- Ethereum has pulled back from its local high of $322 (margin exchanges). It now trades for $312 as of this article’s writing.

- Some analysts argue that the cryptocurrency is preparing for another leg higher, citing the momentum trade that ETH is.

- On-chain metrics, though, suggest that the asset may soon be subject to a “short-term pullback.” This information comes courtesy of Santiment, a popular blockchain analytics firm.

Ethereum Could Print “Short-Term Pullback,” Santiment Data Shows

What a past few weeks it has been for the cryptocurrency market. Save for a select set of players, most digital assets, including Bitcoin, have seemingly entered uptrends, pushing past pivotal resistances.

Ethereum’s price action has been especially intriguing for investors due to the strength of its uptrend. In the past five days alone, the asset has gained 30% ($245 to a local high of around $320). And when you step slightly back, to one week, the asset has gained 40%.

Metrics, though, show that the asset may soon be subject to a retracement.

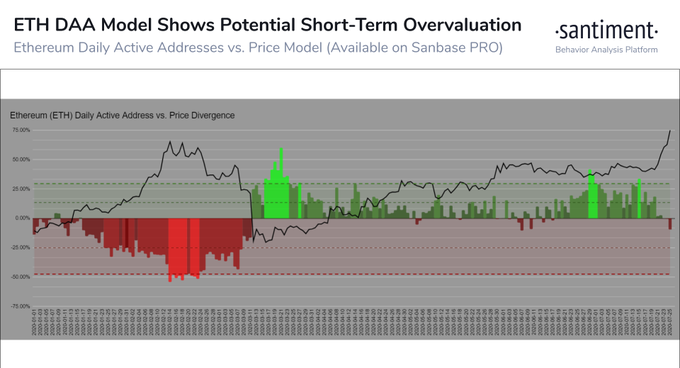

Blockchain analytics firm Santiment shared the below chart on July 26th, writing that its “ETH DAA Model” shows a potential for a “short-term pullback”:

“With $ETH peaking at $316 yesterday, the @santimentfeed DAA vs. Price YTD model shows that the surplus of daily active addresses transacting has finally been equalized by its price. For the first time since June 17th, there is now a deficit of DAA, which indicates the potential of a short-term pullback.”

The company did note, though, that with Ethereum’s positive fundamentals, investors shouldn’t “be surprised if a retracement is extremely minor and temporary before continuing up.”

Not the Only Reversal Sign

This isn’t the only sign that Ethereum may cool off after that explosive move higher.

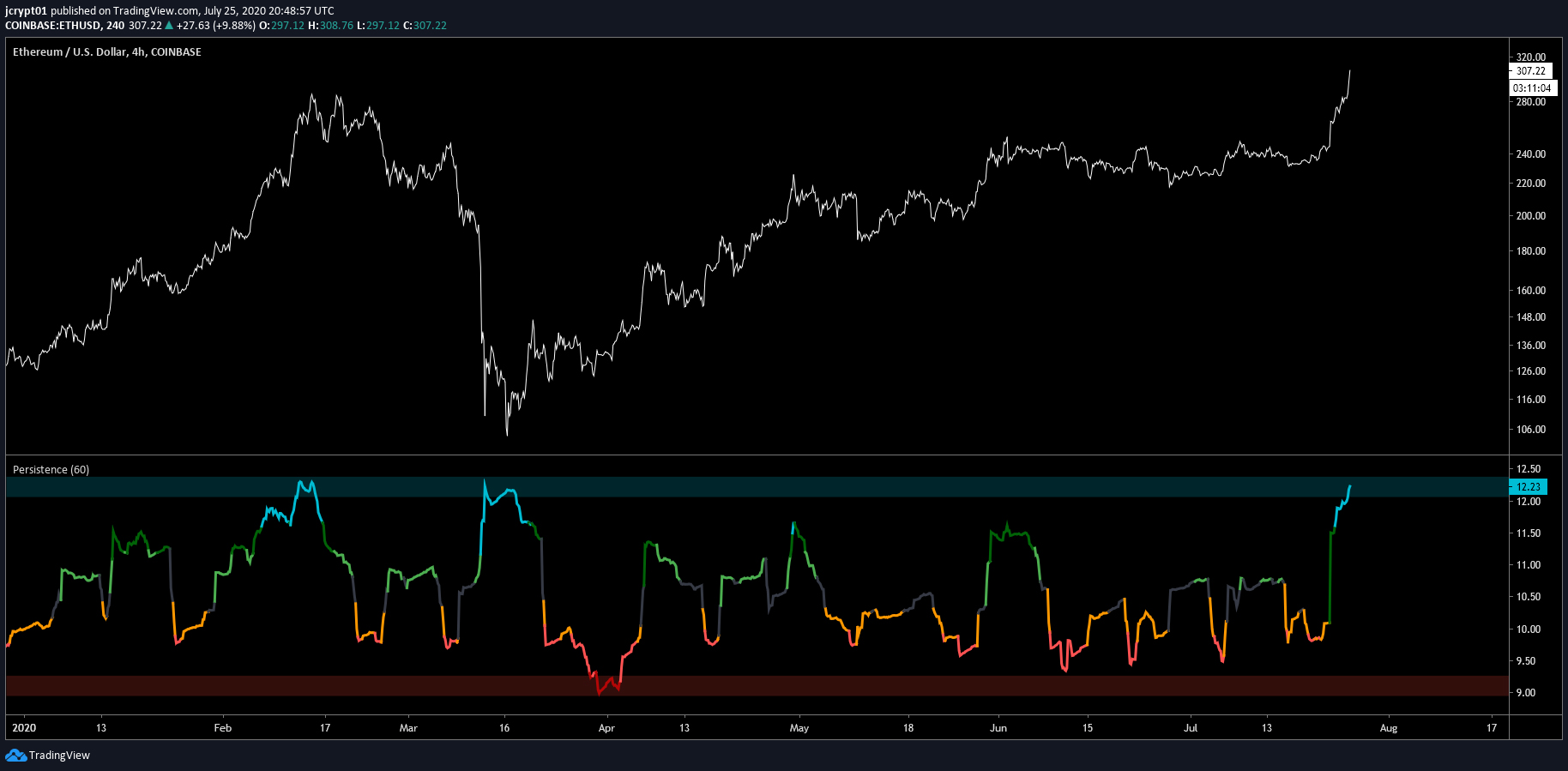

As reported by Bitcoinist previously, one trader remarked that an indicator he uses that tracks the persistence of trends is forming a reading last seen before the “March dump.”

“Watch for a local top on $ETH based on 10 day trend persistence.. highest in Feb was 12.30, March dump highest was 12.25, we are currently at 12.21.”

On the fundamental side of things, ETH transaction fees remain at extremely high levels by historical standards. According to blockchain data firm Glassnode, the average gas cost is five times higher than that of April.

Analysts say that if transaction fees remain high, the asset could lose dominance in its segment of the cryptocurrency industry to competitors.

Featured Image from Shutterstock Price tags: ethusd, ethbtc Charts from TradingView.com Ethereum May Form "Short Pullback" After Rallying 30% in 5 Days: Analysis