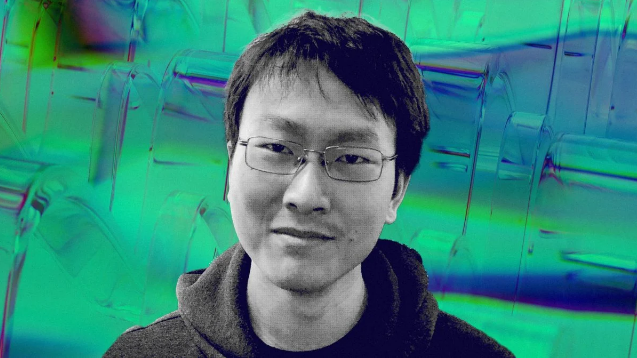

Gary Wang, the enigmatic co-founder and chief technology officer of the defunct cryptocurrency exchange FTX, provided an incriminating testimony during the ongoing criminal trial of Sam Bankman-Fried, marking the trial’s third day.

Wang revealed in a shocking new statement that FTX’s purported $100 million insurance fund for 2021 was a fabrication and never held any of the exchanges’ FTX tokens (FTT) as stated.

Wang’s testimony is consistent with the views held by the cryptocurrency community, which has discovered proof of software code allegedly used by FTX to manipulate its insurance fund and deceive the public about its true values.

Gary Wang: The Damning Testimony

BitMex Research recently tweeted a screenshot purporting to show the FTX database code in dispute. According to BitMex Research, FTX used a random number function to generate the insurance fund it published to the public.

SBF Trial Day 4 – Gary Wang testimony

FTX’s published insurance fund number was fake and FTX’s published insurance fund balance was produced by a random number generator!

Transcript extracts below

Q. And the number here, what is the size of the backstop fund listed? A. Five…

— BitMEX Research (@BitMEXResearch) October 6, 2023

FTX’s insurance fund, intended to safeguard users against substantial market losses, was frequently promoted on its platforms. Yet, Gary Wang’s testimony reveals that FTX employed concealed Python code to misrepresent the value of its insurance fund.

He added that the fund often fell short of covering such losses. In a notable instance in 2021, a trader managed to exploit a margin system bug on FTX, leading to a massive loss of hundreds of millions of dollars for the exchange.

Under intense questioning, Wang admitted that the insurance fund figure presented on FTX’s platform was not only inaccurate but completely fabricated. Notably, he revealed that there was no FTT token in the insurance fund; instead, it was represented solely by a USD figure, which did not align with the actual data stored in the database.

Upon Bankman-Fried’s realization that the insurance fund had nearly depleted, Wang disclosed being instructed to assign the loss to Alameda. The alleged intention behind this action was to conceal the loss, as Alameda’s financial statements were comparatively more confidential than those of FTX.

Gary Wang And SBF: Friends To Enemies

Gary Wang worked behind the scenes at the exchange until it collapsed, while Bankman-Fried kept a prominent public persona for it. While Bankman-Fried dealt with the media, campaigned, and met with investors, Wang stated that his work was mainly focused on coding.

Wang and Bankman-Fried were both involved in the formation of the cryptocurrency hedge fund Alameda Research and attended the Massachusetts Institute of Technology. According to Inner City Press, Wang revealed in his court testimony that he owned 10% of Alameda Research and that Bankman-Fried owned the remaining 90% of the company.

Not only did Gary Wang disclose the purportedly fraudulent nature of FTX’s insurance fund, but he also stated that Bankman-Fried encouraged him and Nishad Singh – FTX’s director of engineering who had a 7.8% stake in the company – to add an “allow_negative” balance feature to the FTX code. This feature allowed Alameda Research to trade on the cryptocurrency exchange with almost infinite liquidity.

Wang entered a guilty plea to wire fraud and other criminal offenses alongside Singh and Caroline Ellison, the former co-CEO of Alameda Research. Seven counts against Bankman-Fried include conspiracy to commit money laundering and wire fraud pertaining to the FTX operation.

Featured image from Tapchibitcoin