The investment landscape is witnessing a seismic shift as Exchange-Traded Funds (ETFs) focused on Bitcoin garner unprecedented inflows, starkly contrasting with the significant outflows from gold ETFs. This trend underscores a growing investor appetite for digital assets over traditional safe havens, marking a pivotal moment in asset allocation strategies.

Gold Out, Bitcoin In

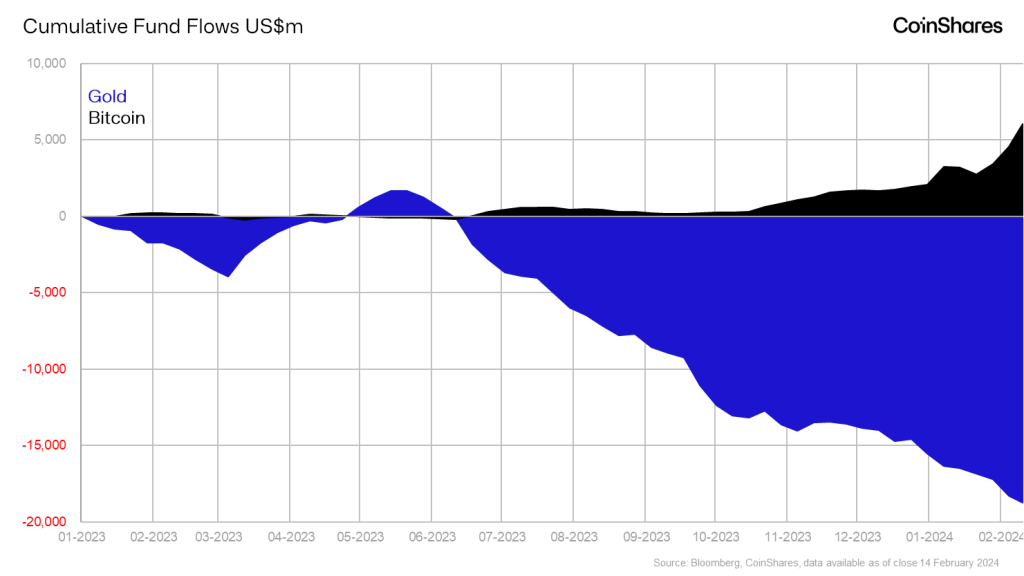

Data from Farside reveals that since the approval of the 10 spot Bitcoin ETFs on January 11, there has been an aggregate inflow of $4.115 billion, accompanied by record trading volumes. Just yesterday, all ETFs saw net inflows of over 12,000, BlackRock alone saw a 10,000 BTC inflow. Notably, all spot Bitcoin ETFs saw three consecutive days over 10,000 BTC net inflows.

In sharp contrast, the 14 leading gold ETFs have experienced outflows totaling $2.4 billion in 2024, with Bloomberg intelligence analyst Eric Balchunas pointing out that the most substantial outflows were from BlackRock’s iShares Gold Trust Micro and iShares Gold Trust, amounting to $230.4 million and $423.6 million, respectively.

James Butterfill, Head of Research at CoinShares, provided insight into the shifting dynamics, stating, “Gold ETP flows haven’t been faring well despite positive price action. Data does suggest some of those outflows are finding their way into Bitcoin ETPs.” This observation indicates a direct correlation between the decline in gold investments and the rise in BTC’s attractiveness among ETF investors.

Adding to the conversation, portfolio manager Bitcoin Munger remarked on the significant transfer of assets, saying, “Not only is Bitcoin sucking up funds, but gold is hemorrhaging AUM at an alarming rate across many ETFs. Bitcoin is going to drink Gold’s milkshake and quite suddenly too.”

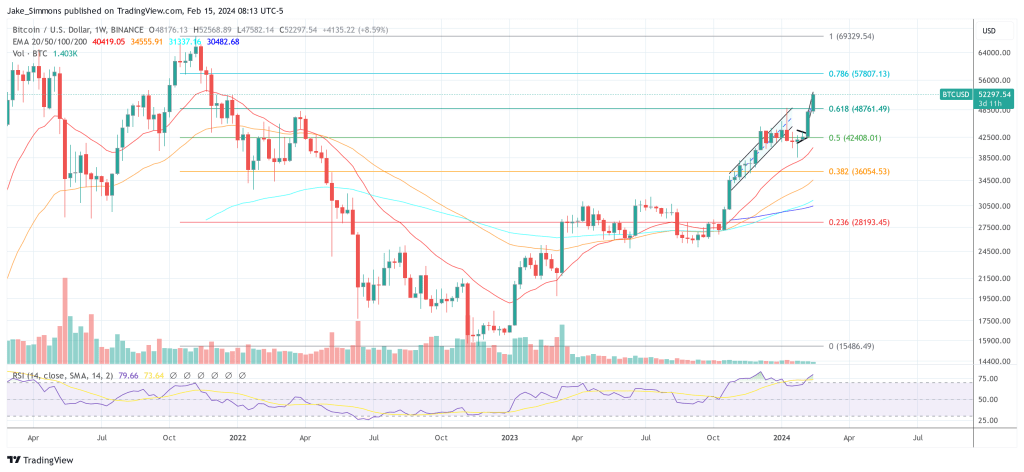

This shift is further evidenced by BTC’s impressive performance, with a 22% increase since the beginning of the year, reaching a two-year high of $52,519 (on Binance) today. In contrast, gold has seen a 3.3% decrease in the same period, falling to a two-month low of $1,988 per ounce yesterday.

However, Eric Balchunas of Bloomberg intelligence offered a more tempered view, suggesting that the movement away from gold ETFs might not be entirely towards Bitcoin.

“Meanwhile it’s a pretty bad scene right now in the gold ETFs category… I don’t think these are ppl migrating to btc ETFs (maybe a tiny bit) but rather just US equity fomo although that could reverse given the new eco data,” Balchunas commented, indicating a broader investment trend driven by a fear of missing out on US equities rather than a direct switch to BTC ETFs.

Gold Bugs Still In Disbelief

This evolving investment landscape is not only about shifting assets but also about changing perceptions. Jameson Lopp, a Bitcoin pioneer, provocatively asked jokingly about the well-being of gold investor Peter Schiff, highlighting the growing debate between traditional and digital asset investors. Mike Alfred commented:

Bitcoin is ripping, +4% in the last day and 25% over the last month. Gold, predictably, is red on the day and down 3.3% ytd. I am waiting for the next asinine Peter Schiff tweet when he says something idiotic about how Bitcoin is about to crash because it’s gone up so much.

Indeed, Schiff is still denying the BTC rally. Just three day ago, he claimed, “It looks like another classic pump-and-dump is going on with Bitcoin and the ETF. The four-day conference kicked-off on Super Bowl Sunday and ends on Valentine’s Day. There’s a lot of hype surrounding the newly listed Bitcoin ETFs. I wonder when the massacre will begin.”

At press time, BTC traded at $52,297.