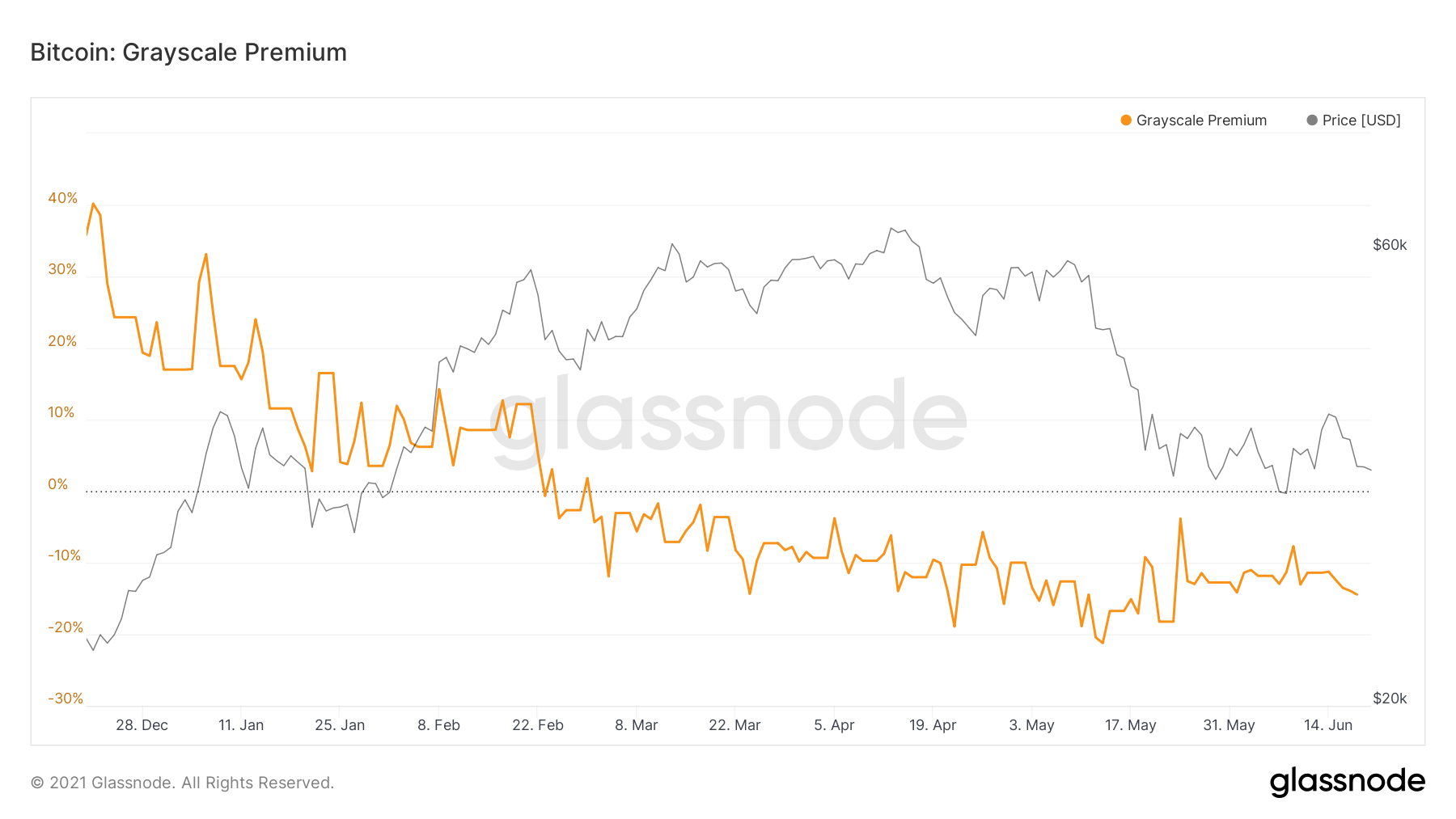

Unsurprisingly, Grayscale Bitcoin Trust (GBTC) remains the most popular investment fund with an AUM of $24.1 billion. According to data from Glassnode, GBTC currently holds 651,772.29 Bitcoin.

Since late February, GBTC has continued to trade at a negative premium, or a discount, meaning that the market price of GBTC shares were less than its net asset value (NAV). This was due to a myriad of factors, including growing competition from crypto ETFs and fund outflows.

Related Reading | Grayscale Bitcoin Trust (GBTC) Premium Tanks to -19% As More Competition Weighs In

The premium sunk to its lowest level on March 13 at -21.23%, and recovered to as high as -3.83% when the asset manager hinted towards revamping GBTC as an exchange-traded fund. The current GBTC discount sits at -14.44%.

Earlier in February, Grayscale said that it would consider dabbling in DeFi by launching products tracking protocols Uniswap (UNI) and Polkadot (DOT), alongside 21 other cryptocurrencies. The asset manager ended up launching 5 additional funds, including Basic Attention (BAT), Chainlink (LINK), Decentraland (MANA), Filecoin (FIL) and Livepeer (LPT).

Of the initial 13 coins under consideration, it remains to be seen how many Grayscale will actually launch. The asset manager stressed that the creation of a new fund is incredibly complicated, and that it “requires significant review and consideration and is subject to substantial internal controls, sufficiently secure custody arrangements, and regulatory considerations.”

Featured image from UnSplash