On July 11 President Donald Trump tweeted that Bitcoin, Facebook’s Libra and all other cryptocurrencies are basically rubbish when compared to the US dollar. Now Tom Lee has a response.

Bitcoin: A Store of Value or the Choice Asset of Criminals?

Earlier this week the US Federal Reserve Chairman Jerome Powell made media waves and rocked crypto Twitter when he suggested that Bitcoin is a speculative store of value that functions similarly to an investment in gold. President Trump, who is often at loggerheads with the Federal Reserve, quickly responded by tweeting that Bitcoin is not money and simply a speculative instrument which is often used to facilitate crime.

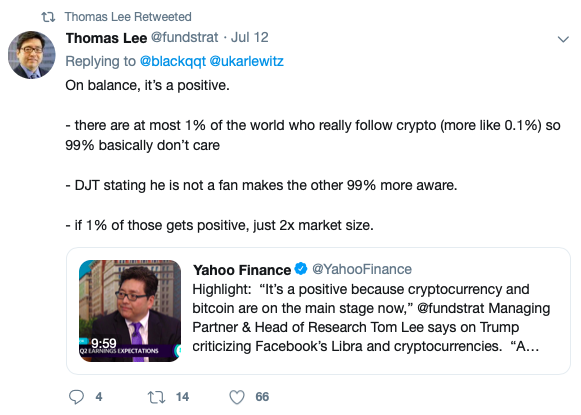

Now, Fundstrat head analyst and partner Thomas Lee has weighed in on the issue and according to him Trump’s tweet will have the unintended effect of bringing more attention to Bitcoin. Lee explained that Trump’s disdain for Bitcoin, Facebook’s Libra and cryptocurrencies in general “makes the other 99% more aware” of Bitcoin and funny enough Trump’s signature phrase “Bad publicity is sometimes better than no publicity at all.”

All News is Good News

Bitcoin thrives from attention whether it’s FUD or bullish news and Lee is confident that as cryptocurrency grows in popularity and is more widely held the macro connection of Bitcoin to commodities and traditional markets will lead to a greater correlation between cryptocurrency and the stock market.

According to Lee, this is not necessarily a bad thing as currently exchanges and a few massive wallets hold a huge amount of crypto and this is why there is such violent volatility. Lee believes that as more institutions engage with cryptocurrency the price and liquidity will increase.

Bitcoin Bullish on Trump Tweet But When Moon?

When questioned about the future of Bitcoin price, Lee was not shy about sharing his estimate and explained that at the moment Bitcoin is trading within a level that it’s only seen 3% of its historical trading timeline. Lee then said that historically bitcoin has rallied 200 to 400% during the following 4 months and when applied to today’s’ price action this equates to a Bitcoin price of $20,000 to $40,000 by Q4 of 2019.

Yahoo Finance host Zack Guzman then asked Lee to share his thoughts on $13,400 being a stiff resistance level for Bitcoin and Lee said that currently it’s primarily retail investors and whales that trade crypto and technicians are incredibly important to this crowd.

Lee agreed that $13,400 was functioning as a strong short-term resistance but then countered that in finance there is no such thing as a triple top and if this concept applies to Bitcoin then we can expect the digital asset to blast through the resistance on its third attempt.

Later on his Twitter page, Lee did admit that there was one thing that could pose a major hangup for Bitcoin and cryptocurrencies as a whole but realistically such an extreme measure is unlikely.

Do you think Thomas Lee is correct about his Bitcoin prediction? Share your thoughts in the comments below!

Images via Shutterstock, Source via Bloomberg