To recover assets and funds, bankrupt cryptocurrency exchange FTX, under the guidance of appointed CEO John Ray III, has filed a new request with the US bankruptcy court of Delaware.

The filing seeks approval for the sale of trust assets held by digital asset manager Grayscale and crypto index fund manager Bitwise, estimated to be worth approximately $744 million.

The sale will be conducted through an investment advisor to protect FTX from potential price fluctuations, maximize the estate’s value, and facilitate upcoming distributions to creditors.

FTX’s Monetization Plan

The filing outlines that the purpose of monetizing the trust assets is to mitigate the risk of price swings and safeguard their value, thereby ensuring maximal returns to creditors and enabling an equitable distribution of funds during FTX’s reorganization plan.

The proposed sales procedures aim to reduce exposure to market volatility and prepare for potential dollarized distributions to creditors. FTX plans to engage a registered investment adviser who will work according to tailored guidelines in facilitating the monetization process.

FTX believes executing the proposed procedures and monetizing the trust assets is a strategic decision that will benefit creditors and stakeholders by mitigating market risks and preparing the estate for plan distributions.

While FTX believes there are “no valid liens” on the trust assets, any valid liens will be attached to the proceeds from the sales or transfers of the pledged trust assets.

FTX Reveals Significant Investments In Grayscale And Bitwise Trust

Grayscale manages statutory trusts known as Grayscale Trusts, which offer investors exposure to digital assets without direct ownership. The Grayscale Trusts issue units representing proportional interests in the trust’s portfolio, which consists exclusively of the relevant digital asset.

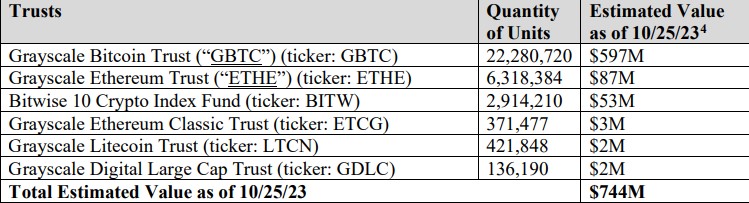

Per the filing, FTX holds units in five Grayscale Trusts and one statutory trust managed by Bitwise. These trust assets are held in brokerage accounts at ED&F Man Capital Markets, Inc. (now known as Marex Capital Markets Inc.) and Deltec Bank and Trust Limited.

The filing mentions ongoing legal matters involving Grayscale Investments. In October 2021, Grayscale submitted a listing application to convert the GBTC into a spot-based Bitcoin (BTC) exchange-traded fund (ETF), which the SEC denied in June 2022.

Following an appeal, the US Court of Appeals for the D.C. Circuit vacated the denial order in August 2023. Additionally, debtor Alameda Research has initiated litigation against Grayscale Investments, alleging violations of trust agreements. This litigation is currently pending in the Delaware Court of Chancery.

Overall, the exchange’s request to sell Grayscale and Bitwise trust assets valued at $744 million represents a strategic move in the ongoing bankruptcy proceedings. By monetizing these assets, FTX aims to protect against market volatility, maximize returns to creditors, and ensure an equitable distribution of funds.

The court’s approval will enable FTX to proceed with the sale, creating an opportunity to recover assets and support the reorganization plan.

Featured image from Shutterstock, chart from TradingView.com