…then they laugh at you, then they fight you, then you win.

I’ve always thought that to understand the mindset of a publication you just have to look at the advertising that it carries. Follow the money. That more than anything will tell you not only what hot-button issues a certain editor will care about (and his bias), but also who his readers are and what they might be interested in.If this is true, there is no other publication that represents the international mainstream economics establishment better than The Economist. Nowhere else will you find a higher concentration of ads and job listings for and from international institutions, executive MBAs, sovereign wealth funds, development banks and economic think tanks. When Washington’s IMF, Paris’ OECD or the WTO need new staff, you’ll probably see some of these positions advertised in The Economist’s pages.Thus it is hardly surprising that their editorial line reflects the Keynesian-monetarist mainstream consensus, with an added dose of central banker and international bureaucrat hero-worship. Their default position is to dismiss and abhor any kind of non-state voluntary money and defend our currently dominant fiat money system like rabid dogs. Their disparagement of gold and their dismissal of Bitcoin over the past few years has rivalled with Paul Krugman’s in bile and viciousness.Therefore when The Economist dedicates not one, but two full page pieces to Bitcoin in a day, and when these articles seem to be a little less dismissive than usual, we should really pay attention. The old guard is watching and worried. The fact that they no longer make the usual ignorant “Bitcoin can be hacked” or similar claims, also shows that they have been studying it in earnest.In Mining Digital Gold the attack is fairly obvious: Bitcoin is Napster.

“Just like Napster, Bitcoin may crash but leave a lasting legacy. “

Savvy investors and users should be looking to the next generation and view Bitcoin as an interesting and enlightening precursor, but not really waste too much time and effort on it. Litecoin and Ripple get a mention. I’m surprised the author didn’t mention Freicoin, after all if they are so scared of “hyperdeflation” they must love Gesell’s demurrage fee.They fail to fully understand network effects and the first-mover advantage. They also fail to understand the power of open source projects and how they can evolve, especially if there is large and vibrant community of thousands of motivated individuals continually working on it. They also forget that Bitcoin had many failed precursors who could more accurately be called the Napster of voluntary internet currencies: DigiCash, e-gold and a score of other failed digital gold currencies, but also the original idea behind Paypal, before the PayPal Wars turned it into what it is today. Perhaps a proliferation of other cryptocurrencies will even help Bitcoin grow.Neither is A New Specie much more subtle:

“The Bitcoin tribe is still a small one, and consists mainly of computer geeks, drug-dealers, gold bugs and libertarians. But wild fluctuations in the value of a Bitcoin, from under $20 at the start of the year to over $200 at one point this week.”

…and of course never forget to add a taste of insult, guilt by association and other assorted smears.What I found particularly interesting was this:

“There is a limit to how far digital currencies like Bitcoin can spread. Long-term demand for the dollar is guaranteed by the fact that American citizens must pay taxes in dollars. Governments will never confer the status of legal tender on a private currency.”

It is not only historically wrong, as even the US government has recognised as legal tender not only private monies but also foreign money (read Edwin Vieira’s excellent book “Pieces of Eight : The Monetary Powers and Disabilities of the United States Constitution” or George Selgin’s “Good Money”), but it is also irrelevant. The citizens of Argentina and Venezuela care little for their local legal tender laws when they transact in US dollars. The people of Zimbabwe ignored Robert Mugabe’s and Gideon Gono’s ban on the use of dollars, euros, rand and gold as an alternative to the Zimbabwean dollar that they had destroyed. Similarly, the citizens of the World Wide Web will pay very little attention to the lack of a government seal of approval. Bitcoins can’t be used to pay for taxes? That’s a feature, not a bug.Finally this made me laugh:

“Bitcoin might end up like MySpace, the now moribund precursor to Facebook.”

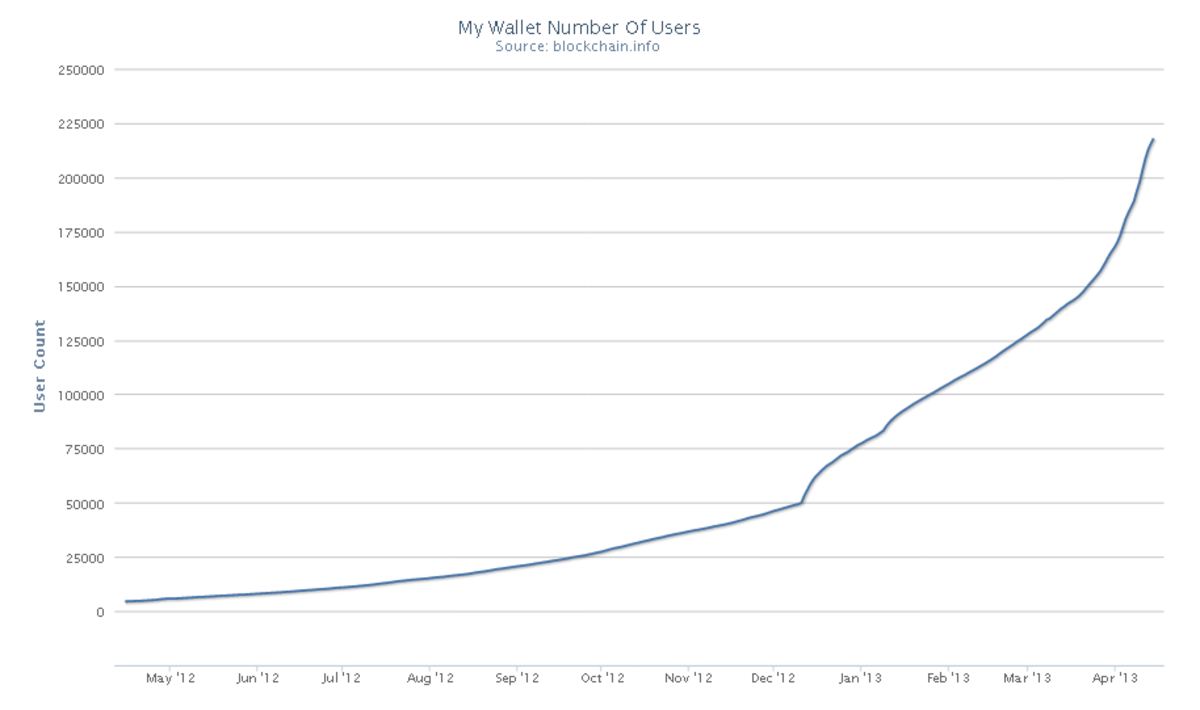

In a sense the Bitcoin community is still relatively small. My estimate, based on the number of downloads of the original client and the statistics published by some online wallets, is between 1.5-2 million users at present (if someone has more precise numbers, I’d be delighted to see them!).This is just a small sample (many thanks to blockchain.info for its transparency)

At its peak MySpace claimed 100 million users. If and when we get there, I’ll be happy to buy The Economist Group for a couple of bitcoins.The fact that even establishment mouthpieces like The Economist, Paul Krugman (this is just silly Paul, although I like the video game reference) or even this Georgetown clown see the need to comment on, and attack Bitcoin is a good sign. It is also a symptom that money talks, and that Bitcoin’s market cap is pretty loud at this point. Publicists say that all press is good press. However, in my humble opinion, Bitcoin is past the point where it needs much more press. What we need now is critical mass. Once we get to 10 million users growth could become exponential.Bitcoin’s ultimate success is far from guaranteed. There are still many dangers, both internal and external. A lot of work needs to be done, on scalability, exchanges and many other weak points. However we have the best odds in a hundred years of returning money to the free markets.We are winning.