Today, February 28, Steven Nerayoff, a former Ethereum advisor now better known as an “Ethereum whistleblower or insider,” has escalated his allegations against Ethereum founders Vitalik Buterin, Joe Lubin, and the Ethereum Foundation. Nerayoff is currently working on filing a fraud lawsuit.

In addition, he is at the forefront of what he refers to as “ETHGate,” a scandal he claims involves “the highest levels of corruption within Ethereum.” In a series of new statements, he promises to bring significant developments to the forefront of the crypto world.

Ethereum Insider Pushes Forward

Nerayoff stated, “EXPOSING THE HIGHEST LEVELS OF CORRUPTION WITHIN ETHEREUM: Despite the lack of global acknowledgment, ETHGate remains one of the largest financial frauds ever witnessed. People are in disbelief over the alleged illicit actions involving Joseph Lubin, Vitalik Buterin, and more, given the enormity of the allegations and the potential implications if true.”

The whistleblower’s communications suggest a conspiracy to suppress the scandal’s coverage, hinting at a collusion between those accused and media outlets.

“The story continues to elude mainstream media attention, as those in power, responsible for holding them accountable, also control the narrative portrayed by the media,” Nerayoff remarked, underscoring the difficulties he faces in bringing his allegations to light. Highlighting his determination, Nerayoff added:

For those of you closely tracking this case on X, know this: we’re relentlessly pursuing ways to amplify this case and adding to our trove of evidence. Day after day, we’re pushing ahead to expose the truth. We’re not slowing down; we’re setting the pace. Despite facing formidable opponents in our industry and government, bear with us, but expect results soon. NOW is the time to SPREAD the word, RAISE your voice, and let’s FIGHT for our rights together!

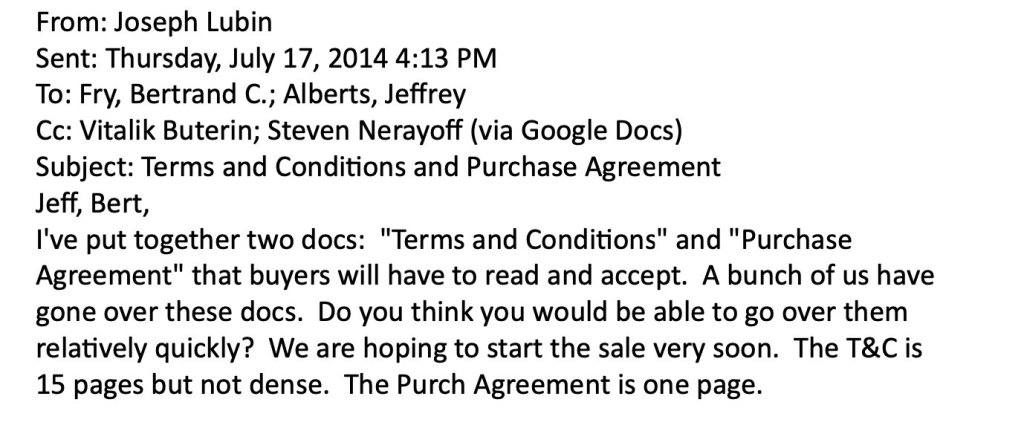

In addition to these statements, Nerayoff has brought forward specific allegations against Joe Lubin, one of Ethereum’s co-founders. He shared a screenshot of an email, allegedly from Lubin, that details ICO purchase agreements designed to prohibit speculative buying—a common practice meant to ensure the stability and legality of token sales.

Nerayoff claims, “Lubin authored the ICO purchase agreements. They prohibit speculative buying (e.g., Institutional Sales). Lubin was COO of the entity. Lubin violated terms himself by speculative buying in the ICO.”

This accusation not only suggests a breach of internal protocols but also draws parallels to past controversies in the crypto space, such as those surrounding Ripple’s institutional sales. Nerayoff’s comparison implies a significant ethical and legal breach, hinting at the potential for widespread repercussions within the Ethereum Foundation and its associated entities.

Supporting Nerayoff’s campaign is TruthLabs (known as BoringSleuth on X), an on-chain investigation team that has been assisting in the lawsuit. TruthLabs’ commented on the escalating situation, “Media and Legal Interests around Ethereum’s History are ACCELERATING Globally. Steven Nerayoff, X sleuths, and I’s Revelations about the wrongdoings tied to the Ethereum Foundation and its coconspirators, centralized nature, and CCP connections will soon shock the World.”

The involvement of TruthLabs indicates a deepening of the investigative efforts into Ethereum’s early days, suggesting that previously unseen evidence and allegations may soon come to light. As the legal and media interest in the case accelerates, the implications for Ethereum’s leadership—and the broader cryptocurrency landscape—could be profound.

As Nerayoff’s lawsuit against the Ethereum founders gathers momentum, the crypto community awaits potentially groundbreaking revelations. With promises of “results soon” and a “shift in power” on the horizon, 2024 could be poised to be an explosive year.

At press time, ETH traded at $3,346.