Bitcoin has blown away the expectations of almost anyone outside of the most steadfast supporters of the cryptocurrency or believers in the stock-to-flow model. The asset over the last several months has exploded from below $10,000 to over $40,000 at the current high. And although the now $11,000 decline could appear to resemble a longer-term “top,” one global macro investor says that the “strong part of the Bitcoin upmove has not started yet.”

Capital Manager: “Strong Part” of Bitcoin Bull Run Has Yet To Begin

The first-ever cryptocurrency now finds itself in a precarious position after pulling back more than $10,000 from its peak at the time of this writing. After Bitcoin touched $20,000, a $10,000 correction was enough to begin a three-year bear market, but this time very well could be different.

Even with a move from $10,000 to $40,000 in a few months time, career global macro investor Dan Tapiero points out that the strongest part of Bitcoin’s new uptrend, hasn’t even “started yet.” The DTAP Capital founder with over 25 years of global macro investing experience mimics the stock-to-flow model creator’s recent comments suggesting that the monthly RSI has yet to reach the “point of no return.”

RELATED READING | S2F CREATOR: BITCOIN HAS YET TO REACH “POINT OF NO RETURN”

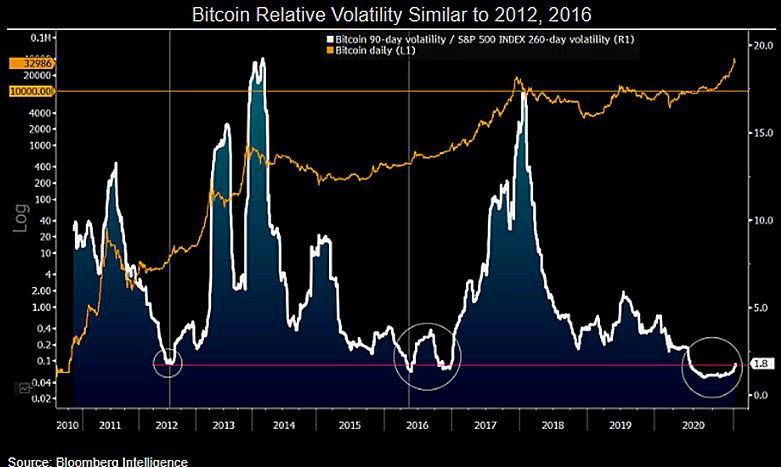

The stock-to-flow model created by the pseudonymous Plan B is based on the asset’s digital scarcity and projects prices of $300,000 per BTC and up within the next year or more. The model itself isn’t what Tapiero is referencing, however, instead highlighting the lack of volatility in the cryptocurrency that it is normally notorious for.

Bitcoin 90-day volatility / S&P 500 Index 260-day volatility | Source: Bloomberg Intelligence

Tapiero calls attention to comparisons in the past, showing that volatility spikes the highest near long-term tops. Not only is Bitcoin nowhere near the high volatility the asset can reach, volatility has barely begun to register compared to past cycles.

As Tapiero suggests, this could mean that a far stronger “upmove” is coming whenever the current correction cools off.

Bitcoin monthly RSI isn't anywhere near the top it is capable of | Source: BLX on TradingView.com

In the months ahead as both the monthly Relative Strength Index and volatility begin to spike to what has been seen in the past, yet at the current price levels, it could provide the momentum and interest necessary to push the cryptocurrency to the prices the stock-to-flow model predicts.

RELATED READING | ANALYST: “DON’T SWEAT” BITCOIN BUY IN PRICE, $300K IS COMING

On the flip side, the more capital coming into Bitcoin and the more widely adopted the network becomes, the less volatile price action will become over time. Is this the end of the volatile Bitcoin of the past, or like Tapiero claims, has the strength not even begun at this stage?

Featured image from Deposit Photos, Charts from TradingView.com