Data shows the Bitcoin correlation to Nasdaq has plunged recently, suggesting that the cryptocurrency is moving more independently now.

Bitcoin 60-Day Correlation With Nasdaq Is Now Underwater

According to data from the analytics firm Kaiko, BTC has recently become less correlated to traditional assets recently. The “correlation” refers to a metric that keeps track of how tied the prices of any two assets are.

When the value of this metric is positive, there exists some positive correlation between the given assets. What this means is that the price of one asset reacts to movements in the other by moving in the same direction. The closer is this value to 1, the stronger is the correlation.

On the other hand, negative values imply that while there is some correlation between the prices, it’s a negative one. This suggests that the assets have been reacting to each other by moving in the opposite directions. In this case, the extreme where this correlation becomes the strongest is -1.

Naturally, when the indicator’s value is around zero, it means that there exists no correlation whatsoever between the two prices, as their movements are independent of each other.

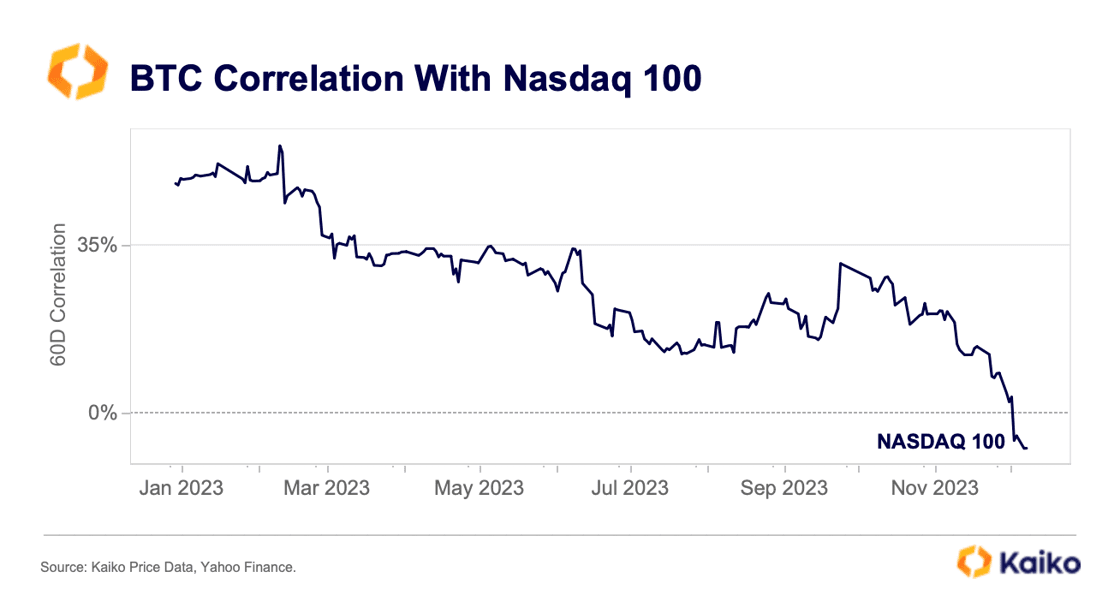

Now, here is a chart that shows the trend in the 60-day correlation between Bitcoin and Nasdaq over the past year:

As is apparent from the chart, the correlation between the assets is displayed as a percentage here (with 100% naturally corresponding to the extreme point of 1).

It would appear that the Bitcoin correlation with Nasdaq had been at notable, but not too high levels throughout the rest of the year, but recently, the indicator’s value has seen a plunge.

The metric has entered inside the negative territory now, meaning that the two assets have been moving opposite to each other over the last 60 days. The correlation is still quite close to 0, though, so in reality there is only a very slight relationship present between the two now.

Bitcoin, which had been shackled to the stock market‘s performance for a while, now finally appears to be travelling independently from the prices of these traditional assets.

The correlation is a useful indicator to watch if the aim of an investor is to diversify their portfolio. If the investor adds two highly correlated assets to their portfolio, they wouldn’t get any benefits of diversification, as their risk would remain about the same.

Since Bitcoin is moving independently to Nasdaq now, it could make up for an ideal diversification option for the traders of the traditional asset.

BTC Price

Bitcoin had plunged towards the $40,500 mark just a few days back, but the cryptocurrency appears to have been made some recovery as it’s now trading around the $43,700 level.