Digital Currency Group’s flagship Grayscale Bitcoin Trust is trading at about 16.52% below the Bitcoin spot price, marking the largest discount since Bitcoin’s May price decline.

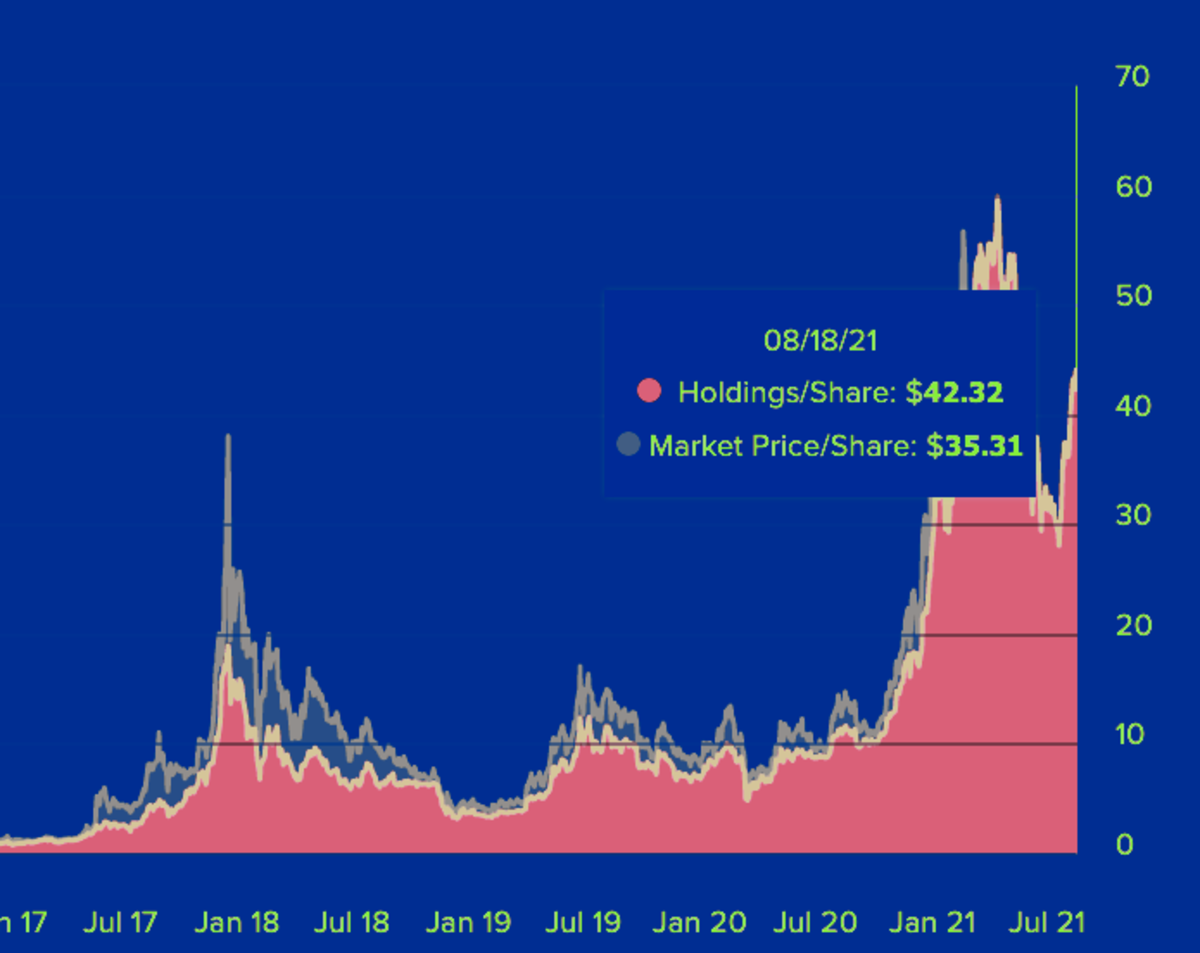

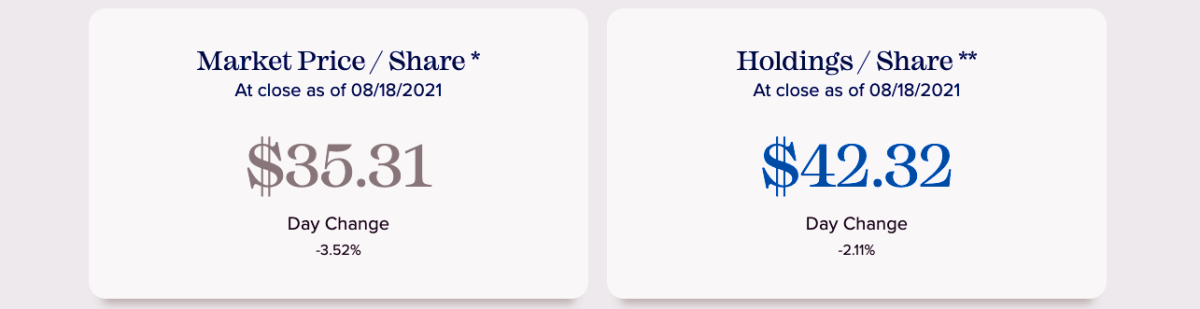

The Grayscale Bitcoin Trust currently offers exposure to 0.000938223 BTC per share, an amount that trades for around $42.32 at market close on August 18. Through shares of GBTC, however, that same amount of Bitcoin trades at $35.31, a 16.52% negative spread between GBTC’s premium and underlying net asset value at time of writing.

Since May, Bitcoin has recovered up to $44,300 at the time of writing, while Grayscale has been slower to catch up. Due to the six-month lock-up of initial GBTC investments, GBTC holders are unable for some time to redeem their shares in reaction to the bitcoin market price. Thus, the product tends to trade at either a premium or a discount compared to the Bitcoin held within.

The development of a GBTC discount disrupts the popular carry trade of redeeming Grayscale shares when they hit a premium and shorting Bitcoin futures. This was a relatively risk-free strategy when GBTC was trading at a premium.

Now, with a negative premium, the incentive to redeem GBTC shares is gone.

At the moment, GBTC shares at a discount are an elegant solution and vehicle for traditional investors, or people who want to get Bitcoin price exposure through their retirement portfolio. The learning curve for buying Bitcoin outright can seem daunting to some, and GBTC has the added benefit of a sixth month forced hodl before shares can be redeemed.

Grayscale Bitcoin currently has $29.3 billion in assets under management.